Experienced Senior Team Overview

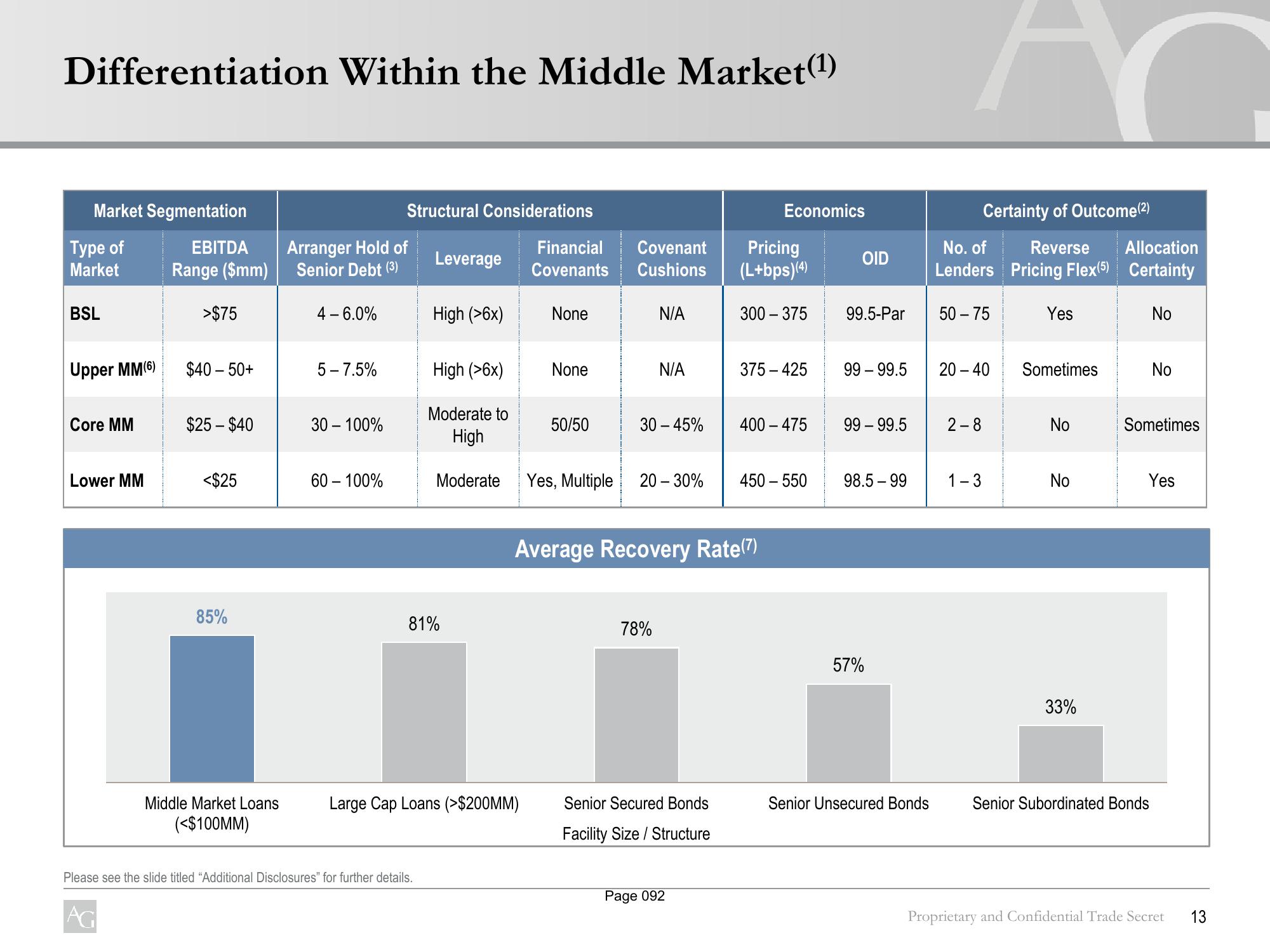

Differentiation Within the Middle Market(¹)

Market Segmentation

Type of

Market

BSL

Upper MM(6)

Core MM

Lower MM

EBITDA

Range ($mm)

AG

>$75

$40 - 50+

$25 - $40

<$25

85%

Middle Market Loans

(<$100MM)

Arranger Hold of

Senior Debt (3)

4-6.0%

5-7.5%

30 - 100%

Structural Considerations

60 - 100%

Leverage

Please see the slide titled "Additional Disclosures" for further details.

High (>6x)

High (>6x)

Moderate to

High

Moderate

81%

Large Cap Loans (>$200MM)

Financial

Covenants

None

None

50/50

Yes, Multiple

Covenant

Cushions

N/A

N/A

30-45%

78%

Senior Secured Bonds

Facility Size/Structure

Economics

Pricing

(L+bps) (4)

Average Recovery Rate(7)

Page 092

300-375

20 - 30% 450-550

375-425

400 - 475

OID

99.5-Par

99-99.5

99 - 99.5

98.5-99

57%

Senior Unsecured Bonds

Certainty of Outcome(²)

No. of

Reverse Allocation

Lenders Pricing Flex(5) Certainty

50-75

20-40 Sometimes

2-8

Yes

1-3

No

No

33%

No

No

Sometimes

Senior Subordinated Bonds

Yes

Proprietary and Confidential Trade Secret

13View entire presentation