NioCorp SPAC Presentation Deck

1

2

3

4

5

NioCorp

Critical Mineral Security

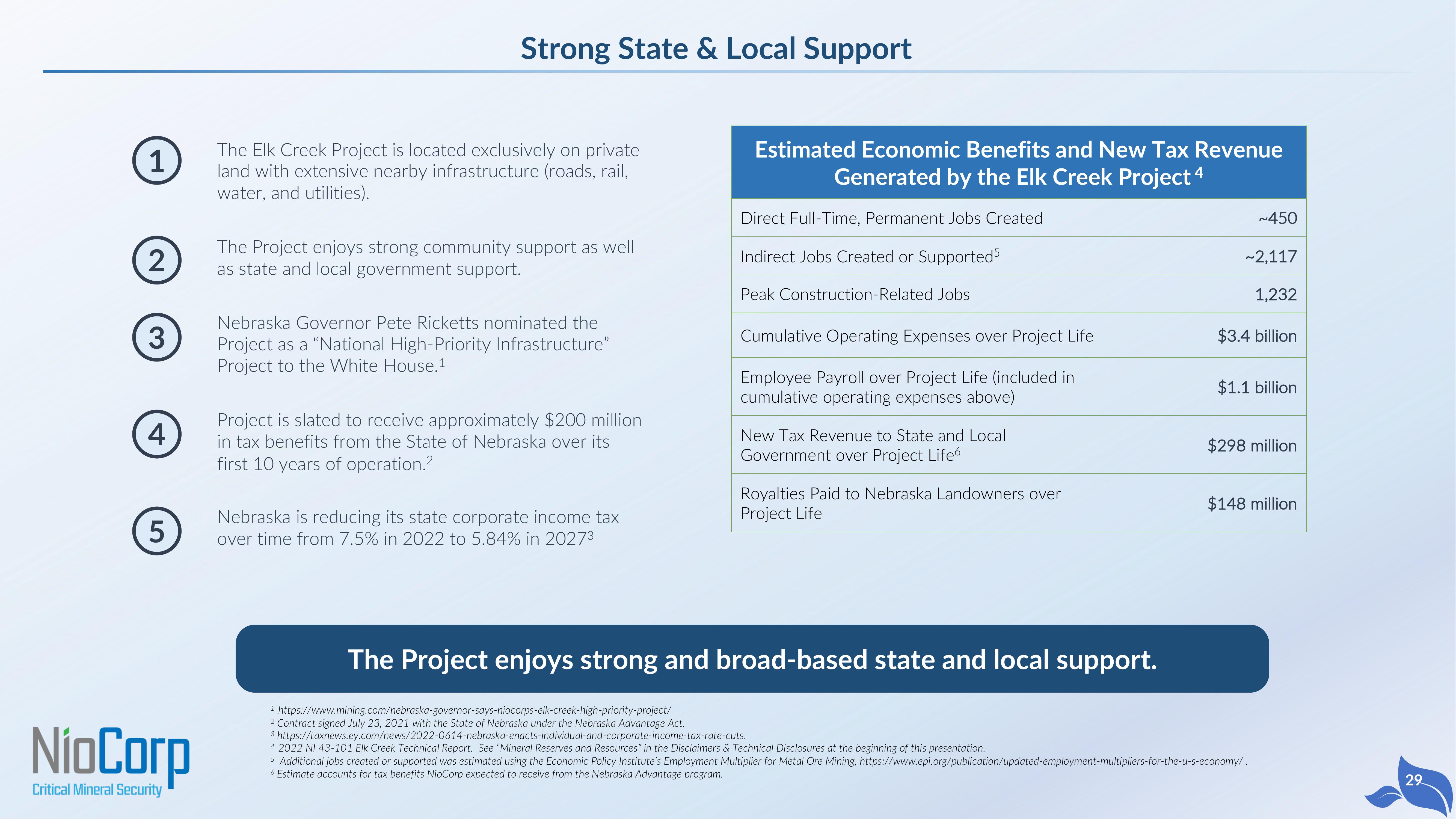

Strong State & Local Support

The Elk Creek Project is located exclusively on private

land with extensive nearby infrastructure (roads, rail,

water, and utilities).

The Project enjoys strong community support as well

as state and local government support.

Nebraska Governor Pete Ricketts nominated the

Project as a "National High-Priority Infrastructure"

Project to the White House. 1

Project is slated to receive approximately $200 million

in tax benefits from the State of Nebraska over its

first 10 years of operation.²

Nebraska is reducing its state corporate income tax

over time from 7.5% in 2022 to 5.84% in 20273

Estimated Economic Benefits and New Tax Revenue

Generated by the Elk Creek Project 4

Direct Full-Time, Permanent Jobs Created

Indirect Jobs Created or Supported5

Peak Construction-Related Jobs

Cumulative Operating Expenses ov Project Life

Employee Payroll over Project Life (included in

cumulative operating expenses above)

New Tax Revenue to State and Local

Government over Project Life

Royalties Paid to Nebraska Landowners over

Project Life

The Project enjoys strong and broad-based state and local support.

~450

~2,117

1,232

$3.4 billion

$1.1 billion

$298 million

$148 million

1

https://www.mining.com/nebraska-governor-says-niocorps-elk-creek-high-priority-project/

2 Contract signed July 23, 2021 with the State of Nebraska under the Nebraska Advantage Act.

3 https://taxnews.ey.com/news/2022-0614-nebraska-enacts-individual-and-corporate-income-tax-rate-cuts.

4 2022 NI 43-101 Elk Creek Technical Report. See "Mineral Reserves and Resources" in the Disclaimers & Technical Disclosures at the beginning of this presentation.

5 Additional jobs created or supported was estimated using the Economic Policy Institute's Employment Multiplier for Metal Ore Mining, https://www.epi.org/publication/updated-employment-multipliers-for-the-u-s-economy/.

6 Estimate accounts for tax benefits NioCorp expected to receive from the Nebraska Advantage program.

29View entire presentation