Cboe Results Presentation Deck

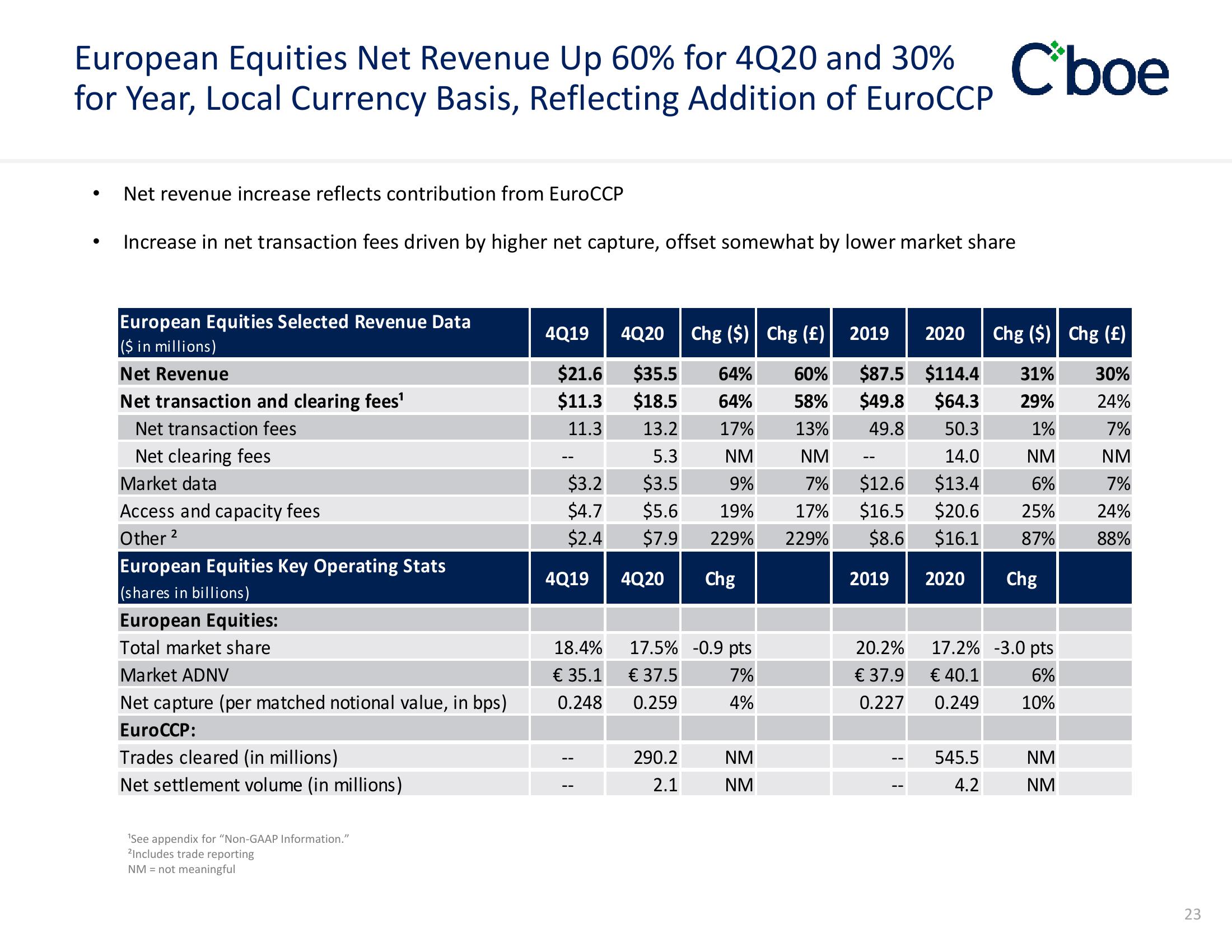

European Equities Net Revenue Up 60% for 4Q20 and 30% C'boe

for Year, Local Currency Basis, Reflecting Addition of EuroCCP

●

●

Net revenue increase reflects contribution from EuroCCP

Increase in net transaction fees driven by higher net capture, offset somewhat by lower market share

European Equities Selected Revenue Data

($ in millions)

Net Revenue

Net transaction and clearing fees¹

Net transaction fees

Net clearing fees

Market data

Access and capacity fees

Other

2

European Equities Key Operating Stats

(shares in billions)

European Equities:

Total market share

Market ADNV

Net capture (per matched notional value, in bps)

EuroCCP:

Trades cleared (in millions)

Net settlement volume (in millions)

¹See appendix for "Non-GAAP Information."

2Includes trade reporting

NM = not meaningful

4Q19

$21.6

$11.3

11.3

$3.2

$4.7

$2.4

4Q19

18.4%

€ 35.1

0.248

4Q20 Chg ($) | Chg (£)

$35.5 64%

$18.5 64%

13.2

17%

NM

9%

19%

17%

229% 229%

Chg

5.3

$3.5

$5.6

$7.9

4Q20

17.5% -0.9 pts

€ 37.5

7%

0.259

4%

290.2

2.1

NM

NM

2019 2020 Chg ($) | Chg (£)

60%

$87.5 $114.4 31%

58% $49.8 $64.3 29%

13%

49.8

50.3

1%

NM

14.0

NM

7% $12.6

$13.4

6%

$16.5 $20.6 25%

$8.6 $16.1

87%

2019 2020

20.2%

€ 37.9

0.227

Chg

17.2% -3.0 pts

€ 40.1

6%

0.249

10%

545.5

4.2

NM

NM

30%

24%

7%

NM

7%

24%

88%

23View entire presentation