dLocal Investor Day Presentation Deck

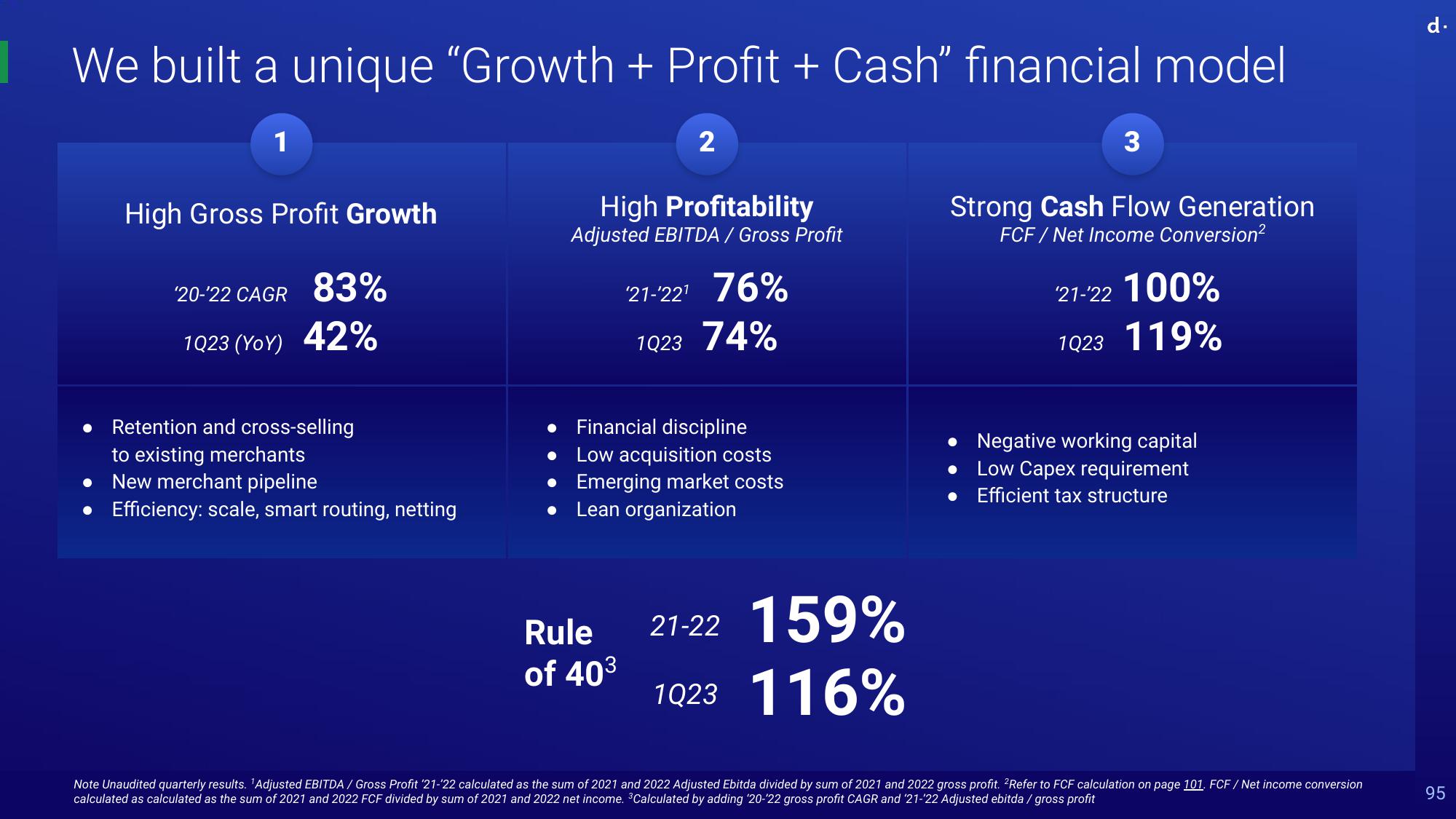

We built a unique "Growth + Profit + Cash” financial model

1

High Gross Profit Growth

20-22 CAGR 83%

1Q23 (YoY) 42%

Retention and cross-selling

to existing merchants

New merchant pipeline

• Efficiency: scale, smart routing, netting

2

High Profitability

Adjusted EBITDA / Gross Profit

Rule

of 40³

21-22¹ 76%

1Q23 74%

Financial discipline

Low acquisition costs

• Emerging market costs

Lean organization

21-22 159%

1Q23

116%

3

Strong Cash Flow Generation

FCF / Net Income Conversion²

21-22 100%

1Q23 119%

Negative working capital

Low Capex requirement

Efficient tax structure

Note Unaudited quarterly results. 'Adjusted EBITDA/Gross Profit '21-22 calculated as the sum of 2021 and 2022 Adjusted Ebitda divided by sum of 2021 and 2022 gross profit. 2Refer to FCF calculation on page 101. FCF/Net income conversion

calculated as calculated as the sum of 2021 and 2022 FCF divided by sum of 2021 and 2022 net income. ³Calculated by adding '20-22 gross profit CAGR and '21-22 Adjusted ebitda / gross profit

d.

95View entire presentation