Hostess SPAC Presentation Deck

PAGE

14

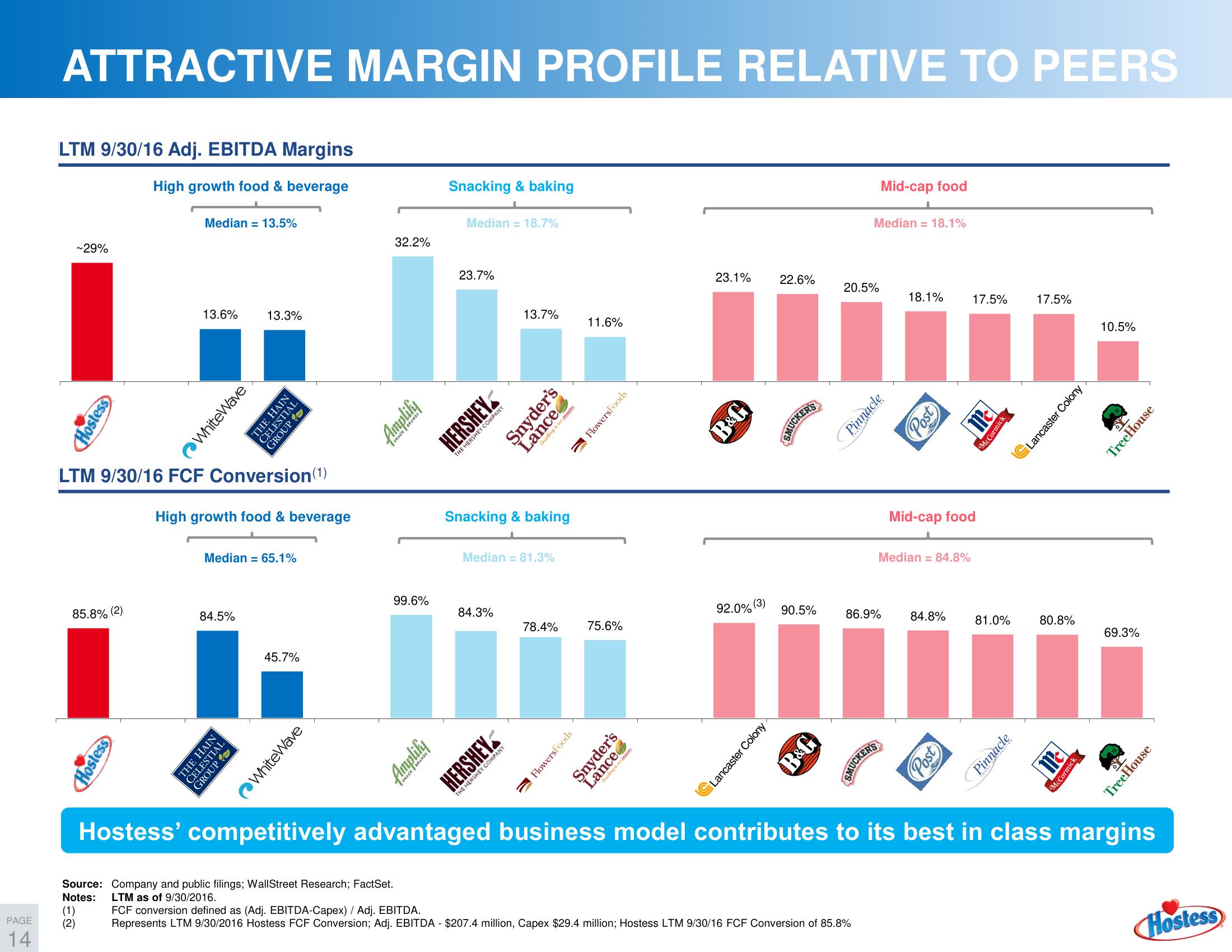

ATTRACTIVE MARGIN PROFILE RELATIVE TO PEERS

LTM 9/30/16 Adj. EBITDA Margins

High growth food & beverage

~29%

Hostess

85.8% (2)

(1)

(2)

Median = 13.5%

Hostess

13.6%

LTM 9/30/16 FCF Conversion (1)

WhiteWave

13.3%

84.5%

THE HAIN

CELESTIAL

GROUP

High growth food & beverage

Median = 65.1%

THE HAIN

CELESTIAL

GROUP

45.7%

WhiteWave

32.2%

Amplify

99.6%

Amplify

Snacking & baking

Median = 18.7%

23.7%

HERSHEY

THE HERSHEY COMPANY

13.7%

Snacking & baking

84.3%

Snyder's

Lance

Snacking is our passion

Median = 81.3%

HERSHEY

THE HERSHEY COMPANY

78.4%

Flowers Foods

11.6%

Flowers Foods

75.6%

Snyder's

Lance

23.1%

B&G

92.0% (3)

Lancaster Colony

22.6%

90.5%

B&G

20.5%

Median = 18.1%

Source: Company and public filings; WallStreet Research; FactSet.

Notes:

LTM as of 9/30/2016.

FCF conversion defined as (Adj. EBITDA-Capex) / Adj. EBITDA.

Represents LTM 9/30/2016 Hostess FCF Conversion; Adj. EBITDA - $207.4 million, Capex $29.4 million; Hostess LTM 9/30/16 FCF Conversion of 85.8%

Mid-cap food

Pinnacle

86.9%

18.1%

Post

รสหวกฟร

Mid-cap food

Median = 84.8%

1

84.8%

17.5%

Post

સા

Fall

McCormick

81.0%

Pinnacle

17.5%

80.8%

Fall

Lancaster Colony

McCormick

10.5%

69.3%

TreeHouse

TreeHouse

Hostess' competitively advantaged business model contributes to its best in class margins

HostessView entire presentation