Nuvei Results Presentation Deck

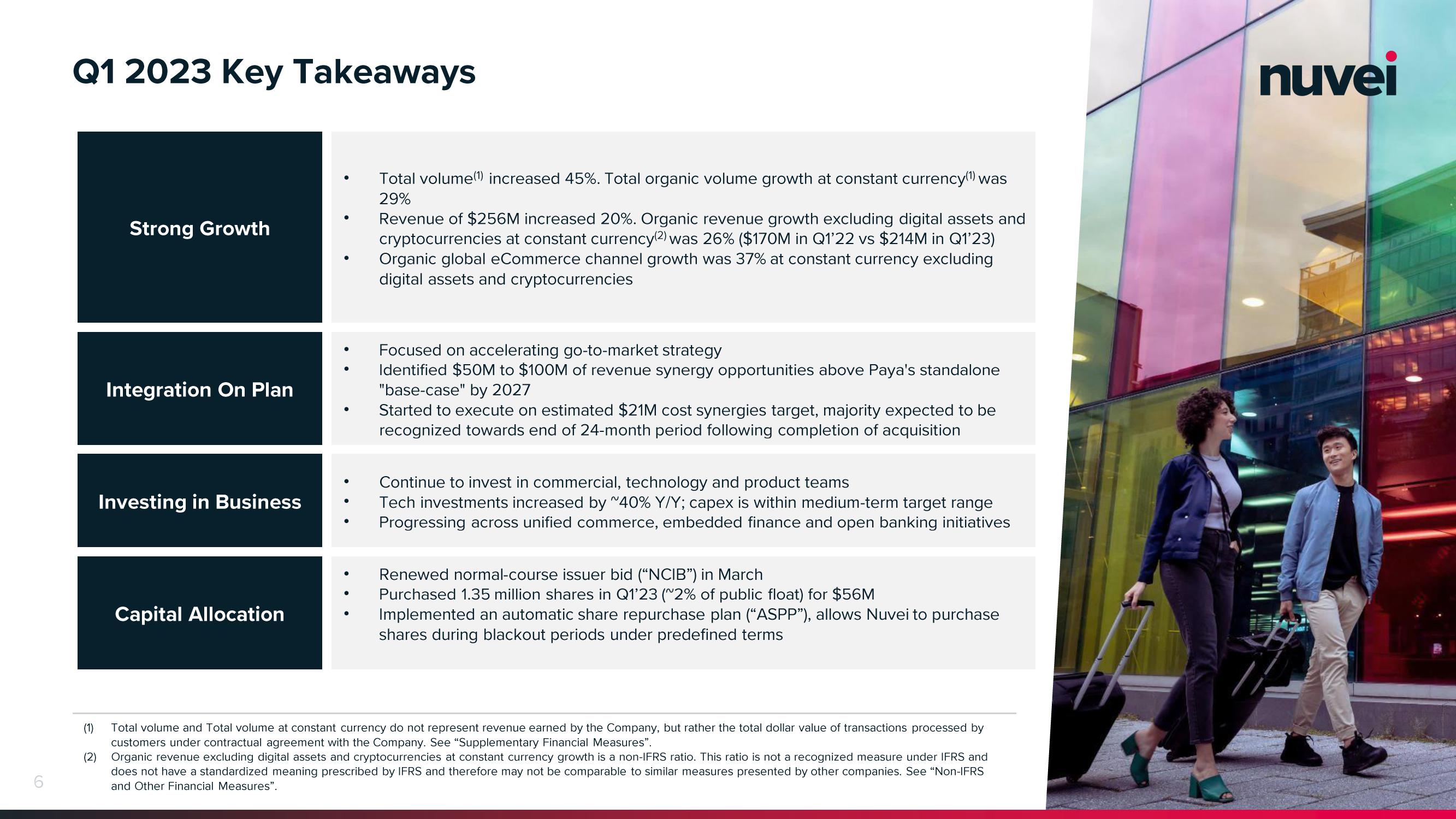

Q1 2023 Key Takeaways

Strong Growth

Integration On Plan

Investing in Business

Capital Allocation

●

●

●

●

●

●

Total volume(¹) increased 45%. Total organic volume growth at constant currency(¹) was

29%

Revenue of $256M increased 20%. Organic revenue growth excluding digital assets and

cryptocurrencies at constant currency(²) was 26% ($170M in Q1'22 vs $214M in Q1'23)

Organic global eCommerce channel growth was 37% at constant currency excluding

digital assets and cryptocurrencies

Focused on accelerating go-to-market strategy

Identified $50M to $100M of revenue synergy opportunities above Paya's standalone

"base-case" by 2027

Started to execute on estimated $21M cost synergies target, majority expected to be

recognized towards end of 24-month period following completion of acquisition

Continue to invest in commercial, technology and product teams

Tech investments increased by ~40% Y/Y; capex is within medium-term target range

Progressing across unified commerce, embedded finance and open banking initiatives

Renewed normal-course issuer bid ("NCIB") in March

Purchased 1.35 million shares in Q1'23 (~2% of public float) for $56M

Implemented an automatic share repurchase plan ("ASPP"), allows Nuvei to purchase

shares during blackout periods under predefined terms

(1)

Total volume and Total volume at constant currency do not represent revenue earned by the Company, but rather the total dollar value of transactions processed by

customers under contractual agreement with the Company. See "Supplementary Financial Measures".

(2) Organic revenue excluding digital assets and cryptocurrencies at constant currency growth is a non-IFRS ratio. This ratio is not a recognized measure under IFRS and

does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other companies. See "Non-IFRS

and Other Financial Measures".

nuveiView entire presentation