Fort Capital Investment Banking Pitch Book

NPV Analysis - Mother Lode

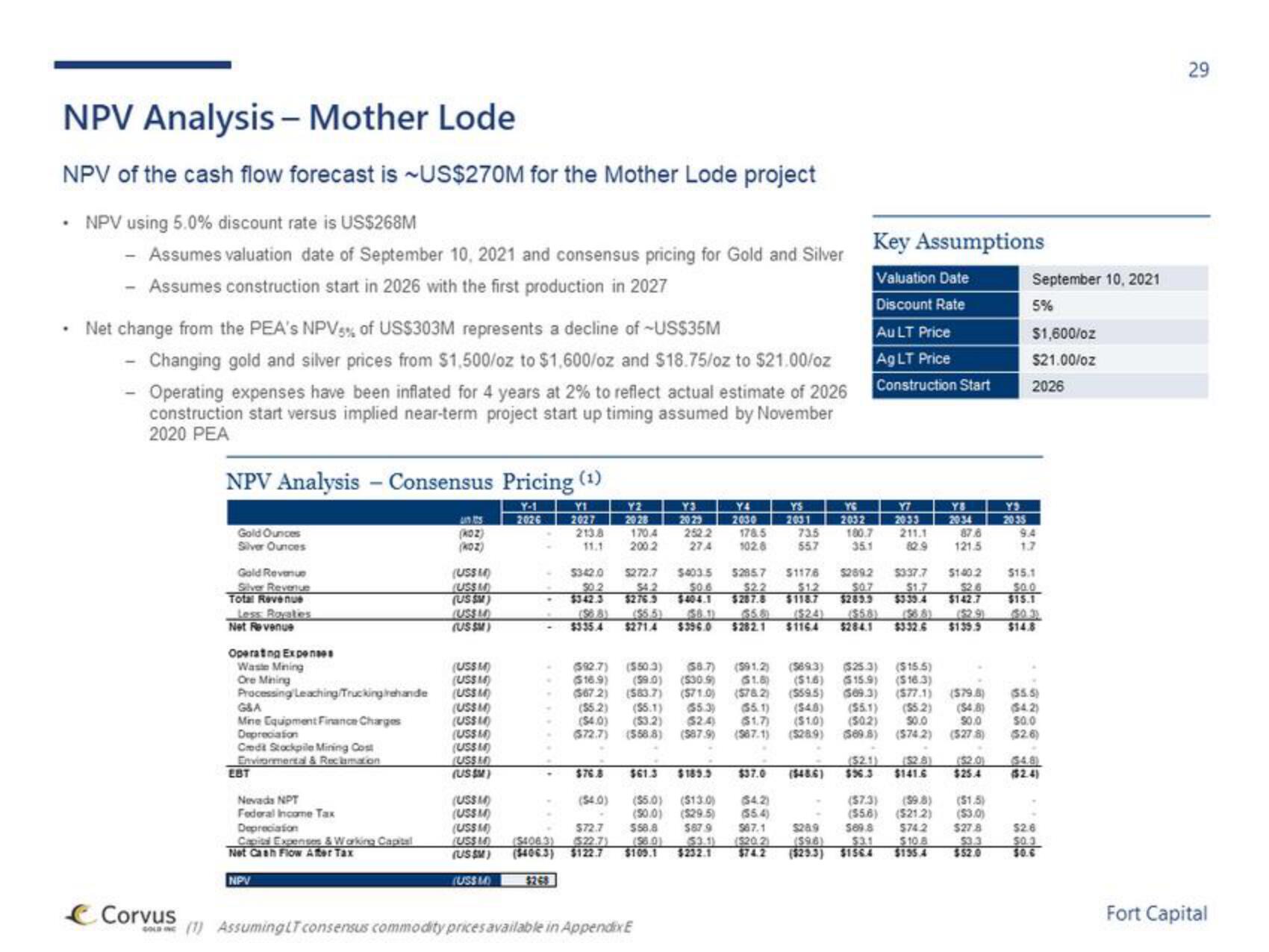

NPV of the cash flow forecast is ~US$270M for the Mother Lode project

• NPV using 5.0% discount rate is US$268M

- Assumes valuation date of September 10, 2021 and consensus pricing for Gold and Silver

