Fort Capital Investment Banking Pitch Book

Overview of North Bullfrog

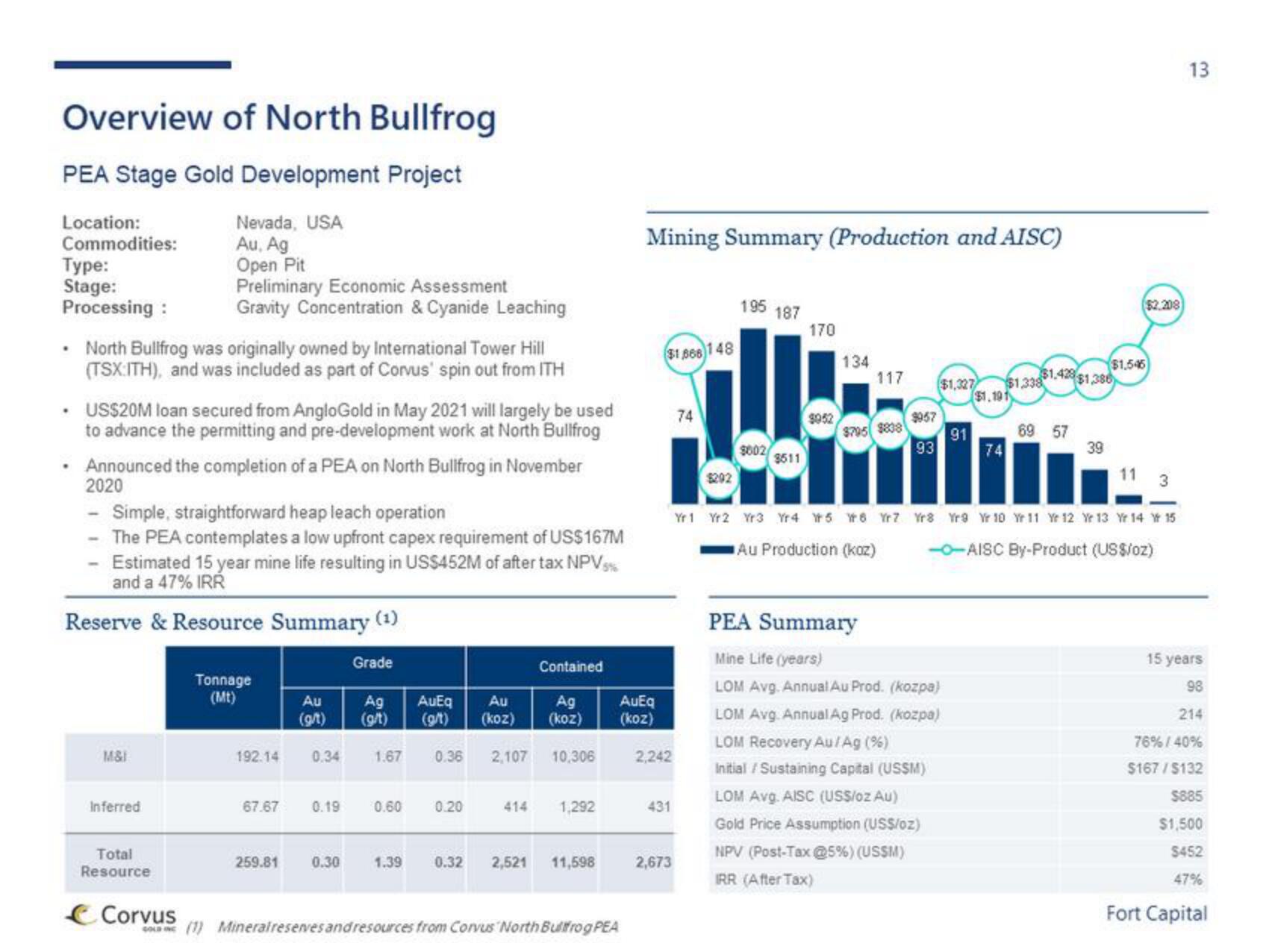

PEA Stage Gold Development Project

Location:

Nevada, USA

Commodities:

Au, Ag

Open Pit

Type:

Stage:

Processing:

.

North Bullfrog was originally owned by International Tower Hill

(TSX:ITH), and was included as part of Corvus' spin out from ITH

US$20M loan secured from AngloGold in May 2021 will largely be used

to advance the permitting and pre-development work at North Bullfrog

Announced the completion of a PEA on North Bullfrog in November

2020

Simple, straightforward heap leach operation

The PEA contemplates a low upfront capex requirement of US$167M

Estimated 15 year mine life resulting in US$452M of after tax NPV5%

and a 47% IRR

Reserve & Resource Summary (¹)

M&I

Preliminary Economic Assessment

Gravity Concentration & Cyanide Leaching

Inferred

Total

Resource

Corvus

Tonnage

(Mt)

67.67 0.19

Au Ag AuEq

(g/t) (g/t) (g/t)

Au

Ag

(koz) (koz)

192.14 0.34 1.67 0.36 2,107 10,306

259.81

Grade

0.30

0.60

1.39

Contained

0.20

414 1,292

0.32 2,521 11,598

Mining Summary (Production and AISC)

AuEq

(koz)

(1) Mineralreserves and resources from Corvus North Bullfrog PEA

$1,868 148

2,242

431

2,673

74

195 187

$292

9002

3511

170

$952

134

117

$795 $838

9957

93

$1,327 $1,338

91

PEA Summary

Mine Life (years)

LOM Avg. Annual Au Prod. (kozpa)

LOM Avg. Annual Ag Prod. (Kozpa)

LOM Recovery Au/Ag (%)

Initial / Sustaining Capital (USSM)

LOM Avg. AISC (USS/oz Au)

Gold Price Assumption (USS/oz)

NPV (Post-Tax @5%) (USSM)

IRR (After Tax)

$1.191

74

$1.428 $1,386

69 57

$1,545

39

11 3

Yr1 Yr2 Yr3 Yr4 5 6 YZ Yrs Yr9 10 11 12 13 14 W 15

Au Production (koz)

-AISC By-Product (US$/oz)

$2,208

13

15 years

98

214

76%/40%

$167/$132

$885

$1,500

$452

47%

Fort CapitalView entire presentation