Vista Equity Partners Fund VIII, L.P. Recommendation Report

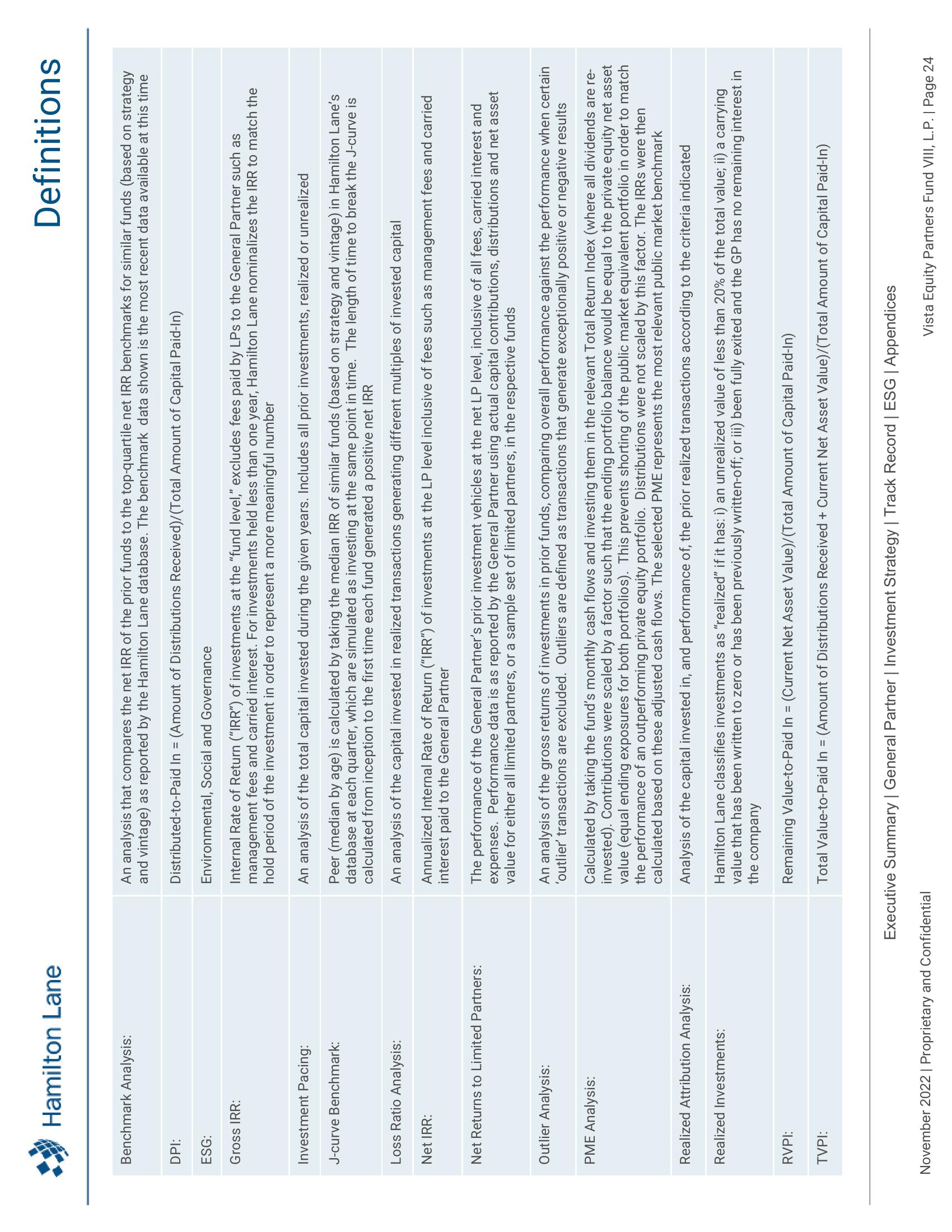

Benchmark Analysis:

Hamilton Lane

DPI:

ESG:

Gross IRR:

Investment Pacing:

J-curve Benchmark:

Loss Ratio Analysis:

Net IRR:

Net Returns to Limited Partners:

Outlier Analysis:

PME Analysis:

Realized Attribution Analysis:

Realized Investments:

RVPI:

TVPI:

November 2022 | Proprietary and Confidential

Definitions

An analysis that compares the net IRR of the prior funds to the top-quartile net IRR benchmarks for similar funds (based on strategy

and vintage) as reported by the Hamilton Lane database. The benchmark data shown is the most recent data available at this time

Distributed-to-Paid In = (Amount of Distributions Received)/(Total Amount of Capital Paid-In)

Environmental, Social and Governance

Internal Rate of Return ("IRR") of investments at the "fund level," excludes fees paid by LPs to the General Partner such as

management fees and carried interest. For investments held less than one year, Hamilton Lane nominalizes the IRR to match the

hold period of the investment in order to represent a more meaningful number

An analysis of the total capital invested during the given years. Includes all prior investments, realized or unrealized

Peer (median by age) is calculated by taking the median IRR of similar funds (based on strategy and vintage) in Hamilton Lane's

database at each quarter, which are simulated as investing at the same point in time. The length of time to break the J-curve is

calculated from inception to the first time each fund generated a positive net IRR

An analysis of the capital invested in realized transactions generating different multiples of invested capital

Annualized Internal Rate of Return ("IRR") of investments at the LP level inclusive of fees such as management fees and carried

interest paid to the General Partner

The performance of the General Partner's prior investment vehicles at the net LP level, inclusive of all fees, carried interest and

expenses. Performance data is as reported by the General Partner using actual capital contributions, distributions and net asset

value for either all limited partners, or a sample set of limited partners, in the respective funds

An analysis of the gross returns of investments in prior funds, comparing overall performance against the performance when certain

'outlier' transactions are excluded. Outliers are defined as transactions that generate exceptionally positive or negative results

Calculated by taking the fund's monthly cash flows and investing them in the relevant Total Return Index (where all dividends are re-

invested). Contributions were scaled by a factor such that the ending portfolio balance would be equal to the private equity net asset

value (equal ending exposures for both portfolios). This prevents shorting of the public market equivalent portfolio in order to match

the performance of an outperforming private equity portfolio. Distributions were not scaled by this factor. The IRRs were then

calculated based on these adjusted cash flows. The selected PME represents the most relevant public market benchmark

Analysis of the capital invested in, and performance of, the prior realized transactions according to the criteria indicated

Hamilton Lane classifies investments as "realized" if it has: i) an unrealized value of less than 20% of the total value; ii) a carrying

value that has been written to zero or has been previously written-off; or iii) been fully exited and the GP has no remaining interest in

the company

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

Remaining Value-to-Paid In = (Current Net Asset Value)/(Total Amount of Capital Paid-In)

Total Value-to-Paid In = (Amount of Distributions Received + Current Net Asset Value)/(Total Amount of Capital Paid-In)

Vista Equity Partners Fund VIII, L.P. | Page 24View entire presentation