J.P.Morgan Software Investment Banking

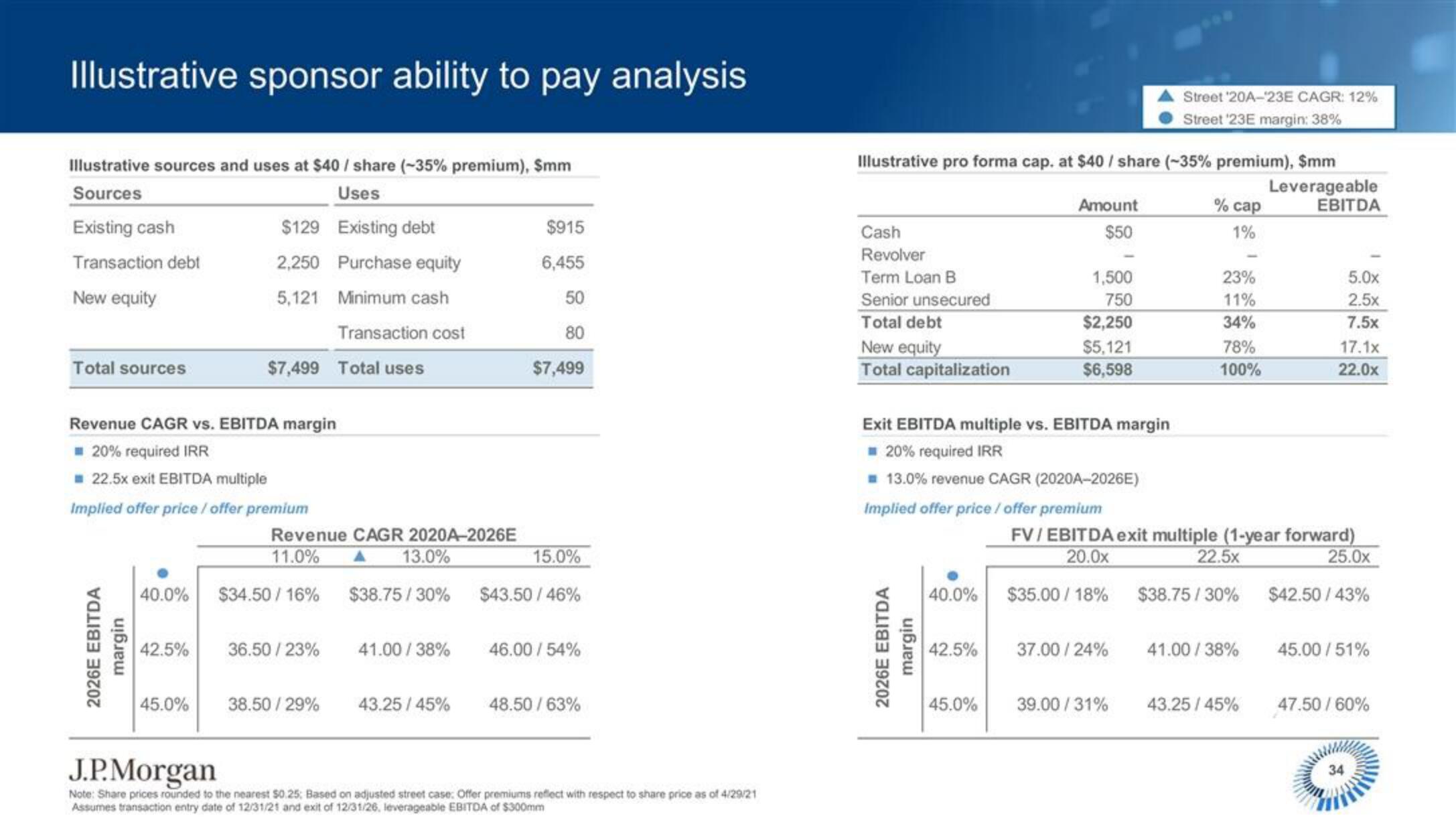

Illustrative sponsor ability to pay analysis

Illustrative sources and uses at $40 / share (-35% premium), Smm

Sources

Uses

Existing cash

Existing debt

Transaction debt

Purchase equity

New equity

Minimum cash

Transaction cost

Total sources

$129

2,250

5,121

2026E EBITDA

margin

$7,499 Total uses

Revenue CAGR vs. EBITDA margin

20% required IRR

☐ 22.5x exit EBITDA multiple

Implied offer price / offer premium

Revenue CAGR 2020A-2026E

11.0% ▲ 13.0%

40.0% $34.50 / 16%

42.5% 36.50/23%

45.0% 38.50/29%

$915

6,455

50

80

$7,499

15.0%

$38.75/30% $43.50 / 46%

43.25/45%

41.00/38% 46.00/54%

48.50 / 63%

J.P.Morgan

Note: Share prices rounded to the nearest $0.25; Based on adjusted street case: Offer premiums reflect with respect to share price as of 4/29/21

Assumes transaction entry date of 12/31/21 and exit of 12/31/26, leverageable EBITDA of $300mm

Illustrative pro forma cap. at $40 / share (-35% premium), $mm

Leverageable

EBITDA

Cash

Revolver

Term Loan B

Senior unsecured

Total debt

New equity

Total capitalization

2026E EBITDA

margin

Exit EBITDA multiple vs. EBITDA margin

☐ 20% required IRR

☐ 13.0% revenue CAGR (2020A-2026E)

40.0%

Amount

$50

Implied offer price / offer premium

42.5%

1,500

750

45.0%

$2,250

$5,121

$6,598

Street '20A-23E CAGR: 12%

Street '23E margin: 38%

37.00/24%

39.00/31%

% cap

1%

23%

11%

34%

78%

100%

FV/EBITDA exit multiple (1-year forward)

20.0x

22.5x

25.0x

$35.00/ 18%

41.00/38%

5.0x

2.5x

7.5x

17.1x

22.0x

$38.75/30% $42.50/43%

43.25/45%

45.00/51%

47.50/60%

34View entire presentation