Citi Investment Banking Pitch Book

6

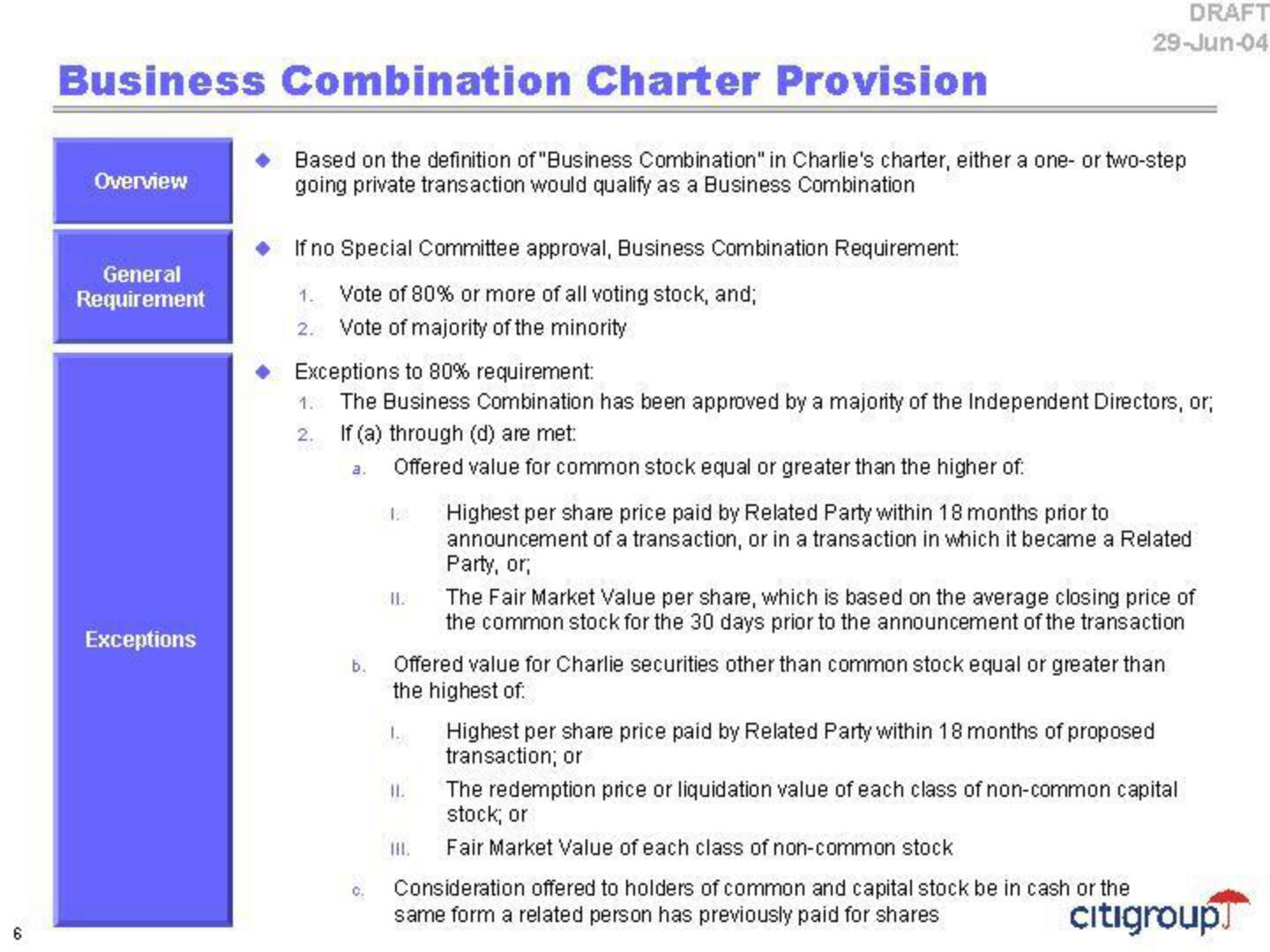

Business Combination Charter Provision

Overview

General

Requirement

Exceptions

Based on the definition of "Business Combination" in Charlie's charter, either a one- or two-step

going private transaction would qualify as a Business Combination

If no Special Committee approval, Business Combination Requirement:

1. Vote of 80% or more of all voting stock, and;

2. Vote of majority of the minority

Exceptions to 80% requirement:

1. The Business Combination has been approved by a majority of the Independent Directors, or;

2. If (a) through (d) are met:

Offered value for common stock equal or greater than the higher of:

a.

b.

C.

II.

DRAFT

29-Jun-04

III.

Highest per share price paid by Related Party within 18 months prior to

announcement of a transaction, or in a transaction in which it became a Related

Party, or,

The Fair Market Value per share, which is based on the average closing price of

the common stock for the 30 days prior to the announcement of the transaction

Offered value for Charlie securities other than common stock equal or greater than

the highest of:

Highest per share price paid by Related Party within 18 months of proposed

transaction; or

The redemption price or liquidation value of each class of non-common capital

stock; or

Fair Market Value of each class of non-common stock

Consideration offered to holders of common and capital stock be in cash or the

same form a related person has previously paid for shares

citigroup]View entire presentation