K6 Private Investors, L.P. Recommendation Report

Hamilton Lane

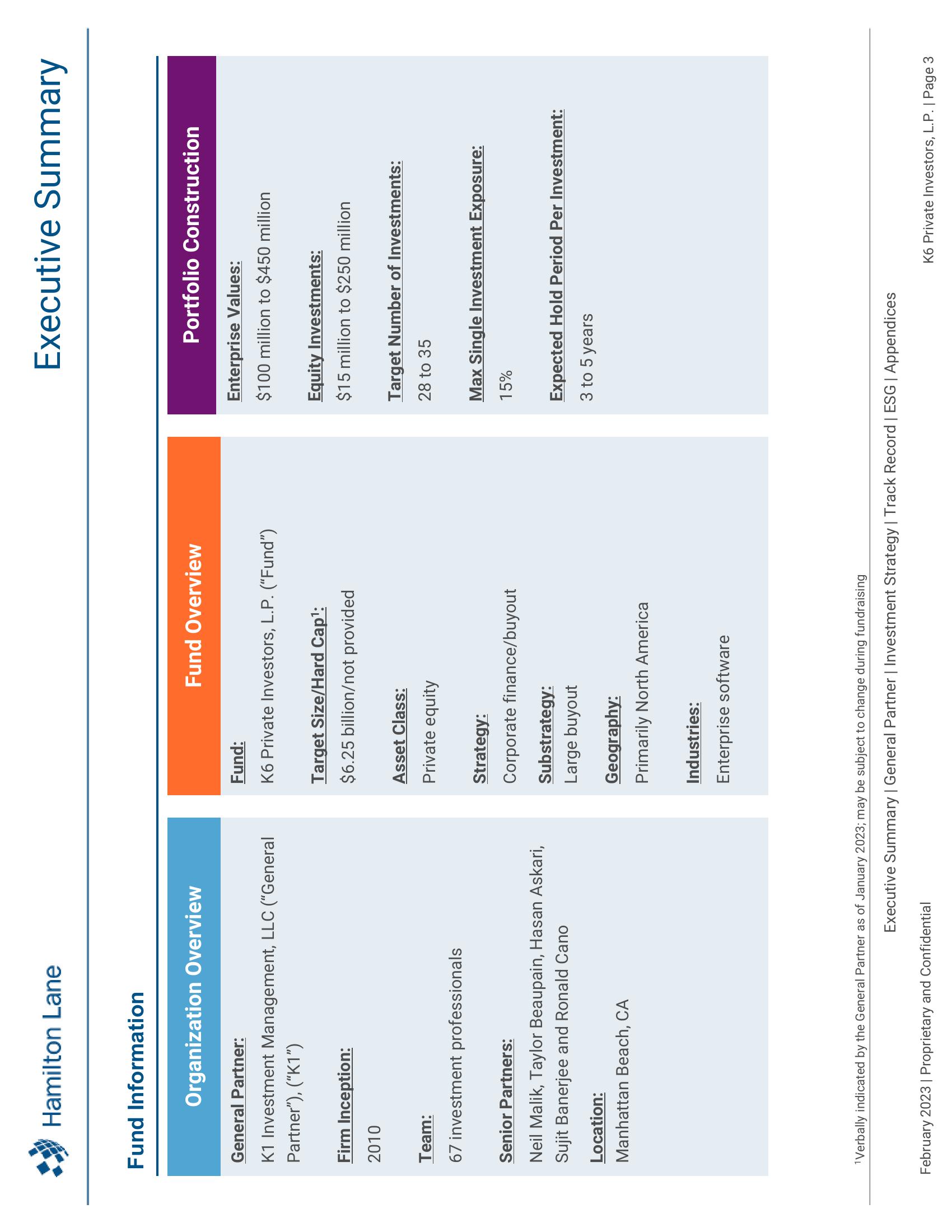

Fund Information

Organization Overview

General Partner:

K1 Investment Management, LLC ("General

Partner"), ("K1")

Firm Inception:

2010

Team:

67 investment professionals

Senior Partners:

Neil Malik, Taylor Beaupain, Hasan Askari,

Sujit Banerjee and Ronald Cano

Location:

Manhattan Beach, CA

Fund Overview

Fund:

K6 Private Investors, L.P. ("Fund")

February 2023 | Proprietary and Confidential

Target Size/Hard Cap¹:

$6.25 billion/not provided

Asset Class:

Private equity

Strategy:

Corporate finance/buyout

Substrategy:

Large buyout

Geography:

Primarily North America

Industries:

Enterprise software

¹Verbally indicated by the General Partner as of January 2023; may be subject to change during fundraising

Executive Summary

Portfolio Construction

Enterprise Values:

$100 million to $450 million

Equity Investments:

$15 million to $250 million

Target Number of Investments:

28 to 35

Max Single Investment Exposure:

15%

Expected Hold Period Per Investment:

3 to 5 years

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

K6 Private Investors, L.P. | Page 3View entire presentation