SoftBank Results Presentation Deck

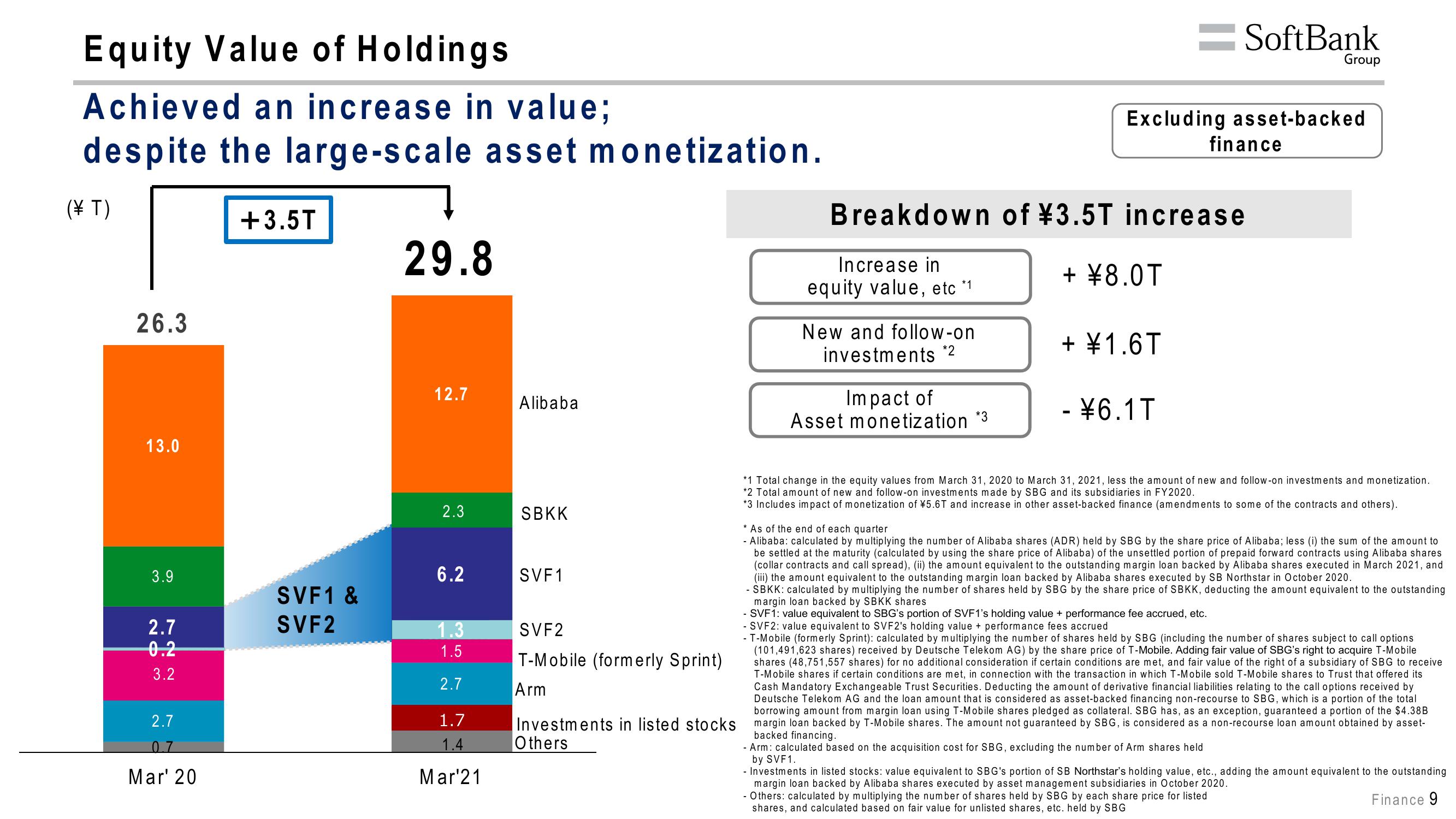

Equity Value of Holdings

Achieved an increase in value;

despite the large-scale asset monetization.

(T)

26.3

13.0

3.9

2.7

0.2

3.2

2.7

0.7

Mar' 20

+3.5T

SVF1 &

SVF2

29.8

12.7

2.3

6.2

1.3

1.5

2.7

1.7

1.4

Mar'21

Alibaba

SBKK

SVF1

SVF2

T-Mobile (formerly Sprint)

Arm

Investments in listed stocks

Others

Increase in

equity value, etc *1

New and follow-on

investments *2

Breakdown of ¥3.5T increase

+ ¥8.0T

Impact of

Asset monetization *3

Excluding asset-backed

+ ¥1.6T

SoftBank

- ¥6.1T

finance

Group

*1 Total change in the equity values from March 31, 2020 to March 31, 2021, less the amount of new and follow-on investments and monetization.

*2 Total amount of new and follow-on investments made by SBG and its subsidiaries in FY2020.

*3 Includes impact of monetization of ¥5.6T and increase in other asset-backed finance (amendments to some of the contracts and others).

- Arm: calculated based on the acquisition cost for SBG, excluding the number of Arm shares held

by SVF1.

*As of the end of each quarter

- Alibaba: calculated by multiplying the number of Alibaba shares (ADR) held by SBG by the share price of Alibaba; less (i) the sum of the amount to

be settled at the maturity (calculated by using the share price of Alibaba) of the unsettled portion of prepaid forward contracts using Alibaba shares

(collar contracts and call spread), (ii) the amount equivalent to the outstanding margin loan backed by Alibaba shares executed in March 2021, and

(iii) the amount equivalent to the outstanding margin loan backed by Alibaba shares executed by SB Northstar in October 2020.

SBKK: calculated by multiplying the number of shares held by SBG by the share price of SBKK, deducting the amount equivalent to the outstanding

margin loan backed by SBKK shares

- SVF1: value equivalent to SBG's portion of SVF1's holding value + performance fee accrued, etc.

- SVF2: value equivalent to SVF2's holding value + performance fees accrued

- T-Mobile (formerly Sprint): calculated by multiplying the number of shares held by SBG (including the number of shares subject to call options

(101,491,623 shares) received by Deutsche Telekom AG) by the share price of T-Mobile. Adding fair value of SBG's right to acquire T-Mobile

shares (48,751,557 shares) for no additional consideration if certain conditions are met, and fair value of the right of a subsidiary of SBG to receive

T-Mobile shares if certain conditions are met, in connection with the transaction in which T-Mobile sold T-Mobile shares to Trust that offered its

Cash Mandatory Exchangeable Trust Securities. Deducting the amount of derivative financial liabilities relating to the call options received by

Deutsche Telekom AG and the loan amount that is considered as asset-backed financing non-recourse to SBG, which is a portion of the total

borrowing amount from margin loan using T-Mobile shares pledged as collateral. SBG has, as an exception, guaranteed a portion of the $4.38B

margin loan backed by T-Mobile shares. The amount not guaranteed by SBG, is considered as a non-recourse loan amount obtained by asset-

backed financing.

- Investments in listed stocks: value equivalent to SBG's portion of SB Northstar's holding value, etc., adding the amount equivalent to the outstanding

margin loan backed by Alibaba shares executed by asset management subsidiaries in October 2020.

- Others: calculated by multiplying the number of shares held by SBG by each share price for listed

shares, and calculated based on fair value for unlisted shares, etc. held by SBG

Finance 9View entire presentation