Atalaya Risk Management Overview

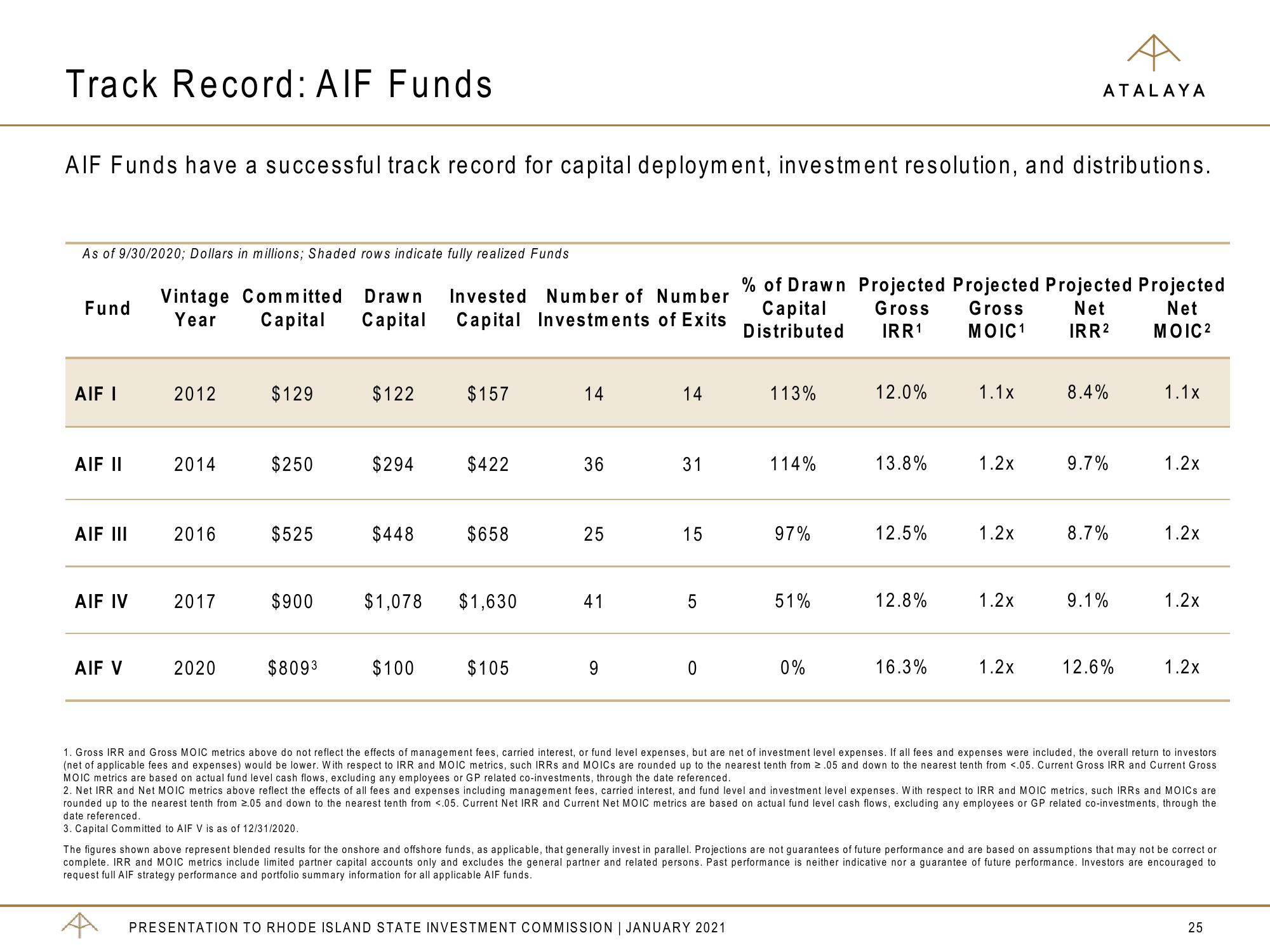

Track Record: AIF Funds

AIF Funds have a successful track record for capital deployment, investment resolution, and distributions.

As of 9/30/2020; Dollars in millions; Shaded rows indicate fully realized Funds

Fund

AIF I

AIF II

AIF III

AIF IV

AIF V

Vintage Committed Drawn Invested Number of Number

Year Capital Capital Capital Investments of Exits

2012

2014

2016

2017

2020

$129

$250

$525

$900

$8093

$122

$294

$448

$157

$100

$422

$658

$1,078 $1,630

$105

14

36

25

41

9

14

31

15

5

0

% of Drawn Projected Projected Projected Projected

Capital Gross Gross

IRR ¹

Net

Net

Distributed

MOIC1

IRR²

MOIC²

113%

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

114%

97%

51%

0%

12.0%

13.8%

12.5%

12.8%

16.3%

1.1x

1.2x

1.2x

ATALAYA

1.2x

1.2x

8.4%

9.7%

8.7%

9.1%

12.6%

1.1x

1.2x

1.2x

1.2x

1.2x

1. Gross IRR and Gross MOIC metrics above do not reflect the effects of management fees, carried interest, or fund level expenses, but are net of investment level expenses. If all fees and expenses were included, the overall return to investors.

(net of applicable fees and expenses) would be lower. With respect to IRR and MOIC metrics, such IRRs and MOICs are rounded up to the nearest tenth from 2.05 and down to the nearest tenth from <.05. Current Gross IRR and Current Gross

MOIC metrics are based on actual fund level cash flows, excluding any employees or GP related co-investments, through the date referenced.

2. Net IRR and Net MOIC metrics above reflect the effects of all fees and expenses including management fees, carried interest, and fund level and investment level expenses. With respect to IRR and MOIC metrics, such IRRS and MOICs are

rounded up to the nearest tenth from 2.05 and down to the nearest tenth from <.05. Current Net IRR and Current Net MOIC metrics are based on actual fund level cash flows, excluding any employees or GP related co-investments, through the

date referenced.

3. Capital Committed to AIF V is as of 12/31/2020.

The figures shown above represent blended results for the onshore and offshore funds, as applicable, that generally invest in parallel. Projections are not guarantees of future performance and are based on assumptions that may not be correct or

complete. IRR and MOIC metrics include limited partner capital accounts only and excludes the general partner and related persons. Past performance is neither indicative nor a guarantee of future performance. Investors are encouraged to

request full AIF strategy performance and portfolio summary information for all applicable AIF funds.

25View entire presentation