E2open Investor Presentation Deck

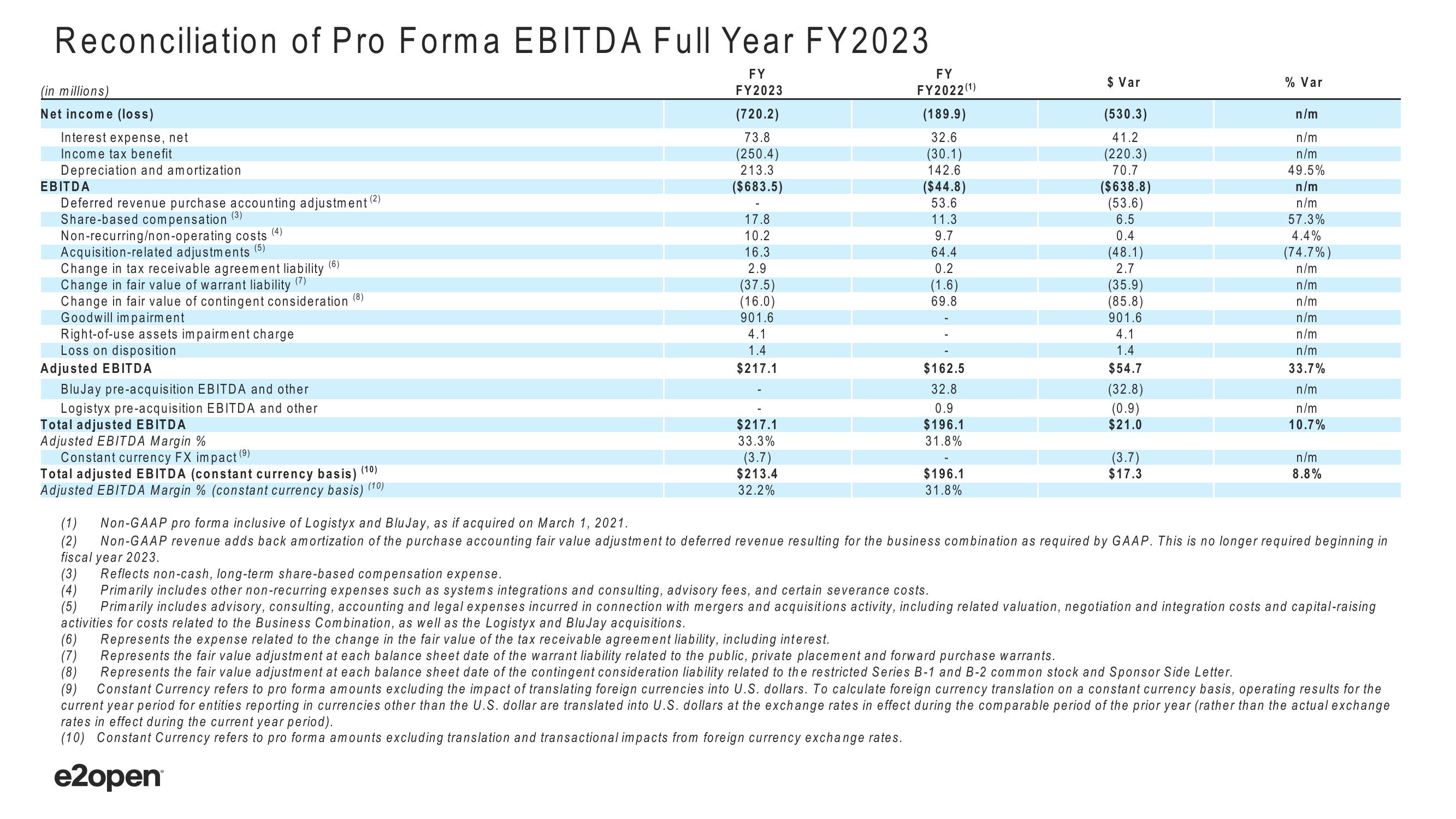

Reconciliation of Pro Forma EBITDA Full Year FY2023

FY

FY2023

(in millions)

Net income (loss)

Interest expense, net

Income tax benefit

Depreciation and amortization

EBITDA

Deferred revenue purchase accounting adjustment (2)

Share-based compensation (³)

Non-recurring/non-operating costs

(4)

(5)

Acquisition-related adjustments

Change in tax receivable agreement liability (6)

Change in fair value of warrant liability

(7)

Change in fair value of contingent consideration

Goodwill impairment

Right-of-use assets impairment charge

Loss on disposition

Adjusted EBITDA

BluJay pre-acquisition EBITDA and other

Logistyx pre-acquisition EBITDA and other

Total adjusted EBITDA

Adjusted EBITDA Margin %

(8)

Constant currency FX impact (⁹)

Total adjusted EBITDA (constant currency basis) (10)

Adjusted EBITDA Margin % (constant currency basis) (10)

(720.2)

73.8

(250.4)

213.3

($683.5)

17.8

10.2

16.3

2.9

(37.5)

(16.0)

901.6

4.1

1.4

$217.1

$217.1

33.3%

(3.7)

$213.4

32.2%

FY

FY2022 (¹)

(189.9)

32.6

(30.1)

142.6

($44.8)

53.6

11.3

9.7

64.4

0.2

(1.6)

69.8

$162.5

32.8

0.9

$196.1

31.8%

$196.1

31.8%

$ Var

(530.3)

41.2

(220.3)

70.7

($638.8)

(53.6)

6.5

0.4

(48.1)

2.7

(35.9)

(85.8)

901.6

4.1

1.4

$54.7

(32.8)

(0.9)

$21.0

(3.7)

$17.3

% Var

n/m

n/m

n/m

49.5%

n/m

n/m

57.3%

4.4%

(74.7%)

n/m

n/m

n/m

n/m

n/m

n/m

33.7%

n/m

n/m

10.7%

n/m

8.8%

(1) Non-GAAP pro forma inclusive of Logistyx and BluJay, as if acquired on March 1, 2021.

(2) Non-GAAP revenue adds back amortization of the purchase accounting fair value adjustment to deferred revenue resulting for the business combination as required by GAAP. This is no longer required beginning in

fiscal year 2023.

(3) Reflects non-cash, long-term share-based compensation expense.

(4) Primarily includes other non-recurring expenses such as systems integrations and consulting, advisory fees, and certain severance costs.

(5) Primarily includes advisory, consulting, accounting and legal expenses incurred in connection with mergers and acquisitions activity, including related valuation, negotiation and integration costs and capital-raising

activities for costs related to the Business Combination, as well as the Logistyx and BluJay acquisitions.

(6) Represents the expense related to the change in the fair value of the tax receivable agreement liability, including interest.

(7)

Represents the fair value adjustment at each balance sheet date of the warrant liability related to the public, private placement and forward purchase warrants.

(8) Represents the fair value adjustment at each balance sheet date of the contingent consideration liability related to the restricted Series B-1 and B-2 common stock and Sponsor Side Letter.

(9) Constant Currency refers to pro forma amounts excluding the impact of translating foreign currencies into U.S. dollars. To calculate foreign currency translation on a constant currency basis, operating results for the

current year period for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the exchange rates in effect during the comparable period of the prior year (rather than the actual exchange

rates in effect during the current year period).

(10) Constant Currency refers to pro forma amounts excluding translation and transactional impacts from foreign currency exchange rates.

e2openView entire presentation