SimCorp Investor Day Presentation Deck

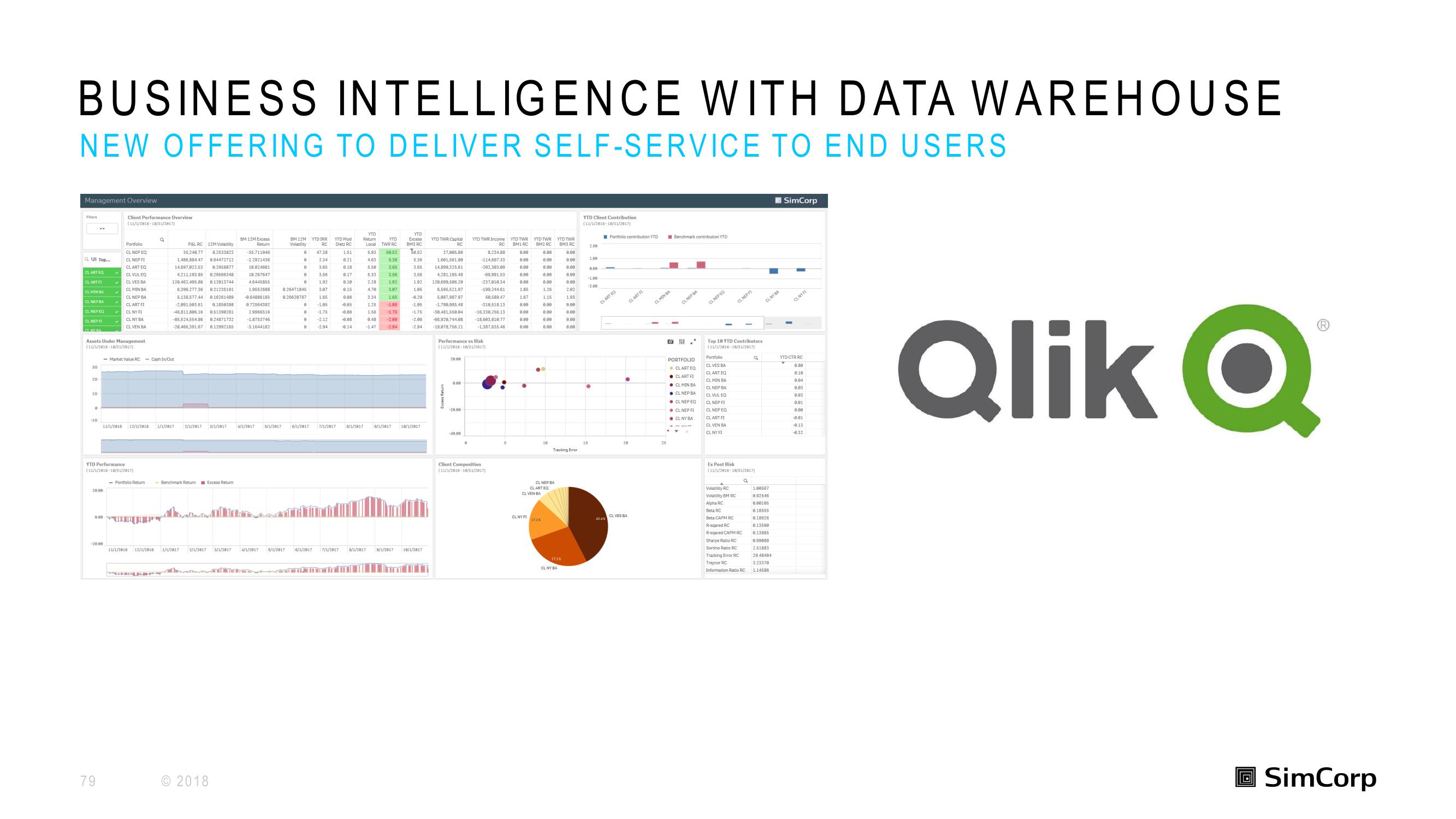

BUSINESS INTELLIGENCE WITH DATA WAREHOUSE

NEW OFFERING TO DELIVER SELF-SERVICE TO END USERS

Management Overview

Filtera

CLART EQ

CL ART FI

CL MIN BA

CL NEP BA

Top...

