Ashtead Group Results Presentation Deck

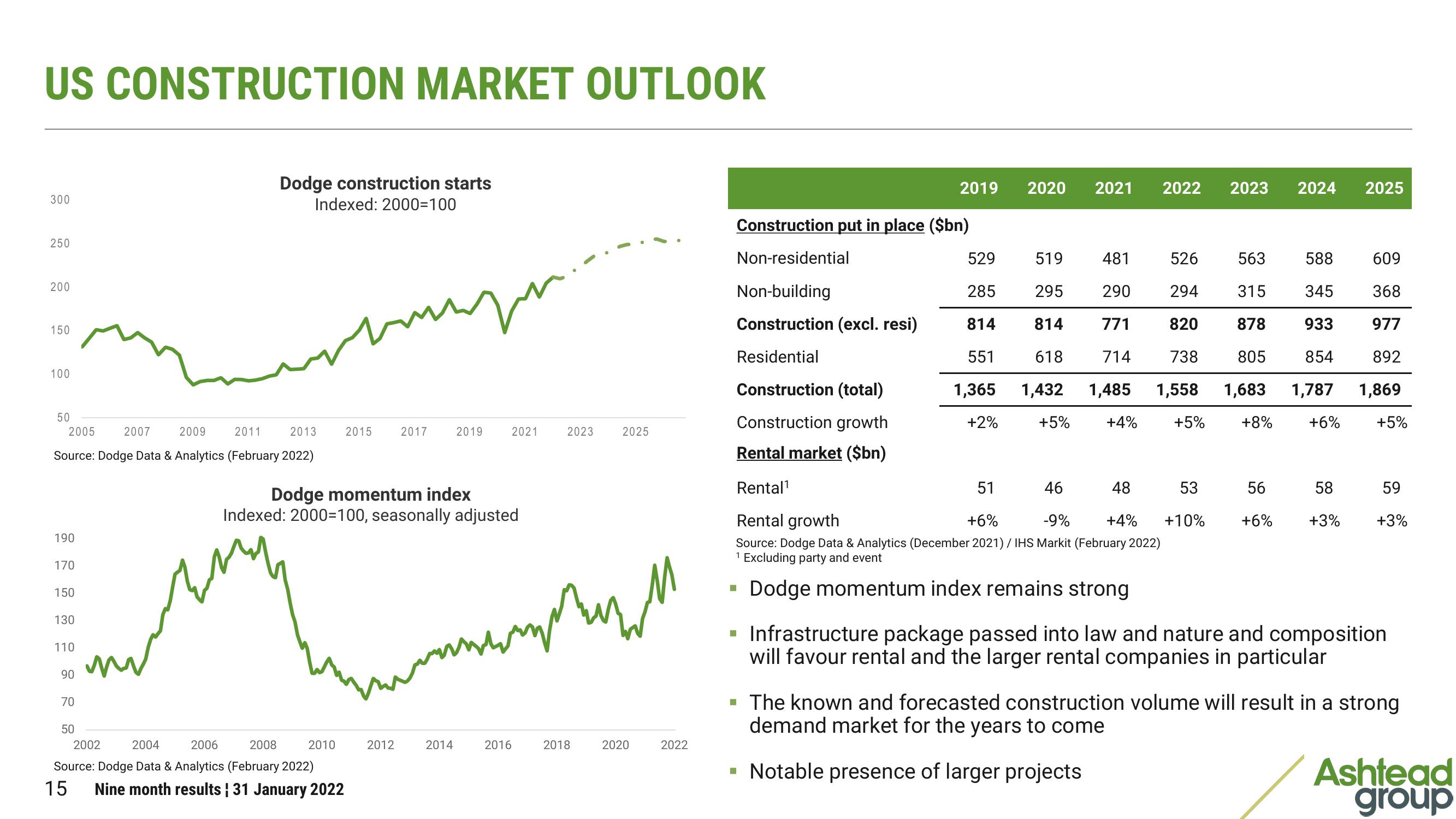

US CONSTRUCTION MARKET OUTLOOK

300

250

200

150

100

50

2005

2007

2009

2011

2013

Source: Dodge Data & Analytics (February 2022)

190

170

150

130

110

90

70

Dodge construction starts

Indexed: 2000-100

50

2002 2004 2006 2008

Source: Dodge Data & Analytics (February 2022)

15 Nine month results ¦ 31 January 2022

muu

2010

2015

2017

2012

mu

Dodge momentum index

Indexed: 2000=100, seasonally adjusted

2019

2021

2014

2023

тетрит

2016

2025

2018

2020

2022

Construction put in place ($bn)

Non-residential

2019

■

529

285

814

551

1,365

+2%

■

2020

2021 2022 2023 2024

519

481

526

295

290

294

814

771

820

618 714 738

1,432 1,485 1,558

+4% +5%

Non-building

Construction (excl. resi)

Residential

Construction (total)

Construction growth

Rental market ($bn)

Rental¹

51

46

56

48

53

Rental growth

+4% +10% +6%

Source: Dodge Data & Analytics (December 2021) / IHS Markit (February 2022)

1 Excluding party and event

+6%

-9%

Dodge momentum index remains strong

+5%

563

588

315

345

878

933

854

805

1,683 1,787

+8%

+6%

58

+3%

2025

609

368

977

892

1,869

+5%

59

+3%

▪ Infrastructure package passed into law and nature and composition

will favour rental and the larger rental companies in particular

The known and forecasted construction volume will result in a strong

demand market for the years to come

Notable presence of larger projects

Ashtead

groupView entire presentation