Hilltop Holdings Results Presentation Deck

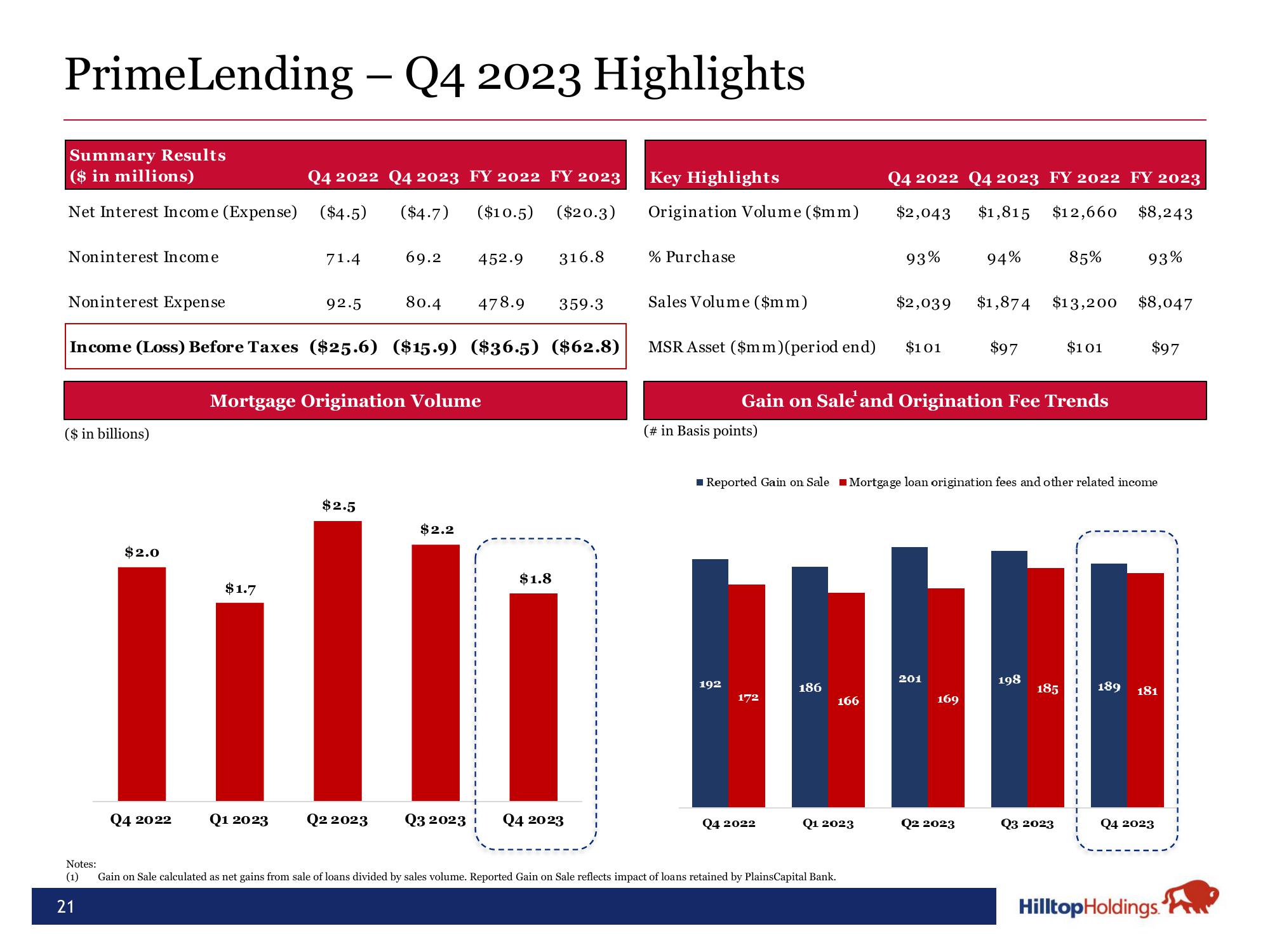

PrimeLending - Q4 2023 Highlights

Summary Results

($ in millions)

Q4 2022 Q4 2023 FY 2022 FY 2023

Net Interest Income (Expense) ($4.5) ($4.7) ($10.5) ($20.3)

Noninterest Income

Noninterest Expense

($ in billions)

478.9 359.3

Income (Loss) Before Taxes ($25.6) ($15.9) ($36.5) ($62.8)

$2.0

$1.7

1₁

Q4 2022

71.4

Q1 2023

92.5

Mortgage Origination Volume

69.2 452.9

$2.5

80.4

Q2 2023

$2.2

Q3 2023

316.8

$1.8

Q4 2023

Key Highlights

Origination Volume ($mm)

% Purchase

(# in Basis points)

Sales Volume ($mm)

MSR Asset ($mm)(period end) $101

192

172

Q4 2022

186

Q4 2022 Q4 2023 FY 2022 FY 2023

$2,043 $1,815 $12,660 $8,243

93%

166

Q1 2023

Notes:

(1) Gain on Sale calculated as net gains from sale of loans divided by sales volume. Reported Gain on Sale reflects impact of loans retained by PlainsCapital Bank.

21

Gain on Sale' and Origination Fee Trends

$2,039 $1,874

Reported Gain on Sale Mortgage loan origination fees and other related income

94%

201

169

$97

Q2 2023

198

85%

$13,200 $8,047

185

$101

Q3 2023

93%

$97

189 181

Q4 2023

Hilltop Holdings.View entire presentation