Bunzl Results Presentation Deck

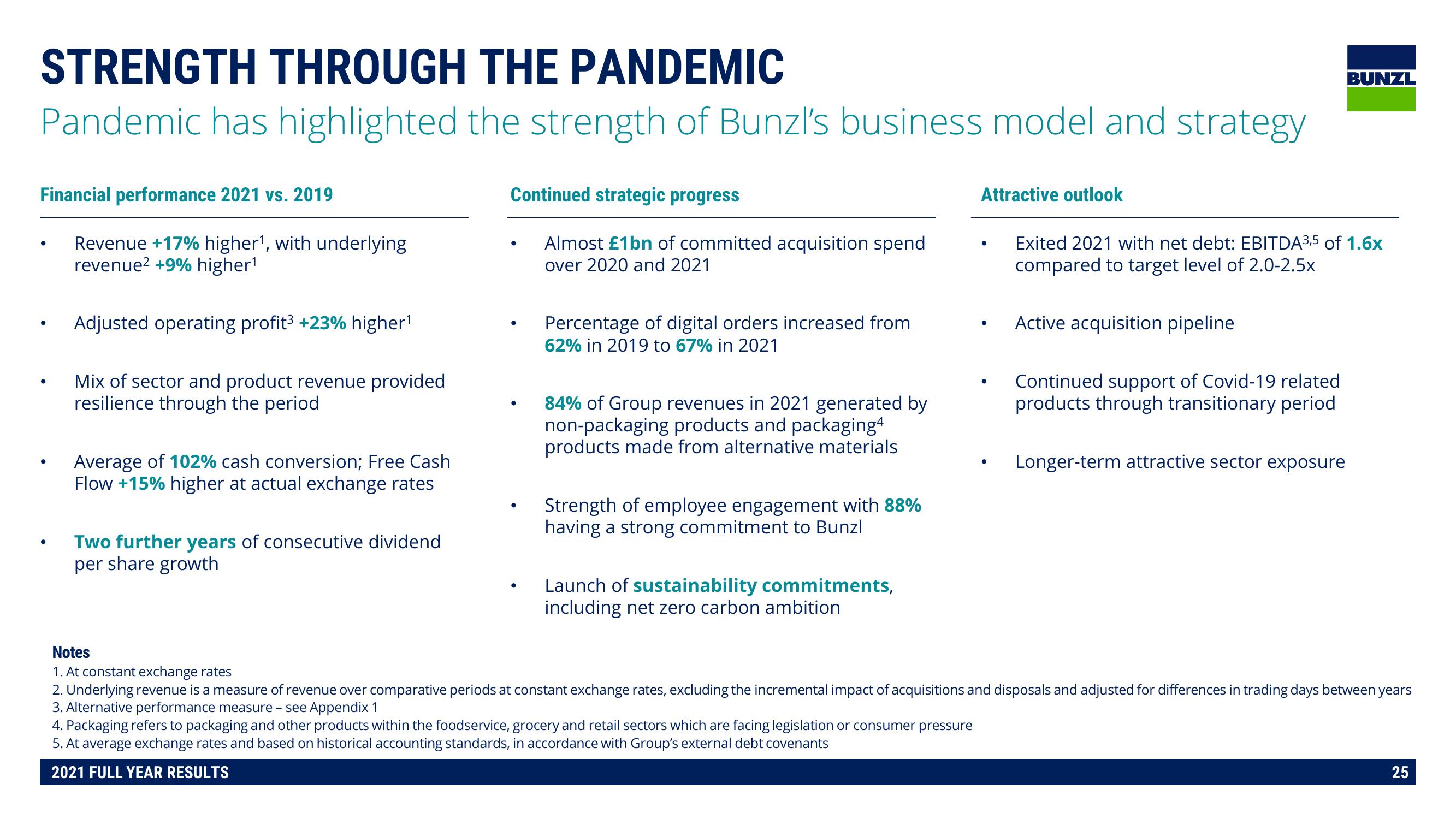

STRENGTH THROUGH THE PANDEMIC

Pandemic has highlighted the strength of Bunzl's business model and strategy

Financial performance 2021 vs. 2019

●

●

●

●

Revenue +17% higher¹, with underlying

revenue² +9% higher¹

Adjusted operating profit³ +23% higher¹

Mix of sector and product revenue provided

resilience through the period

Average of 102% cash conversion; Free Cash

Flow +15% higher at actual exchange rates

Two further years of consecutive dividend

per share growth

Continued strategic progress

Almost £1bn of committed acquisition spend

over 2020 and 2021

●

●

●

Percentage of digital orders increased from

62% in 2019 to 67% in 2021

84% of Group revenues in 2021 generated by

non-packaging products and packaging4

products made from alternative materials

Strength of employee engagement with

having a strong commitment to Bunzl

Launch of sustainability commitments,

including net zero carbon ambition

Attractive outlook

●

Exited 2021 with net debt: EBITDA3,5 of 1.6x

compared to target level of 2.0-2.5x

Active acquisition pipeline

Continued support of Covid-19 related

products through transitionary period

BUNZL

Longer-term attractive sector exposure

Notes

1. At constant exchange rates

2. Underlying revenue is a measure of revenue over comparative periods at constant exchange rates, excluding the incremental impact of acquisitions and disposals and adjusted for differences in trading days between years

3. Alternative performance measure - see Appendix 1

4. Packaging refers to packaging and other products within the foodservice, grocery and retail sectors which are facing legislation or consumer pressure

5. At average exchange rates and based on historical accounting standards, in accordance with Group's external debt covenants

2021 FULL YEAR RESULTS

25View entire presentation