Bird Investor Presentation Deck

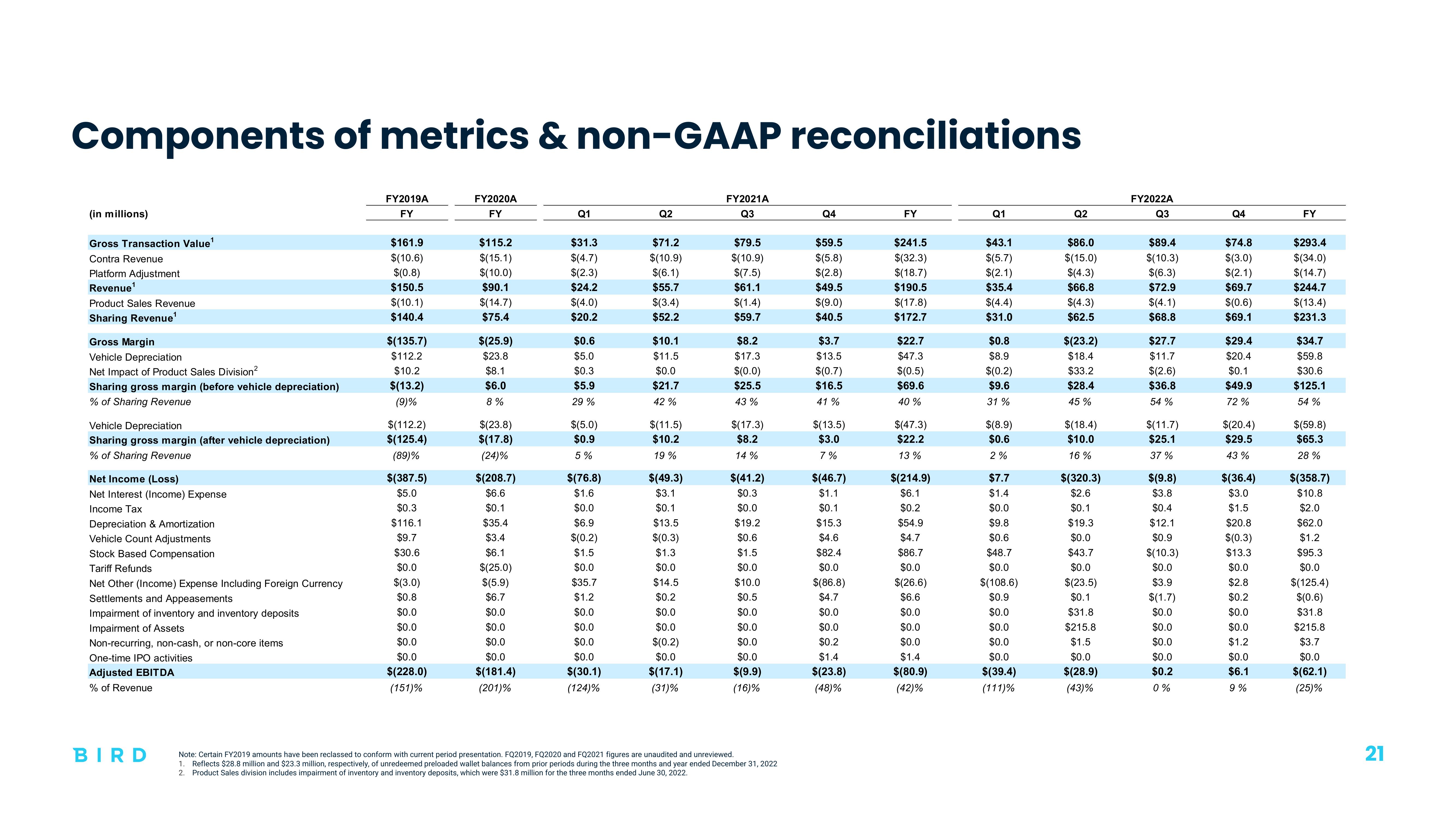

Components of metrics & non-GAAP reconciliations

(in millions)

Gross Transaction Value¹

Contra Revenue

Platform Adjustment

Revenue¹

Product Sales Revenue

Sharing Revenue¹

Gross Margin

Vehicle Depreciation

Net Impact of Product Sales Division²

Sharing gross margin (before vehicle depreciation)

% of Sharing Revenue

Vehicle Depreciation

Sharing gross margin (after vehicle depreciation)

% of Sharing Revenue

Net Income (Loss)

Net Interest (Income) Expense

Income Tax

Depreciation & Amortization

Vehicle Count Adjustments

Stock Based Compensation

Tariff Refunds

Net Other (Income) Expense Including Foreign Currency

Settlements and Appeasements

Impairment of inventory and inventory deposits

Impairment of Assets

Non-recurring, non-cash, or non-core items

One-time IPO activities

Adjusted EBITDA

% of Revenue

BIRD

FY2019A

FY

$161.9

$(10.6)

$(0.8)

$150.5

$(10.1)

$140.4

$(135.7)

$112.2

$10.2

$(13.2)

(9)%

$(112.2)

$(125.4)

(89)%

$(387.5)

