J.P.Morgan Results Presentation Deck

Corporate & Investment Bank1

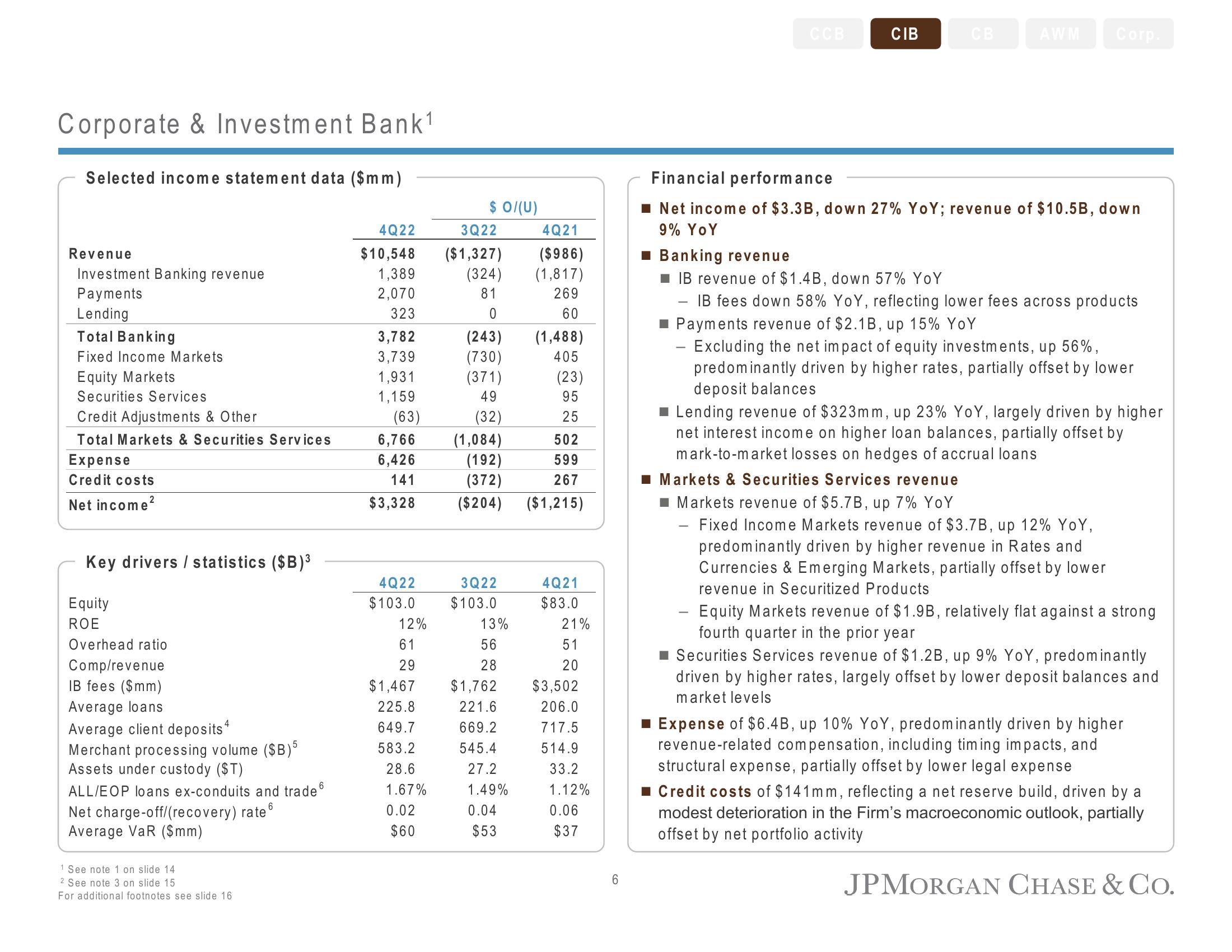

Selected income statement data ($mm)

Revenue

Investment Banking revenue

Payments

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services

Credit Adjustments & Other

Total Markets & Securities Services

Expense

Credit costs

Net income²

Key drivers / statistics ($B)³

Equity

ROE

Overhead ratio

Comp/revenue

IB fees ($mm)

Average loans

4

Average client deposits

Merchant processing volume ($B)5

Assets under custody ($T)

6

ALL/EOP loans ex-conduits and trade

6

Net charge-off/(recovery) rate

Average VaR ($mm)

1 See note 1 on slide 14

2 See note 3 on slide 15

For additional footnotes see slide 16

4Q22

$10,548

1,389

2,070

323

3,782

3,739

1,931

1,159

(63)

6,766

6,426

141

$3,328

4Q22

$103.0

12%

61

29

$1,467

225.8

649.7

583.2

28.6

1.67%

0.02

$60

$ 0/(U)

3Q22

($1,327)

(324)

81

0

(243)

(730)

(371)

49

(32)

(1,084)

(192)

(372)

($204)

3Q22

$103.0

13%

56

28

$1,762

221.6

669.2

545.4

27.2

1.49%

0.04

$53

4Q21

($986)

(1,817)

269

60

(1,488)

405

(23)

95

25

502

599

267

($1,215)

4Q21

$83.0

21%

51

20

$3,502

206.0

717.5

514.9

33.2

1.12%

0.06

$37

6

CCB

CIB

CB

AWM Corp.

Financial performance

■ Net income of $3.3B, down 27% YoY; revenue of $10.5B, down

9% YOY

Banking revenue

■ IB revenue of $1.4B, down 57% YoY

IB fees down 58% YoY, reflecting lower fees across products

Payments revenue of $2.1B, up 15% YoY

Excluding the net impact of equity investments, up 56%,

predominantly driven by higher rates, partially offset by lower

deposit balances

■ Markets revenue of $5.7B, up 7% YoY

■ Lending revenue of $323mm, up 23% YoY, largely driven by higher

net interest income on higher loan balances, partially offset by

mark-to-market losses on hedges of accrual loans

■ Markets & Securities Services revenue

Fixed Income Markets revenue of $3.7B, up 12% YOY,

predominantly driven by higher revenue in Rates and

Currencies & Emerging Markets, partially offset by lower

revenue in Securitized Products

- Equity Markets revenue of $1.9B, relatively flat against a strong

fourth quarter in the prior year

Securities Services revenue of $1.2B, up 9% YoY, predominantly

driven by higher rates, largely offset by lower deposit balances and

market levels

■ Expense of $6.4B, up 10% YoY, predominantly driven by higher

revenue-related compensation, including timing impacts, and

structural expense, partially offset by lower legal expense

■ Credit costs of $141mm, reflecting a net reserve build, driven by a

modest deterioration in the Firm's macroeconomic outlook, partially

offset by net portfolio activity

JPMORGAN CHASE & Co.View entire presentation