Evercore Investment Banking Pitch Book

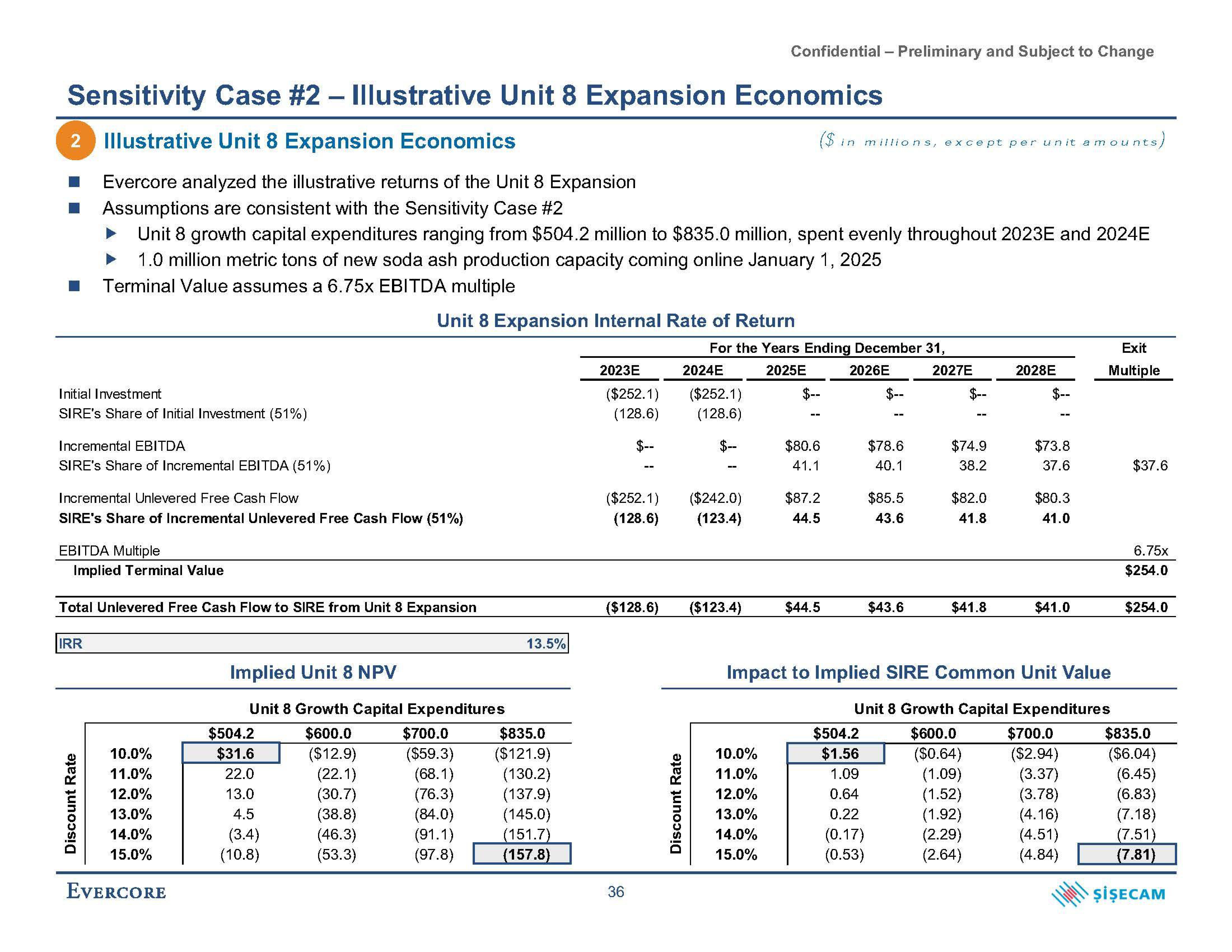

Sensitivity Case #2 - Illustrative Unit 8 Expansion Economics

2 Illustrative Unit 8 Expansion Economics

Evercore analyzed the illustrative returns of the Unit 8 Expansion

Assumptions are consistent with the Sensitivity Case #2

Unit 8 growth capital expenditures ranging from $504.2 million to $835.0 million, spent evenly throughout 2023E and 2024E

1.0 million metric tons of new soda ash production capacity coming online January 1, 2025

Terminal Value assumes a 6.75x EBITDA multiple

Initial Investment

SIRE's Share of Initial Investment (51%)

Incremental EBITDA

SIRE's Share of Incremental EBITDA (51%)

Incremental Unlevered Free Cash Flow

SIRE's Share of Incremental Unlevered Free Cash Flow (51%)

EBITDA Multiple

Implied Terminal Value

Total Unlevered Free Cash Flow to SIRE from Unit 8 Expansion

IRR

Discount Rate

10.0%

11.0%

12.0%

13.0%

14.0%

15.0%

EVERCORE

Unit 8 Expansion Internal Rate of Return

Implied Unit 8 NPV

Unit 8 Growth Capital Expenditures

$600.0

($12.9)

(22.1)

(30.7)

(38.8)

(46.3)

(53.3)

$504.2

$31.6

22.0

13.0

4.5

(3.4)

(10.8)

$700.0

($59.3)

(68.1)

(76.3)

(84.0)

(91.1)

(97.8)

13.5%

$835.0

($121.9)

(130.2)

(137.9)

(145.0)

(151.7)

(157.8)

2023E

2024E

($252.1) ($252.1)

(128.6)

(128.6)

($252.1)

(128.6)

($128.6)

36

Discount Rate

Confidential - Preliminary and Subject to Change

For the Years Ending December 31,

2025E

2026E

($242.0)

(123.4)

($123.4)

($ in millions, except per unit amounts,

10.0%

11.0%

12.0%

13.0%

14.0%

15.0%

$80.6

41.1

$87.2

44.5

$44.5

$--

$504.2

$1.56

1.09

0.64

0.22

(0.17)

(0.53)

$78.6

40.1

$85.5

43.6

$43.6

2027E

$--

--

$74.9

38.2

$82.0

41.8

$41.8

2028E

$--

$73.8

37.6

$80.3

41.0

$41.0

Impact to Implied SIRE Common Unit Value

Unit 8 Growth Capital Expenditures

$600.0

($0.64)

(1.09)

(1.52)

(1.92)

(2.29)

(2.64)

Exit

Multiple

$700.0

($2.94)

(3.37)

(3.78)

(4.16)

(4.51)

(4.84)

$37.6

6.75x

$254.0

$254.0

$835.0

($6.04)

(6.45)

(6.83)

(7.18)

(7.51)

(7.81)

ŞİŞECAMView entire presentation