Greystar Equity Partners XI (May-23)

A GLOBAL LEADER IN RENTAL HOUSING™

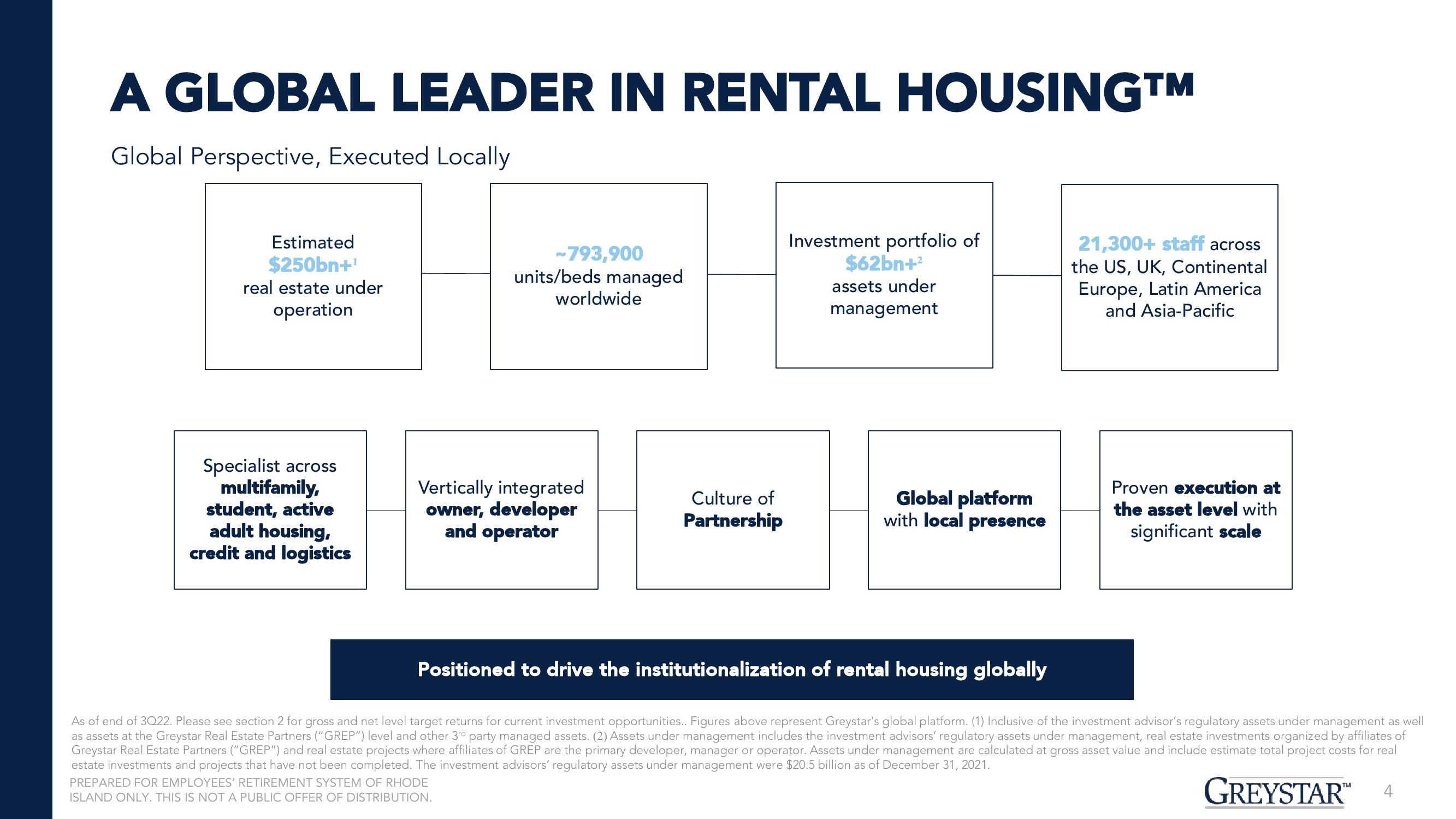

Global Perspective, Executed Locally

Estimated

$250bn+¹

real estate under

operation

Specialist across

multifamily,

student, active

adult housing,

credit and logistics

-793,900

units/beds managed

worldwide

Vertically integrated

owner, developer

and operator

PREPARED FOR EMPLOYEES' RETIREMENT SYSTEM OF RHODE

ISLAND ONLY. THIS IS NOT A PUBLIC OFFER OF DISTRIBUTION.

Culture of

Partnership

Investment portfolio of

$62bn+²

assets under

management

Global platform

with local presence

21,300+ staff across

the US, UK, Continental

Europe, Latin America

and Asia-Pacific

Proven execution at

the asset level with

significant scale

Positioned to drive the institutionalization of rental housing globally

As of end of 3Q22. Please see section 2 for gross and net level target returns for current investment opportunities.. Figures above represent Greystar's global platform. (1) Inclusive of the investment advisor's regulatory assets under management as well

as assets at the Greystar Real Estate Partners ("GREP") level and other 3rd party managed assets. (2) Assets under management includes the investment advisors' regulatory assets under management, real estate investments organized by affiliates of

Greystar Real Estate Partners ("GREP") and real estate projects where affiliates of GREP are the primary developer, manager or operator. Assets under management are calculated at gross asset value and include estimate total project costs for real

estate investments and projects that have not been completed. The investment advisors' regulatory assets under management were $20.5 billion as of December 31, 2021.

GREYSTAR™

4View entire presentation