Apollo Global Management Investor Day Presentation Deck

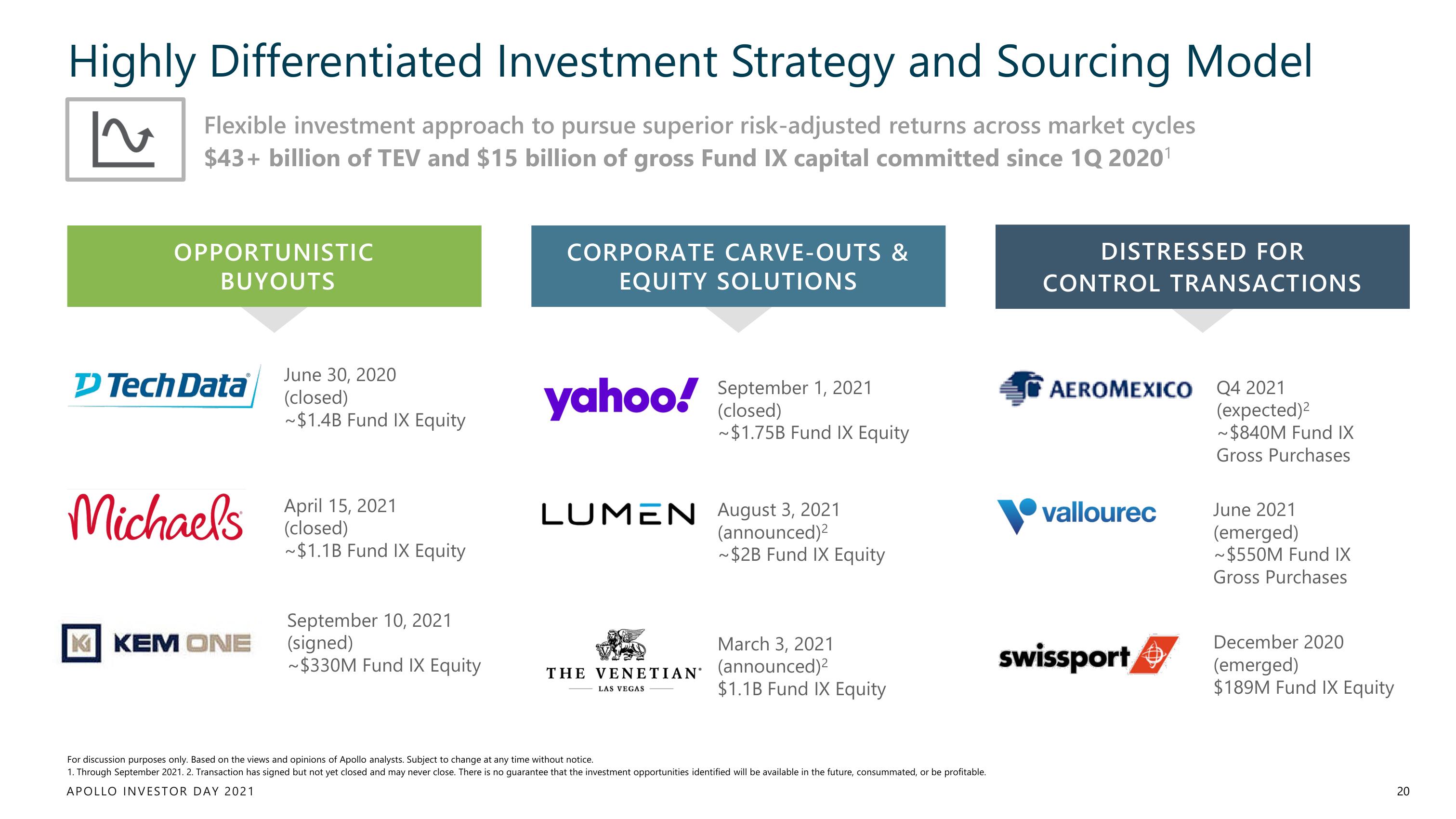

Highly Differentiated Investment Strategy and Sourcing Model

IN

Flexible investment approach to pursue superior risk-adjusted returns across market cycles

$43+ billion of TEV and $15 billion of gross Fund IX capital committed since 1Q 2020¹

OPPORTUNISTIC

BUYOUTS

D Tech Data

Michaels

K KEM ONE

June 30, 2020

(closed)

~$1.4B Fund IX Equity

April 15, 2021

(closed)

~$1.1B Fund IX Equity

September 10, 2021

(signed)

~$330M Fund IX Equity

CORPORATE CARVE-OUTS &

EQUITY SOLUTIONS

yahoo!

LUMEN August 3, 2021

(announced)²

~$2B Fund IX Equity

THE VENETIAN

September 1, 2021

(closed)

~$1.75B Fund IX Equity

LAS VEGAS

March 3, 2021

(announced)²

$1.1B Fund IX Equity

For discussion purposes only. Based on the views and opinions of Apollo analysts. Subject to change at any time without notice.

1. Through September 2021. 2. Transaction has signed but not yet closed and may never close. There is no guarantee that the investment opportunities identified will be available in the future, consummated, or be profitable.

APOLLO INVESTOR DAY 2021

DISTRESSED FOR

CONTROL TRANSACTIONS

AEROMEXICO Q4 2021

vallourec

swissport4

(expected)²

~$840M Fund IX

Gross Purchases

June 2021

(emerged)

~$550M Fund IX

Gross Purchases

December 2020

(emerged)

$189M Fund IX Equity

20View entire presentation