Assumes construction start in 2026 with the first production in 2027

Net change from the PEA's NPV5% of US$303M represents a decline of US$35M

- Changing gold and silver prices from $1,500/oz to $1,600/oz and $18.75/oz to $21.00/oz

- Operating expenses have been inflated for 4 years at 2% to reflect actual estimate of 2026

construction start versus implied near-term project start up timing assumed by November

2020 PEA

Corvus

NPV Analysis - Consensus Pricing (1)

YI

2027

Gold Ounces

Silver Ounces

Gold Revenue

Silver Revenue

Total Revenue

Less Roates

Net Revenue

Operating Expenses

Waste Mining

Ore Mining

Processing Leaching/Truckingrehande

G&A

Mine Equipment Finance Charges

Depreciation

Credit Stockpile Mining Cost

Environmental & Reclamation

ЕВТ

Nevads NPT

Federal Income Tax

Depreciation

Capital Expenses & Working Capital

Net Cash Flow After Tax

NPV

(KOZ)

(KOZ)

(USS)

(USSM)

(USSM)

(USSLO)

(USSM)

(USSM)

(USS 16)

(USSM)

(US$M)

(US$ 14)

(US$ 14)

(USS)

(USS)

(US$M)

(USSM)

(USSM)

2026

213.8

Y2

2028

$335.4

170.4

200.2

178.5

102.8

$342.0 $272.7 $403.5 52857

$1176 $289.2

$0.2

$4.2 $0.6 $2.2 $1.2 $0.7

$342.3 $276.3 $404.1 $287.8 $118.7

$289.3

($5.5)

(524) (558)

$271.4 $396.0

$76.8 $61.3

($5.0)

(50.0)

Y3

20 29

(USSM)

$72.7 $58.8

(USSM) ($4063) ($22.7) (56.0)

(US$M)

(USSM)

252.2

27 A

(1) AssumingLT consensus commodity prices available in Appendix E

Y4

2030

YS

2031

$122.7 $109.1 $232.1

735

557

YC

2032

Key Assumptions

Valuation Date

Discount Rate

Au LT Price

Ag LT Price

Construction Start

$189.3 $37.0 ($48.6)

($13.0)

($29.5)

$87.9

180.7

35.1

Y7

2033

211.1

$337.7

$1.7

(592.7) ($50.3) (58.7) (991.2) (569.3) ($25.3) ($15.5)

($16.9) (59.0) ($30.9) $1.8)

($1.6) ($15.9) ($16.3)

($67.2) ($83.7) ($71.0) ($78.2) ($59.5) (509.3) ($77.1) ($79.8)

($5.2) (55.1) (65.3) (55.1) (548) ($5.1) (55.2) (54.8)

($4.0) (53.2) $2.4) ($1.7) ($1.0) (502) 50.0 90.0

(572.7) (558.8) (587.9) (987.1) ($28.9) (589.8) ($74.2) (527.8)

YS

2034

87.6

121.5

$140.2

$142.7

$282.1 $116.4 $284.1 $3.32.6 $135.9

($2.1) ($2.8) ($2.0)

$56.3 $141.6 $25.4

(57.3) (39.8)

($1.5)

($5.6) ($21.2)

($3.0)

64.2)

(55.4)

567.1 $28.9 589.8 $74.2 $27.8

($20.2) (596) $3.1

$74.2 ($29.3) $1564 $195.4

$10.8

$3.3

$52.0

YS

2035

September 10, 2021

5%

$1,600/oz

$21.00/oz

2026

1.7

$15.1

$0.0

$15.1

$14.8

($5.5)

($4.2)

$0.0

($2.6)

(54.8)

($2.4)

$2.6

$0.3

$0.6

29

Fort CapitalView entire presentation