Allego SPAC Presentation Deck

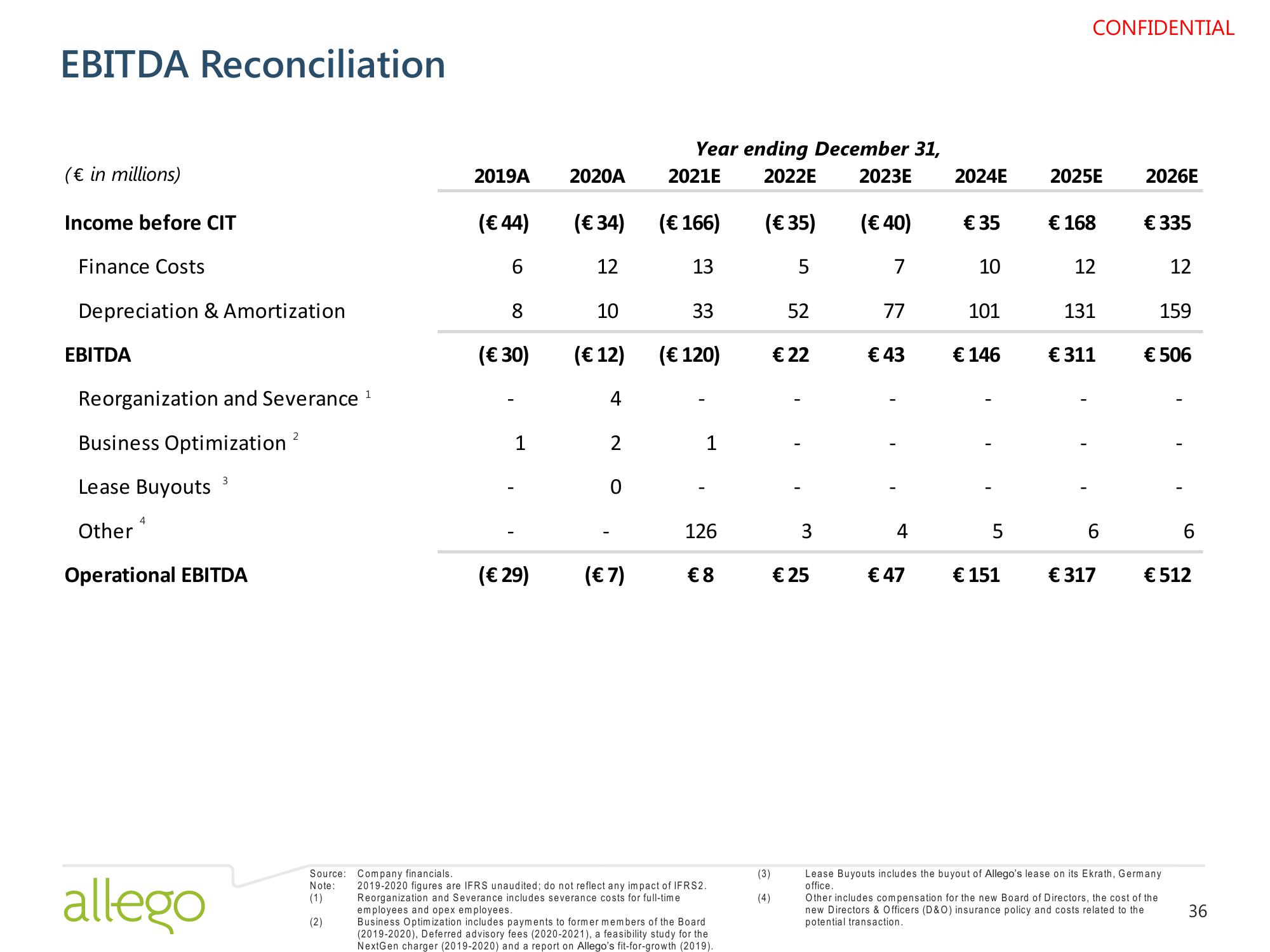

EBITDA Reconciliation

(€ in millions)

Income before CIT

Finance Costs

Depreciation & Amortization

EBITDA

Reorganization and Severance ¹

Business Optimization

Lease Buyouts

Other

Operational EBITDA

4

allego

3

2

Source: Company financials.

Note:

(1)

(2)

2019A

(€ 44)

6

8

(€ 30)

1

(€ 29)

2020A

(€ 34)

12

10

(€ 12)

4

2

0

(€ 7)

Year ending December 31,

2022E

2023E

2021E

(€ 166)

13

33

(€ 120)

1

126

€8

2019-2020 figures are IFRS unaudited; do not reflect any impact of IFRS2.

Reorganization and Severance includes severance costs for full-time

employees and opex employees.

Business Optimization includes payments to former members of the Board

(2019-2020), Deferred advisory fees (2020-2021), a feasibility study for the

NextGen charger (2019-2020) and a report on Allego's fit-for-growth (2019).

(€ 35)

5

(3)

52

€ 22

3

€ 25

(€ 40)

7

77

€ 43

4

€ 47

2024E

€ 35

10

101

€ 146

5

€ 151

CONFIDENTIAL

2025E

€ 168

12

131

€ 311

6

€ 317

2026E

€ 335

12

159

€ 506

Lease Buyouts includes the buyout of Allego's lease on its Ekrath, Germany

office.

Other includes compensation for the new Board of Directors, the cost of the

new Directors & Officers (D&O) insurance policy and costs related to the

potential transaction.

6

€ 512

36View entire presentation