Q2 Quarter 2023

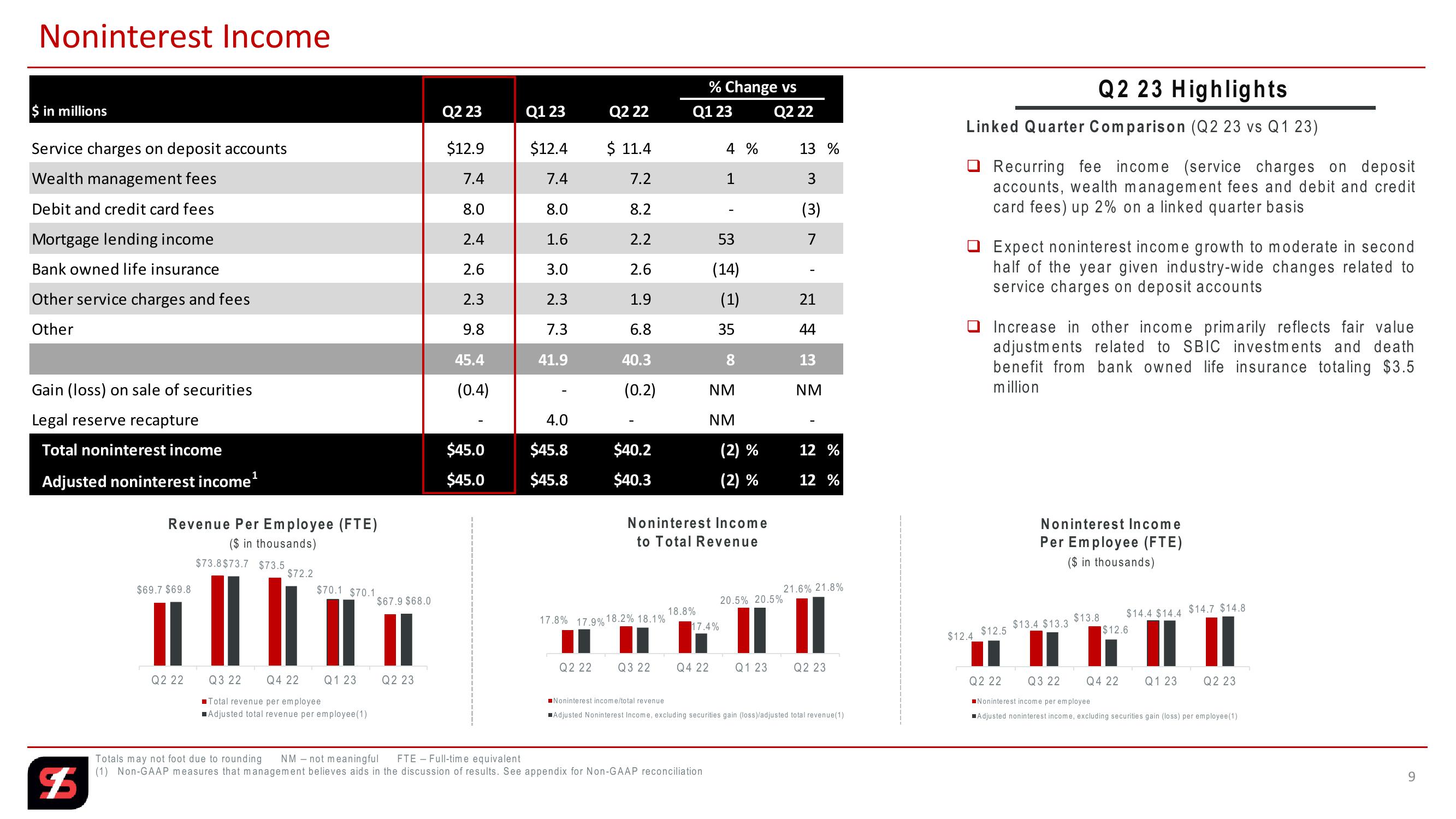

Noninterest Income

% Change vs

$ in millions

Q2 23

Q1 23

Q2 22

Q1 23

Q2 22

Service charges on deposit accounts

$12.9

$12.4

$ 11.4

4 %

13 %

Wealth management fees

7.4

7.4

7.2

1

3

Debit and credit card fees

8.0

8.0

8.2

(3)

Mortgage lending income

2.4

1.6

2.2

53

7

Bank owned life insurance

2.6

3.0

2.6

(14)

Other service charges and fees

2.3

2.3

1.9

(1)

21

Other

9.8

7.3

6.8

35

44

45.4

41.9

40.3

8

13

Gain (loss) on sale of securities

(0.4)

(0.2)

NM

NM

Legal reserve recapture

4.0

NM

Total noninterest income

$45.0

$45.8

$40.2

(2) %

12 %

Adjusted noninterest income¹

$45.0

$45.8

$40.3

(2) %

12 %

$5

Q2 23 Highlights

Linked Quarter Comparison (Q2 23 vs Q1 23)

Recurring fee income (service charges on deposit

accounts, wealth management fees and debit and credit

card fees) up 2% on a linked quarter basis

Expect noninterest income growth to moderate in second

half of the year given industry-wide changes related to

service charges on deposit accounts

Increase in other income primarily reflects fair value

adjustments related to SBIC investments and death

benefit from bank owned life insurance totaling $3.5

million

Revenue Per Employee (FTE)

($ in thousands)

Noninterest Income

to Total Revenue

$73.8$73.7 $73.5

$72.2

$69.7 $69.8

$70.1 $70.1.

21.6% 21.8%

$67.9 $68.0

20.5% 20.5%

18.8%

17.8% 17.9% 18.2% 18.1%

17.4%

Noninterest Income

Per Employee (FTE)

($ in thousands)

$13.8

$14.4 $14.4 $14.7 $14.8

$12.4 $12.5

$13.4 $13.3

$12.6

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

■Total revenue per employee

■Adjusted total revenue per employee (1)

FTE

Full-time equivalent

Noninterest income/total revenue

■Adjusted Noninterest Income, excluding securities gain (loss)/adjusted total revenue(1)

(1) Non-GAAP measures that management believes aids in the discussion of results. See appendix for Non-GAAP reconciliation

Totals may not foot due to rounding NM not meaningful

Q2 22 Q3 22

Noninterest income per employee

Q4 22

Q1 23

Q2 23

■Adjusted noninterest income, excluding securities gain (loss) per employee(1)

6View entire presentation