Evercore Investment Banking Pitch Book

Appendix

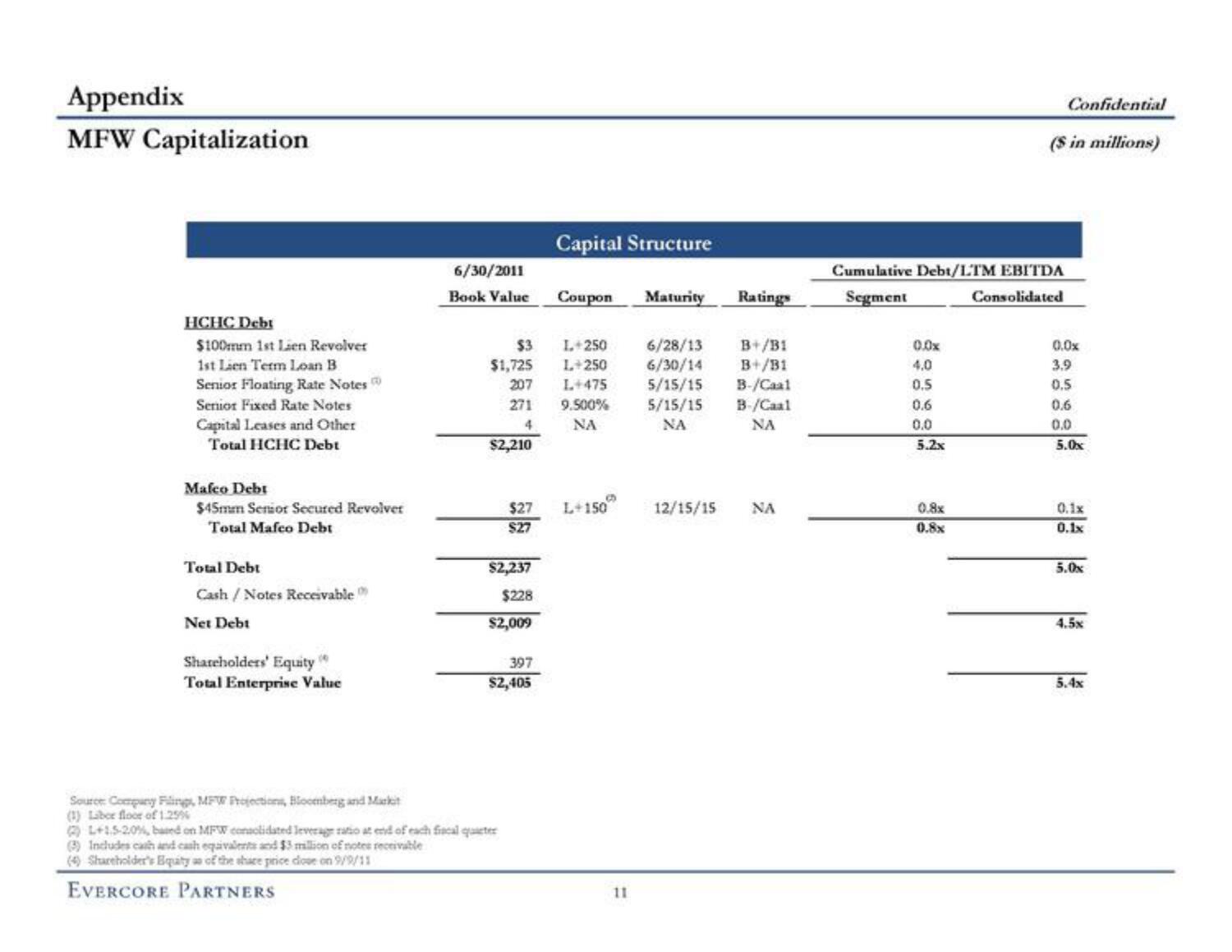

MFW Capitalization

HCHC Debt

$100mm 1st Lien Revolver

1st Lien Term Loan B

Senior Floating Rate Notes

Senior Fixed Rate Notes

Capital Leases and Other

Total HCHC Debt

Mafco Debi

$45mm Senior Secured Revolver

Total Mafco Debt

Total Debt

Cash / Notes Receivable

Net Debt

8

Shareholders' Equity

Total Enterprise Value

Source Company Filing, MFW Projections, Bloomberg and Markt

(1) Laber floor of 1.25%

6/30/2011

Book Value

$3 L+250

$1,725 1+250

207 L+475

271 9.500%

4 NA

$2,210

$2,237

$228

$2,009

Capital Structure

397

$2,405

(2) L+15-20%, based on MFW consolidated leverage ratio at end of each fiscal queter

(3) Includes cash and cash equivalents and $3 million of notes receivable

(4) Shareholder's Bqaty as of the share price dloue on 9/9/11

EVERCORE PARTNERS

Coupon Maturity

$27 L+150

$27

65

11

Ratings

6/28/13

B+/B1

6/30/14

B+/B1

5/15/15 B-/Caal

5/15/15

ΝΑ

B-/Caal

NA

12/15/15

NA

Cumulative Debt/LTM EBITDA

Segment

Consolidated

0.0x

4.0

0.5

0.6

0.0

5.2x

0.8x

0.8x

Confidential

($ in millions)

0.0x

3.9

0.5

0.6

0.0

5.0x

0.1x

0.1x

5.0x

4.5x

5.4xView entire presentation