Zegna Investor Day Presentation Deck

CAPITAL MARKETS DAY

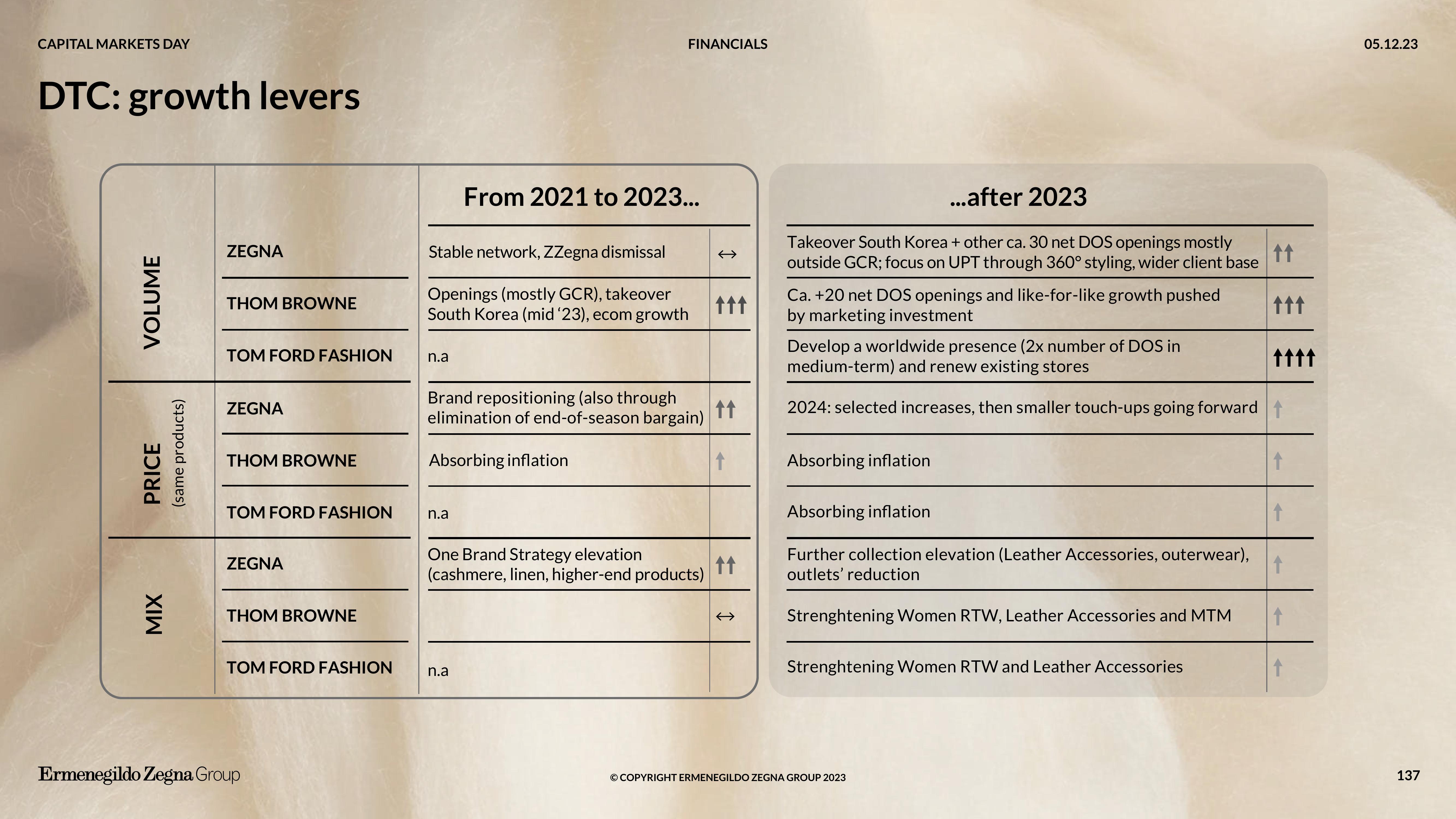

DTC: growth levers

VOLUME

PRICE

(same products)

MIX

ZEGNA

THOM BROWNE

TOM FORD FASHION

ZEGNA

THOM BROWNE

TOM FORD FASHION

ZEGNA

THOM BROWNE

TOM FORD FASHION

Ermenegildo Zegna Group

n.a

Stable network, ZZegna dismissal

Openings (mostly GCR), takeover

South Korea (mid '23), ecom growth

FINANCIALS

n.a

From 2021 to 2023...

Brand repositioning (also through

elimination of end-of-season bargain)

Absorbing inflation

n.a

One Brand Strategy elevation

(cashmere, linen, higher-end products)

←

↑↑↑

↑↑

↑

...after 2023

Takeover South Korea + other ca. 30 net DOS openings mostly

outside GCR; focus on UPT through 360° styling, wider client base

↑↑

Ca. +20 net DOS openings and like-for-like growth pushed

by marketing investment

Develop a worldwide presence (2x number of DOS in

medium-term) and renew existing stores

2024: selected increases, then smaller touch-ups going forward

Absorbing inflation

Absorbing inflation

Further collection elevation (Leather Accessories, outerwear),

outlets' reduction

Strenghtening Women RTW, Leather Accessories and MTM

Strenghtening Women RTW and Leather Accessories

© COPYRIGHT ERMENEGILDO ZEGNA GROUP 2023

↑↑↑

↑

↑

05.12.23

137View entire presentation