CL NEPEQ

CL NEP

3G

20

10

Assets Under Management

(11/1/2816-18/31/2017)

B

-10

20.00

Client Performance Overview

(11/1/2816-10/31/2017)

-20:00

79

Portfolio

CL NEP EC

CL NEP FI

CLART EQ

CL VUL EQ

0.00

CL VES BA

CL MIN BA

CL NEP BA

CLART FI

CL NY FI

CL NY BA

CL VEN BA

YTD Performance

(11/1/2016-10/31/2017)

- Market Value RC Cash In/Out

P&LRC 12M Volatility

35,249.77 8.2533822

1,486,884,47 864472712

14,697,022.53 8.2958877

4,211,193.95 8.29566348

128,462,495.86 812013744

6.396,277.36 8.21235191

5,138,577.44 8.16261489

-2.091.503.61 8.1858398

-46,811.886.16 8.51398281

-85.524.554.86 8.24871732

-20.466.391.67 8.12992165

11/1/2016 12/1/2016 1/1/2017 2/1/2017 3/1/2017 4/1/2017

- Portfolio Return - Benchmark Return Excess Return

11/1/2016 12/1/2018 1/1/2017 2/1/2017 3/1/2017

BM 12M Excess

Return

-35.711946

-2.2921436

18.824601

10.267647

4.6445855

1.9552688

©2018

5/1/2017

BM 12M YTD IRR

Volatility

RC

4/1/2017 5/1/2017

8

8

8

9.26471845

-0.64886185 9.26628787

0.72564392

2.9966516

-1.8753746

-3.1644182

8

e

A

8

8

8

47.38

2.34

3.65

3.56

1.92

3.07

1.65

-1.05

-1.75

YTD Mod

Dietz RC

151

8.21

0.18

0.17

8.18

0.15

0.98

-0.05

-0.88

-0.08

-814

YTD

Return

YTD

Local TWR RC

5.93

4.63

5.50

5.33

2.28

4.78

3.34

1.25

1.56 -1.75

9.48 -2.09

-1.47

-2.94

7/1/2017

6/1/2017

50.52

5.36

3.65

3.56

1.92

3.07

1.65

-1.85

6/1/2017 7/1/2017 8/1/2017 9/1/2017

YTD

Excess

BM3 RC

58.52

5.36

3.65

3.56

1.05

-8.29

-1.85

-1.75

-2.09

-2.94

10/1/2017

6/1/2017 9/1/2017 18/1/2017

YTD TWR Capital

RC

27,885.89

1.601.581.88

14,899,325.61

4,281,185.48

128,699,506.20

6,595,521.97

5,887,987.97

58,589.47

-1.780,985.48

-310,518.13

-38,481,550.04 -16,338,256.13

-66,920,744.08

-19.878,756.21

20.08

-20.00

YTD TWR Income YTD TWR YTD TWR

RC BMIRC BM2 RC

0.00

Performance vs Risk

(11/1/2016-10/31/2017)

-40.00

8,234.88

-114.697.33

-202,303.09

-69.991.53

-237,810.34

-199,244.61

-18,603,810.77

-1,387,635.46

Client Composition

(11/1/2016-10/31/2017)

:

8.00

8.09

0.00

8.00

1.85

1.67

0.00

8.00

0.00

8.00

CLNYFI

0.00

8.00

0.00

1.26

115

0.00

0.00

8.00

8.08

10

CL NEP BA

CLARTEQ

YTD TWR

BMS RO

8.08

0.08

27.15

8.00

8.00

2.82

Tracking Error

1.93

8.08

8.00

8.08

8.00

YTD Client Contribution

(11/1/2016-10/31/2017)

2.50

8.06

-1.80

Portfolio contribution YTD

CLART EQ

42.4%

CLART FI

20

CL VES BA

CL MIN BA

25

Benchmark contribution YTD

CL NEP BA

PORTFOLIO

CLART EQ

CLART FI

CL MIN BA

CL NEP BA

●CL NEP EQ

●CL NEP FI

CLNYRA

CL NEP EQ

Top 10 YTD Contributors

(11/1/2016-10/31/2017)

Portfolio

CL VES BA

CLART EQ

CL MIN BA

CL NEP BA

CL VUL EQ

CL NEP FL

CL NEP EQ

CL ART FI

CL VEN BA

CL NY FI

CL NEP FL

Volatility RC

Volatility BM RC

Alpha RC

Beta RC

Beta CAPM RC

Ex Post Risk

(11/1/2016-10/31/2017)

q

R-sqared RC

R-sqared CAPM RC

Sharpe Ratio RC

Sortino Ratio RC

Tracking Error RC

Treymor RC

Information Ratio RC

CLNY BA

180567

8.92546

080106

0.18555

@ 18926

0.13590

813886

0.99088

2.51883

29.48484

3.23370

114586

SimCorp

CLNYFI

YTD CTR RC

0.80

0.10

8.04

0.83

8.03

0.01

8.00

-0.01

-0.13

-0.32

Qlik Q

SimCorpView entire presentation