Presentation to Vermont Pension Investment Committee

Overview of Pathfinder Core

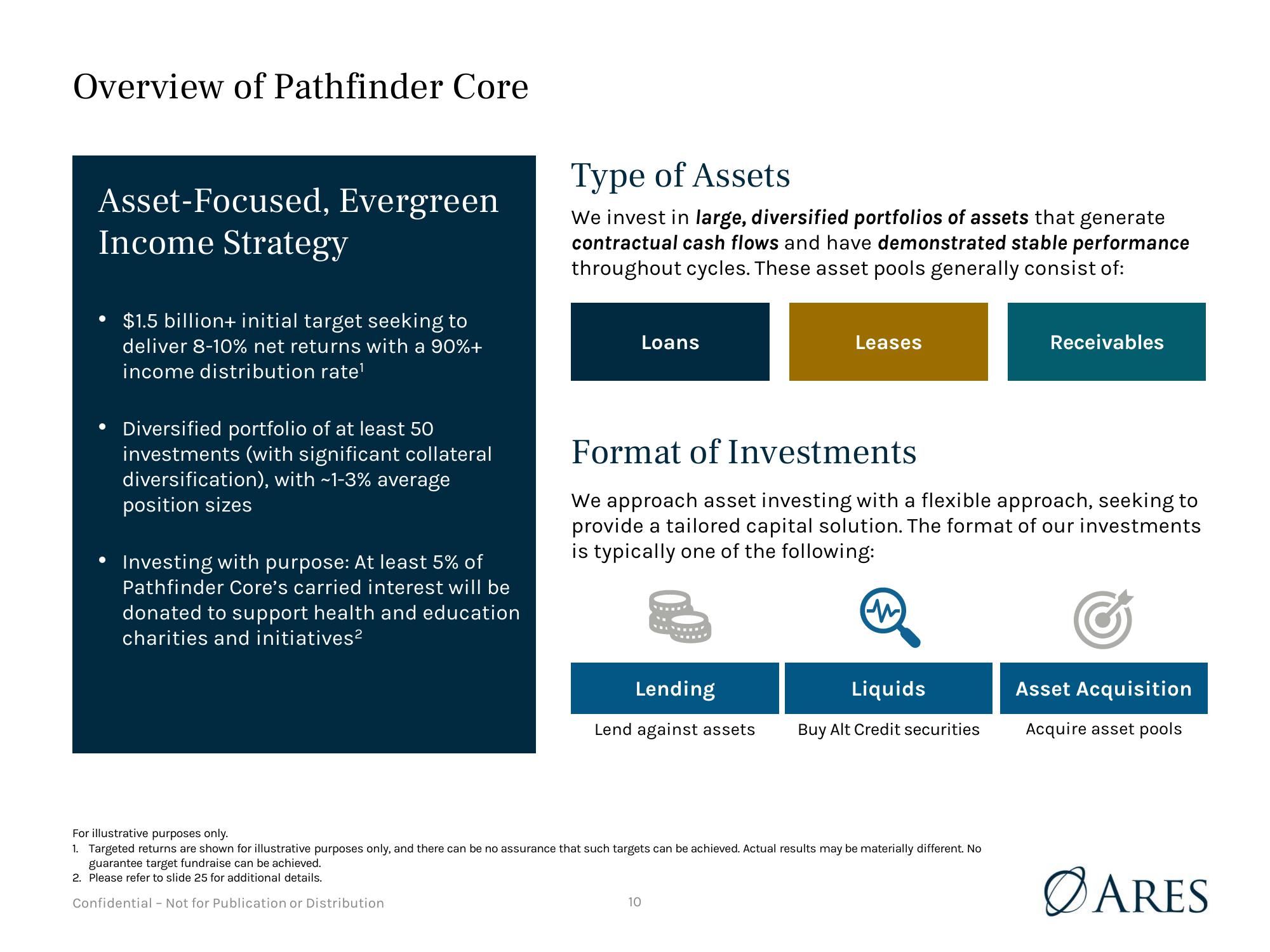

Asset-Focused, Evergreen

Income Strategy

●

$1.5 billion+ initial target seeking to

deliver 8-10% net returns with a 90%+

income distribution rate¹

Diversified portfolio of at least 50

investments (with significant collateral

diversification), with ~1-3% average

position sizes

Investing with purpose: At least 5% of

Pathfinder Core's carried interest will be

donated to support health and education

charities and initiatives²

Type of Assets

We invest in large, diversified portfolios of assets that generate

contractual cash flows and have demonstrated stable performance

throughout cycles. These asset pools generally consist of:

Loans

Lending

Lend against assets

Leases

Format of Investments

We approach asset investing with a flexible approach, seeking to

provide a tailored capital solution. The format of our investments

is typically one of the following:

10

Liquids

Buy Alt Credit securities

For illustrative purposes only.

1. Targeted returns are shown for illustrative purposes only, and there can be no assurance that such targets can be achieved. Actual results may be materially different. No

guarantee target fundraise can be achieved.

2. Please refer to slide 25 for additional details.

Confidential - Not for Publication or Distribution

Receivables

Asset Acquisition

Acquire asset pools

ØARESView entire presentation