Apollo Global Management Investor Day Presentation Deck

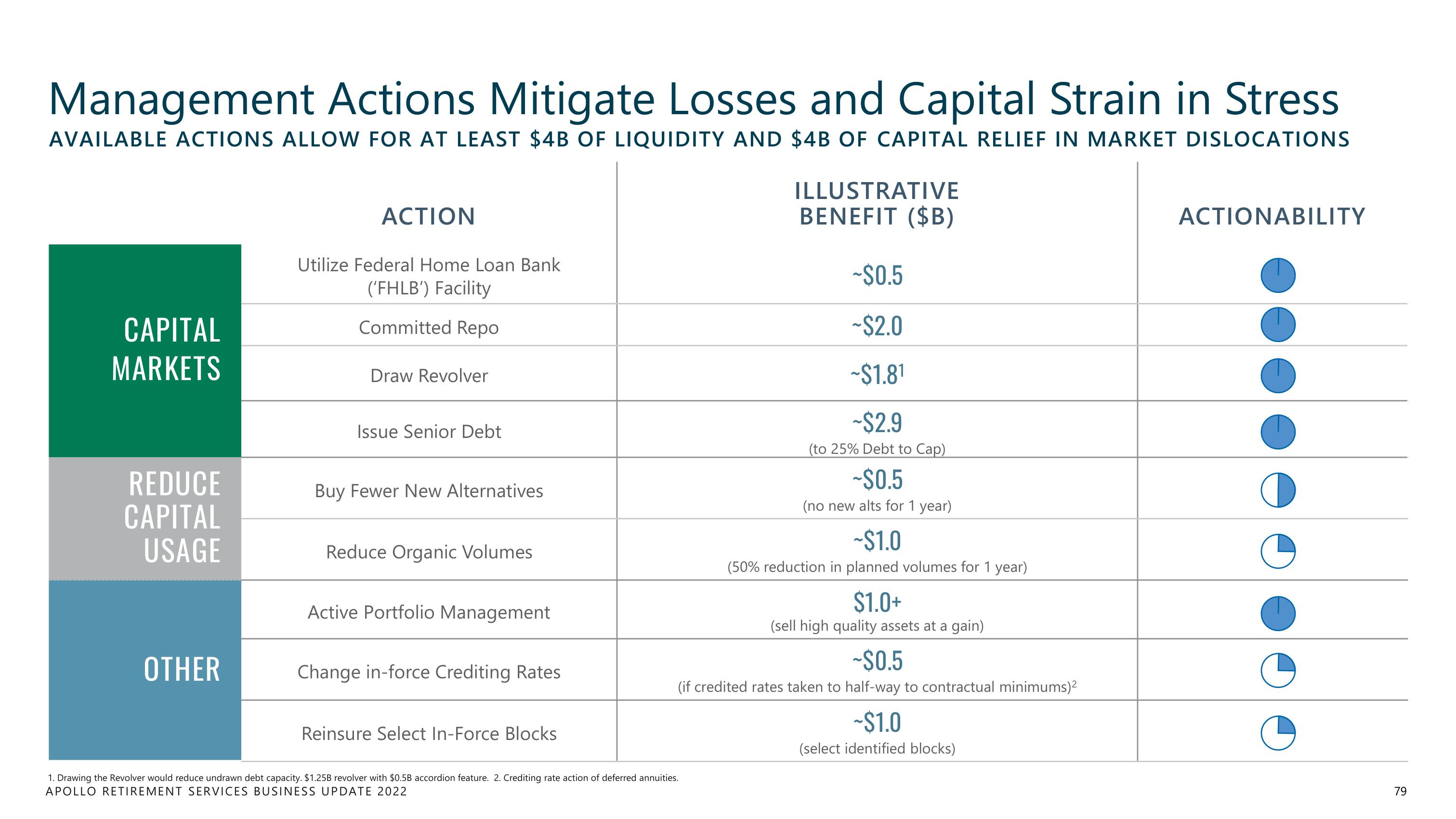

Management Actions Mitigate Losses and Capital Strain in Stress

AVAILABLE ACTIONS ALLOW FOR AT LEAST $4B OF LIQUIDITY AND $4B OF CAPITAL RELIEF IN MARKET DISLOCATIONS

CAPITAL

MARKETS

REDUCE

CAPITAL

USAGE

OTHER

ACTION

Utilize Federal Home Loan Bank

('FHLB') Facility

Committed Repo

Draw Revolver

Issue Senior Debt

Buy Fewer New Alternatives

Reduce Organic Volumes

Active Portfolio Management

Change in-force Crediting Rates

Reinsure Select In-Force Blocks

ILLUSTRATIVE

BENEFIT ($B)

1. Drawing the Revolver would reduce undrawn debt capacity. $1.25B revolver with $0.5B accordion feature. 2. Crediting rate action of deferred annuities.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

~$0.5

~$2.0

~$1.81

~$2.9

(to 25% Debt to Cap)

~$0.5

(no new alts for 1 year)

~$1.0

(50% reduction in planned volumes for 1 year)

$1.0+

(sell high quality assets at a gain)

~$0.5

(if credited rates taken to half-way to contractual minimums)²

~$1.0

(select identified blocks)

ACTIONABILITY

79View entire presentation