Quanergy SPAC Presentation Deck

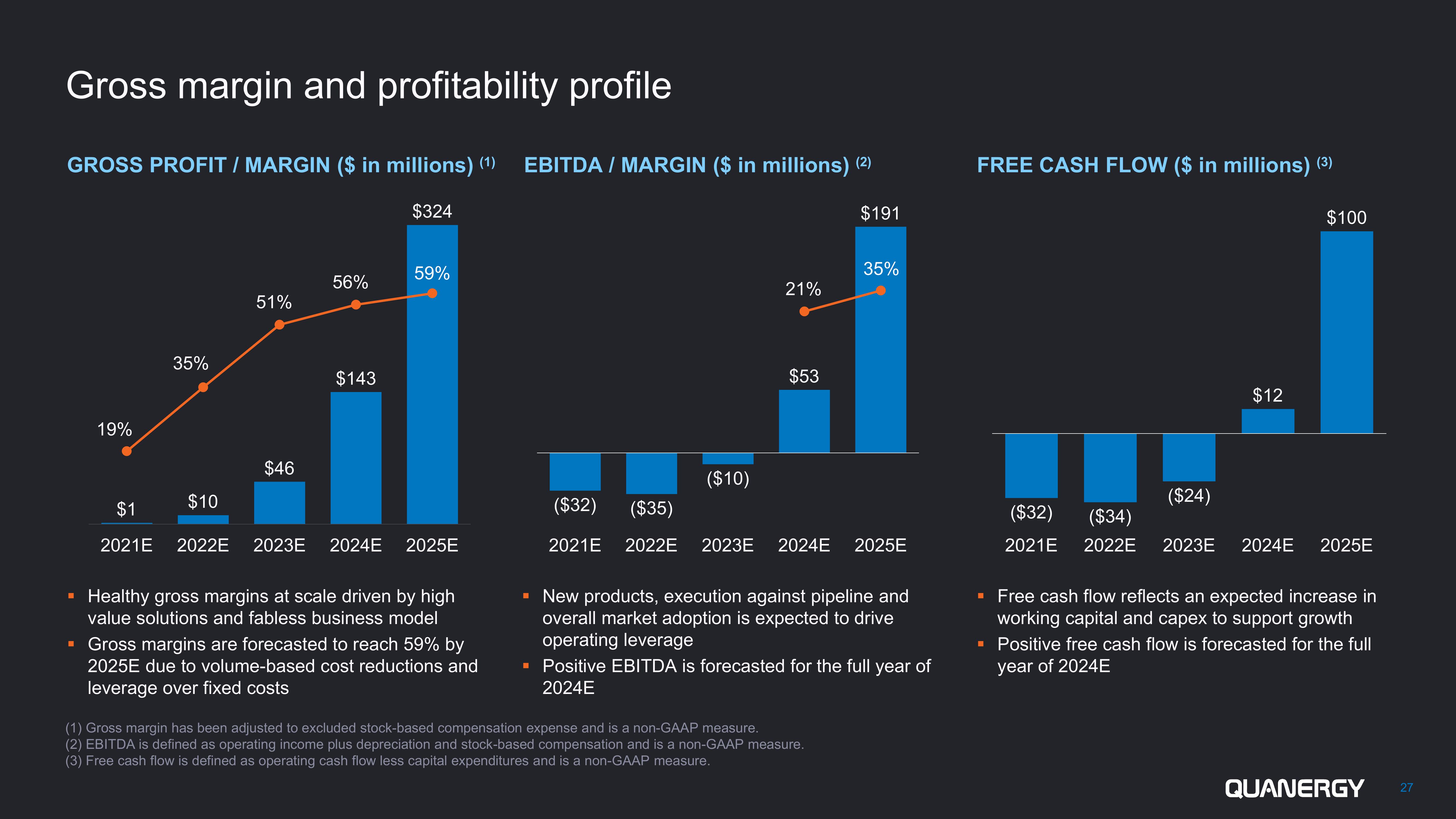

Gross margin and profitability profile

GROSS PROFIT / MARGIN ($ in millions) (1)

$324

19%

35%

51%

$46

56%

$143

59%

$1

$10

2021E 2022E 2023E 2024E 2025E

Healthy gross margins at scale driven by high

value solutions and fabless business model

▪ Gross margins are forecasted to reach 59% by

2025E due to volume-based cost reductions and

leverage over fixed costs

EBITDA / MARGIN ($ in millions) (2)

$191

($10)

21%

$53

35%

($32) ($35)

2021E 2022E 2023E 2024E 2025E

▪ New products, execution against pipeline and

overall market adoption is expected to drive

operating leverage

▪ Positive EBITDA is forecasted for the full year of

2024E

(1) Gross margin has been adjusted to excluded stock-based compensation expense and is a non-GAAP measure.

(2) EBITDA is defined as operating income plus depreciation and stock-based compensation and is a non-GAAP measure.

(3) Free cash flow is defined as operating cash flow less capital expenditures and is a non-GAAP measure.

FREE CASH FLOW ($ in millions) (³)

■

($24)

$12

$100

($32) ($34)

2021E 2022E 2023E 2024E 2025E

Free cash flow reflects an expected increase in

working capital and capex to support growth

▪ Positive free cash flow is forecasted for the full

year of 2024E

QUANERGY

27View entire presentation