Matson Results Presentation Deck

15

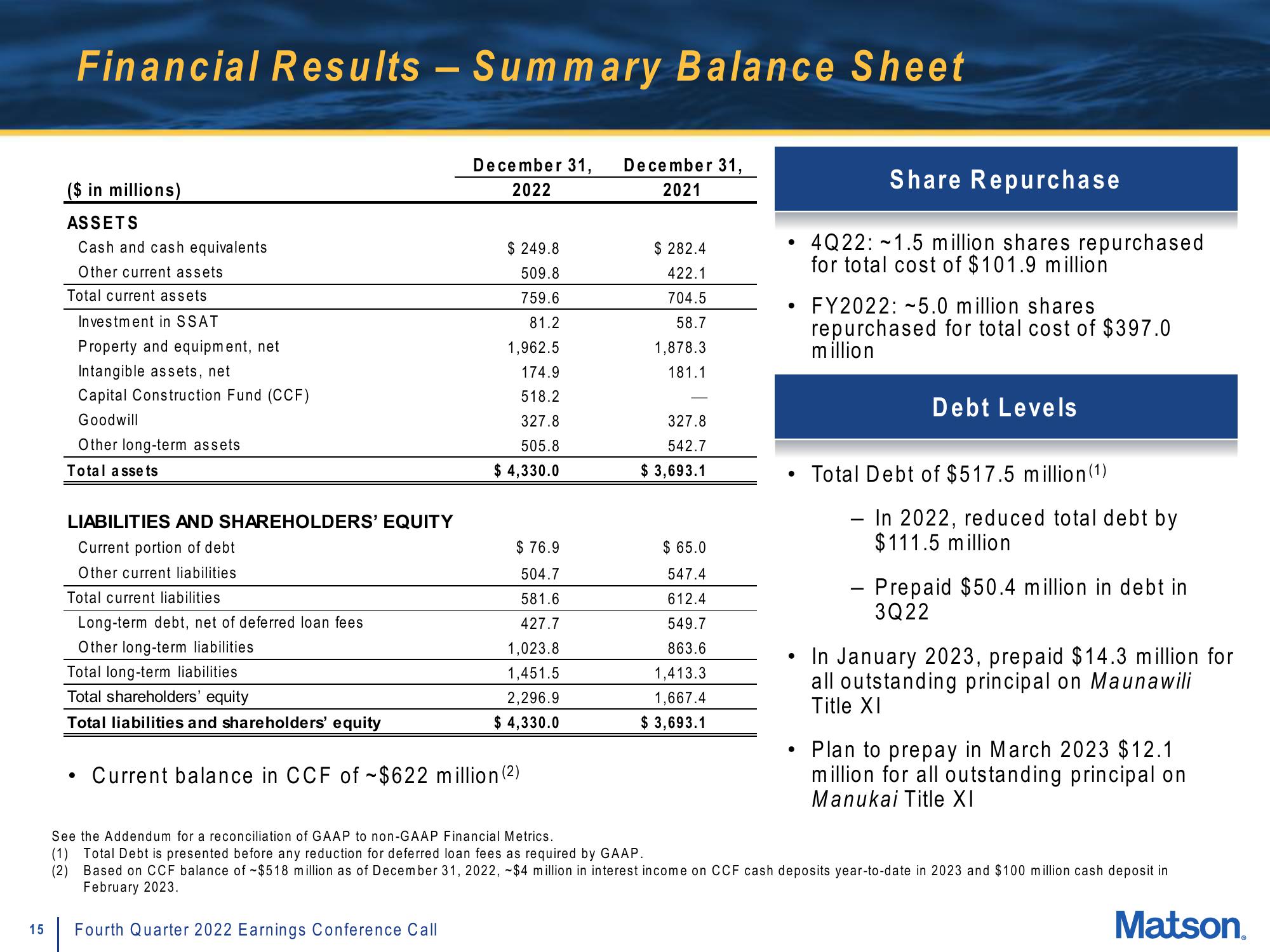

Financial Results - Summary Balance Sheet

December 31, December 31,

2022

2021

($ in millions)

ASSETS

Cash and cash equivalents

Other current assets

Total current assets

Investment in SSAT

Property and equipment, net

Intangible assets, net

Capital Construction Fund (CCF)

Goodwill

Other long-term assets

Total assets

LIABILITIES AND SHAREHOLDERS' EQUITY

Current portion of debt

Other current liabilities

Total current liabilities

Long-term debt, net of deferred loan fees

Other long-term liabilities

Total long-term liabilities

Total shareholders' equity

Total liabilities and shareholders' equity

●

$ 249.8

509.8

759.6

81.2

1,962.5

174.9

518.2

327.8

505.8

$ 4,330.0

$76.9

504.7

581.6

427.7

1,023.8

1,451.5

2,296.9

$ 4,330.0

Current balance in CCF of ~$622 million (²)

$ 282.4

422.1

704.5

58.7

1,878.3

181.1

327.8

542.7

$ 3,693.1

$65.0

547.4

612.4

549.7

863.6

1,413.3

1,667.4

$3,693.1

Share Repurchase

•4Q22:~1.5 million shares repurchased

for total cost of $101.9 million

●

●

●

●

FY2022: -5.0 million shares

repurchased for total cost of $397.0

million

Debt Levels

Total Debt of $517.5 million (1)

- In 2022, reduced total debt by

$111.5 million

- Prepaid $50.4 million in debt in

3Q22

In January 2023, prepaid $14.3 million for

all outstanding principal on Maunawili

Title XI

Plan to prepay in March 2023 $12.1

million for all outstanding principal on

Manukai Title XI

See the Addendum for a reconciliation of GAAP to non-GAAP Financial Metrics.

(1) Total Debt is presented before any reduction for deferred loan fees as required by GAAP.

Based on CCF balance of $518 million as of December 31, 2022, $4 million in interest income on CCF cash deposits year-to-date in 2023 and $100 million cash deposit in

February 2023.

Fourth Quarter 2022 Earnings Conference Call

Matson.View entire presentation