Marti Results Presentation Deck

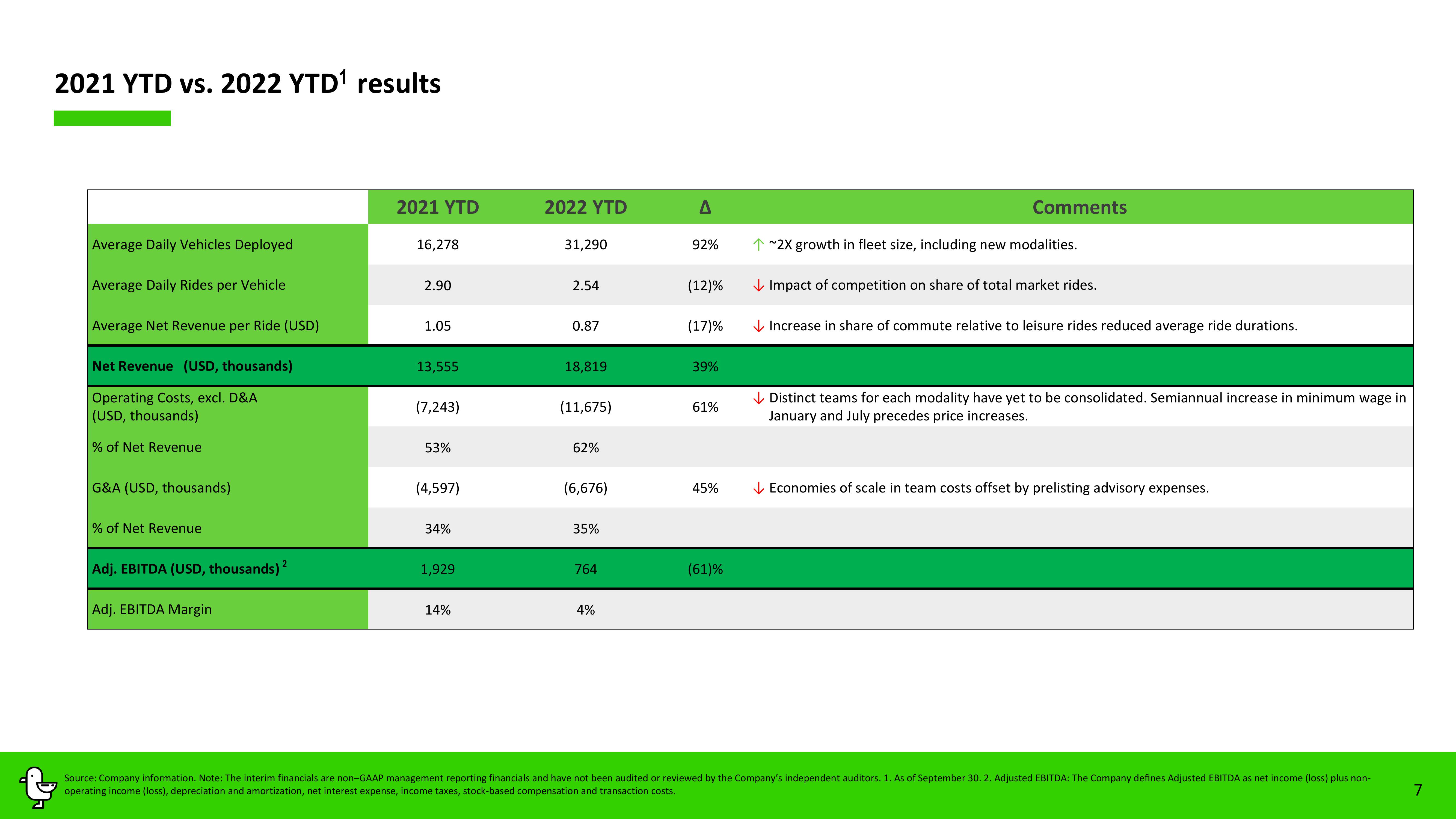

2021 YTD vs. 2022 YTD¹ results

Average Daily Vehicles Deployed

Average Daily Rides per Vehicle

Average Net Revenue per Ride (USD)

Net Revenue (USD, thousands)

Operating Costs, excl. D&A

(USD, thousands)

% of Net Revenue

G&A (USD, thousands)

% of Net Revenue

Adj. EBITDA (USD, thousands) 2

Adj. EBITDA Margin

2021 YTD

16,278

2.90

1.05

13,555

(7,243)

53%

(4,597)

34%

1,929

14%

2022 YTD

31,290

2.54

0.87

18,819

(11,675)

62%

(6,676)

35%

764

4%

A

92%

(12)%

(17)%

39%

61%

45%

(61)%

Comments

↑~2X growth in fleet size, including new modalities.

Impact of competition on share of total market rides.

✓ Increase in share of commute relative to leisure rides reduced average ride durations.

✓ Distinct teams for each modality have yet to be consolidated. Semiannual increase in minimum wage in

January and July precedes price increases.

Economies of scale in team costs offset by prelisting advisory expenses.

Source: Company information. Note: The interim financials are non-GAAP management reporting financials and have not been audited or reviewed by the Company's independent auditors. 1. As of September 30. 2. Adjusted EBITDA: The Company defines Adjusted EBITDA as net income (loss) plus non-

operating income (loss), depreciation and amortization, net interest expense, income taxes, stock-based compensation and transaction costs.

7View entire presentation