Granite Ridge Investor Presentation Deck

Overview

Assets

Strategy & Execution

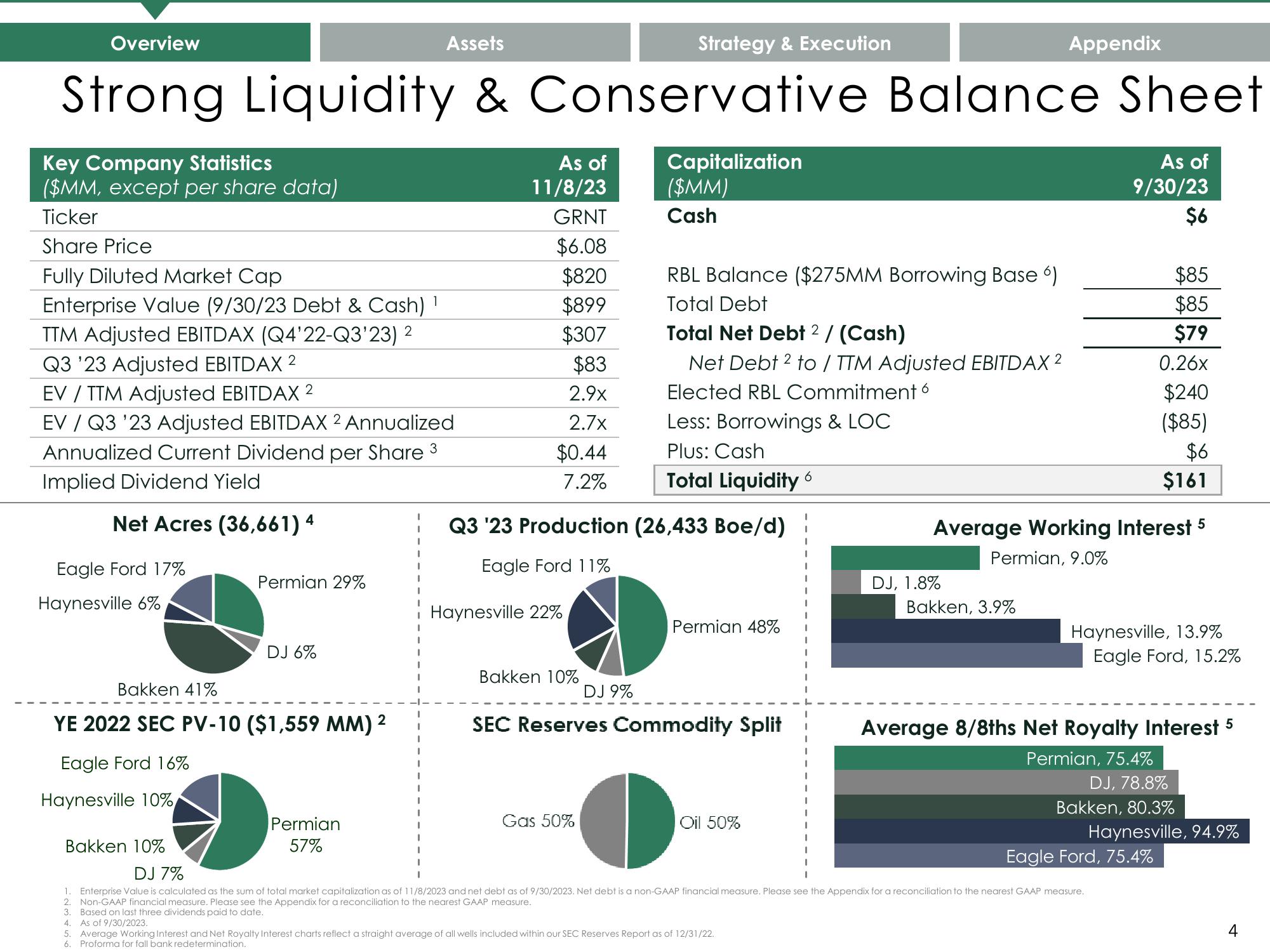

Strong Liquidity & Conservative Balance Sheet

Key Company Statistics

($MM, except per share data)

Ticker

Share Price

Fully Diluted Market Cap

Enterprise Value (9/30/23 Debt & Cash) 1

TTM Adjusted EBITDAX (Q4'22-Q3'23) 2

Q3 '23 Adjusted EBITDAX 2

EV / TTM Adjusted EBITDAX 2

EV / Q3 '23 Adjusted EBITDAX 2 Annualized

Annualized Current Dividend per Share 3

Implied Dividend Yield

Net Acres (36,661) 4

Eagle Ford 17%

Haynesville 6%

Haynesville 10%

Permian 29%

Bakken 41%

YE 2022 SEC PV-10 ($1,559 MM) 2

Eagle Ford 16%

Bakken 10%

DJ 6%

Permian

57%

As of

11/8/23

GRNT

$6.08

$820

$899

$307

$83

2.9x

2.7x

$0.44

7.2%

Q3 '23 Production

Eagle Ford 11%

Haynesville 22%

Bakken 10%

DJ 9%

Gas 50%

Capitalization

($MM)

Cash

RBL Balance ($275MM Borrowing Base 6)

Total Debt

Total Net Debt 2 / (Cash)

Net Debt 2 to/ TTM Adjusted EBITDAX ²

Elected RBL Commitment 6

Less: Borrowings & LOC

Plus: Cash

Total Liquidity 6

(26,433 Boe/d)

SEC Reserves Commodity Split

Permian 48%

●

Oil 50%

4. As of 9/30/2023.

5. Average Working Interest and Net Royalty Interest charts reflect a straight average of all wells included within our SEC Reserves Report as of 12/31/22.

6. Proforma for fall bank redetermination.

Appendix

DJ, 1.8%

Bakken, 3.9%

Average Working Interest 5

Permian, 9.0%

As of

9/30/23

$6

$85

$85

$79

0.26x

$240

($85)

$6

$161

Haynesville, 13.9%

DJ 7%

1.

Enterprise Value is calculated as the sum of total market capitalization as of 11/8/2023 and net debt as of 9/30/2023. Net debt is a non-GAAP financial measure. Please see the Appendix for a reconciliation to the nearest GAAP measure.

2. Non-GAAP financial measure. Please see the Appendix for a reconciliation to the nearest GAAP measure.

Based on last three dividends paid to date.

Eagle Ford, 15.2%

Average 8/8ths Net Royalty Interest 5

Permian, 75.4%

DJ, 78.8%

Bakken, 80.3%

Haynesville, 94.9%

Eagle Ford, 75.4%

4View entire presentation