SoftBank Results Presentation Deck

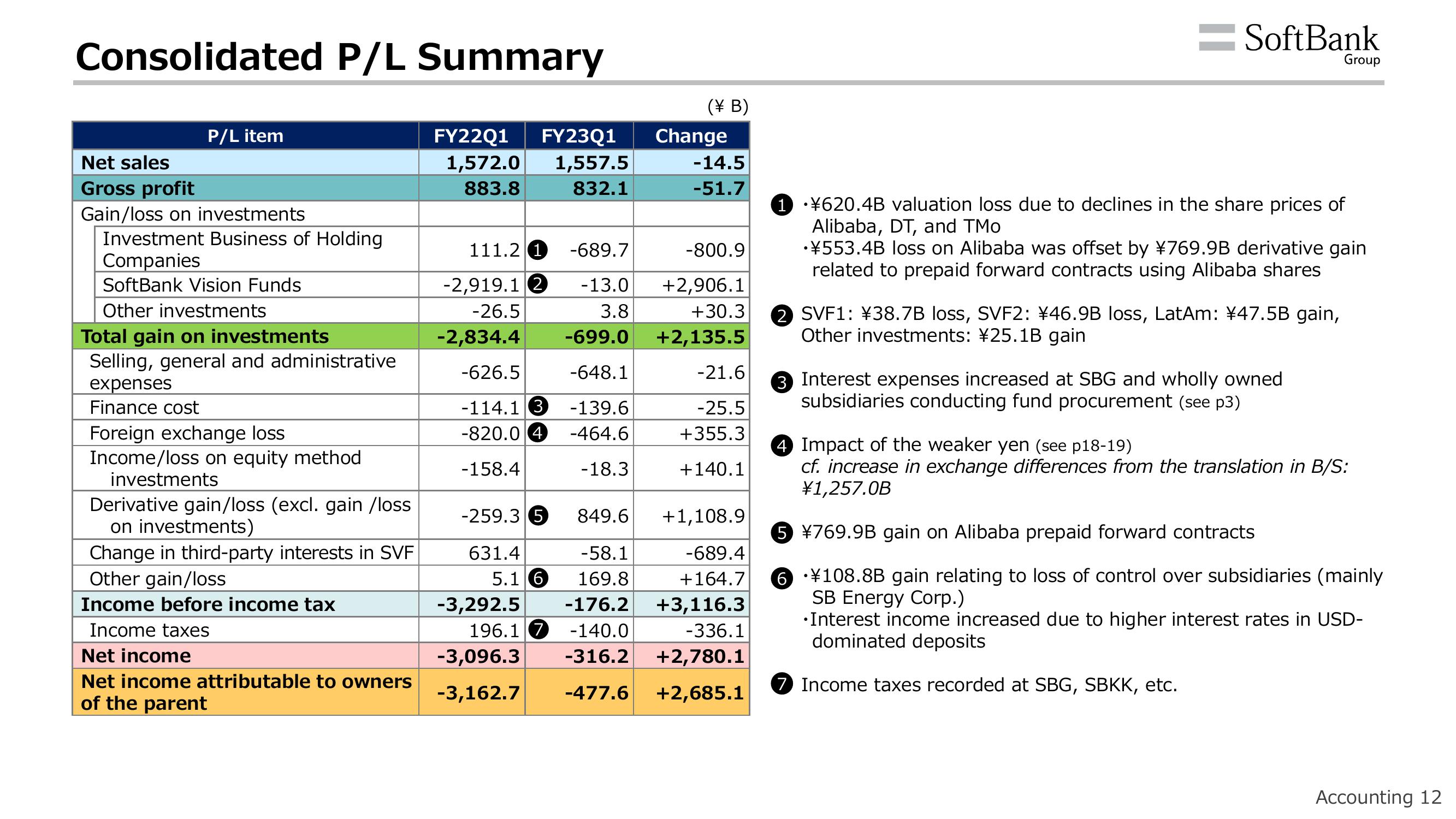

Consolidated P/L Summary

P/L item

Net sales

Gross profit

Gain/loss on investments

Investment Business of Holding

Companies

SoftBank Vision Funds

Other investments

Total gain on investments

Selling, general and administrative

expenses

Finance cost

Foreign exchange loss

Income/loss on equity method

investments

Derivative gain/loss (excl. gain /loss

on investments)

Change in third-party interests in SVF

Other gain/loss

Income before income tax

Income taxes

Net income

Net income attributable to owners

of the parent

(\B)

FY22Q1 FY23Q1 Change

1,572.0 1,557.5

883.8

832.1

-689.7

-800.9

+2,906.1

111.2 1

-2,919.1 2 -13.0

-26.5

3.8

+30.3

-699.0 +2,135.5

-2,834.4

-626.5

-648.1

-114.1 3 -139.6

-820.0 4

-464.6

-158.4

-18.3

-259.35

631.4

5.1 6

-3,292.5

196.1 7

-14.5

-51.7

-3,096.3

-3,162.7 -477.6

-21.6

-25.5

+355.3

+140.1

849.6

-58.1

169.8

-176.2

-140.0

-316.2 +2,780.1

+2,685.1

+1,108.9

-689.4

+164.7

+3,116.3

-336.1

=SoftBank

1 •¥620.4B valuation loss due to declines in the share prices of

Alibaba, DT, and TMo

•¥553.4B loss on Alibaba was offset by ¥769.9B derivative gain

related to prepaid forward contracts using Alibaba shares

2 SVF1: ¥38.7B loss, SVF2: ¥46.9B loss, LatAm: ¥47.5B gain,

Other investments: ¥25.1B gain

Group

3 Interest expenses increased at SBG and wholly owned

subsidiaries conducting fund procurement (see p3)

4 Impact of the weaker yen (see p18-19)

cf. increase in exchange differences from the translation in B/S:

¥1,257.0B

5 ¥769.9B gain on Alibaba prepaid forward contracts

6 ¥108.8B gain relating to loss of control over subsidiaries (mainly

SB Energy Corp.)

•Interest income increased due to higher interest rates in USD-

dominated deposits

7 Income taxes recorded at SBG, SBKK, etc.

Accounting 12View entire presentation