$5.0

$0.3

$116.1

$9.7

$30.6

$0.0

$(3.0)

$0.8

$0.0

$0.0

$0.0

$0.0

$(228.0)

(151)%

FY2020A

FY

$115.2

$(15.1)

$(10.0)

$90.1

$(14.7)

$75.4

$(25.9)

$23.8

$8.1

$6.0

8%

$(23.8)

$(17.8)

(24)%

$(208.7)

$6.6

$0.1

$35.4

$3.4

$6.1

$(25.0)

$(5.9)

$6.7

$0.0

$0.0

$0.0

$0.0

$(181.4)

(201)%

Q1

$31.3

$(4.7)

$(2.3)

$24.2

$(4.0)

$20.2

$0.6

$5.0

$0.3

$5.9

29 %

$(5.0)

$0.9

5%

$(76.8)

$1.6

$0.0

$6.9

$(0.2)

$1.5

$0.0

$35.7

$1.2

$0.0

$0.0

$0.0

$0.0

$(30.1)

(124)%

Q2

$71.2

$(10.9)

$(6.1)

$55.7

$(3.4)

$52.2

$10.1

$11.5

$0.0

$21.7

42%

$(11.5)

$10.2

19%

$(49.3)

$3.1

$0.1

$13.5

$(0.3)

$1.3

$0.0

$14.5

$0.2

$0.0

$0.0

$(0.2)

$0.0

$(17.1)

(31)%

FY2021A

Q3

$79.5

$(10.9)

$(7.5)

$61.1

$(1.4)

$59.7

$8.2

$17.3

$(0.0)

$25.5

43%

$(17.3)

$8.2

14%

$(41.2)

$0.3

$0.0

$19.2

$0.6

$1.5

$0.0

$10.0

$0.5

$0.0

$0.0

$0.0

$0.0

$(9.9)

(16)%

Note: Certain FY2019 amounts have been reclassed to conform with current period presentation. FQ2019, FQ2020 and FQ2021 figures are unaudited and unreviewed.

1. Reflects $28.8 million and $23.3 million, respectively, of unredeemed preloaded wallet balances from prior periods during the three months and year ended December 31, 2022

2. Product Sales division includes impairment of inventory and inventory deposits, which were $31.8 million for the three months ended June 30, 2022.

Q4

$59.5

$(5.8)

$(2.8)

$49.5

$(9.0)

$40.5

$3.7

$13.5

$(0.7)

$16.5

41%

$(13.5)

$3.0

7%

$(46.7)

$1.1

$0.1

$15.3

$4.6

$82.4

$0.0

$(86.8)

$4.7

$0.0

$0.0

$0.2

$1.4

$(23.8)

(48)%

FY

$241.5

$(32.3)

$(18.7)

$190.5

$(17.8)

$172.7

$22.7

$47.3

$(0.5)

$69.6

40 %

$(47.3)

$22.2

13%

$(214.9)

$6.1

$0.2

$54.9

$4.7

$86.7

$0.0

$(26.6)

$6.6

$0.0

$0.0

$0.0

$1.4

$(80.9)

(42)%

Q1

$43.1

$(5.7)

$(2.1)

$35.4

$(4.4)

$31.0

$0.8

$8.9

$(0.2)

$9.6

31%

$(8.9)

$0.6

2%

$7.7

$1.4

$0.0

$9.8

$0.6

$48.7

$0.0

$(108.6)

$0.9

$0.0

$0.0

$0.0

$0.0

$(39.4)

(111)%

Q2

$86.0

$(15.0)

$(4.3)

$66.8

$(4.3)

$62.5

$(23.2)

$18.4

$33.2

$28.4

45 %

$(18.4)

$10.0

16%

$(320.3)

$2.6

$0.1

$19.3

$0.0

$43.7

$0.0

$(23.5)

$0.1

$31.8

$215.8

$1.5

$0.0

$(28.9)

(43)%

FY2022A

Q3

$89.4

$(10.3)

$(6.3)

$72.9

$(4.1)

$68.8

$27.7

$11.7

$(2.6)

$36.8

54%

$(11.7)

$25.1

37 %

$(9.8)

$3.8

$0.4

$12.1

$0.9

$(10.3)

$0.0

$3.9

$(1.7)

$0.0

$0.0

$0.0

$0.0

$0.2

0%

Q4

$74.8

$(3.0)

$(2.1)

$69.7

$(0.6)

$69.1

$29.4

$20.4

$0.1

$49.9

72%

$(20.4)

$29.5

43%

$(36.4)

$3.0

$1.5

$20.8

$(0.3)

$13.3

$0.0

$2.8

$0.2

$0.0

$0.0

$1.2

$0.0

$6.1

9%

FY

$293.4

$(34.0)

$(14.7)

$244.7

$(13.4)

$231.3

$34.7

$59.8

$30.6

$125.1

54%

$(59.8)

$65.3

28%

$(358.7)

$10.8

$2.0

$62.0

$1.2

$95.3

$0.0

$(125.4)

$(0.6)

$31.8

$215.8

$3.7

$0.0

$(62.1)

(25)%

21View entire presentation