Investor Presentation

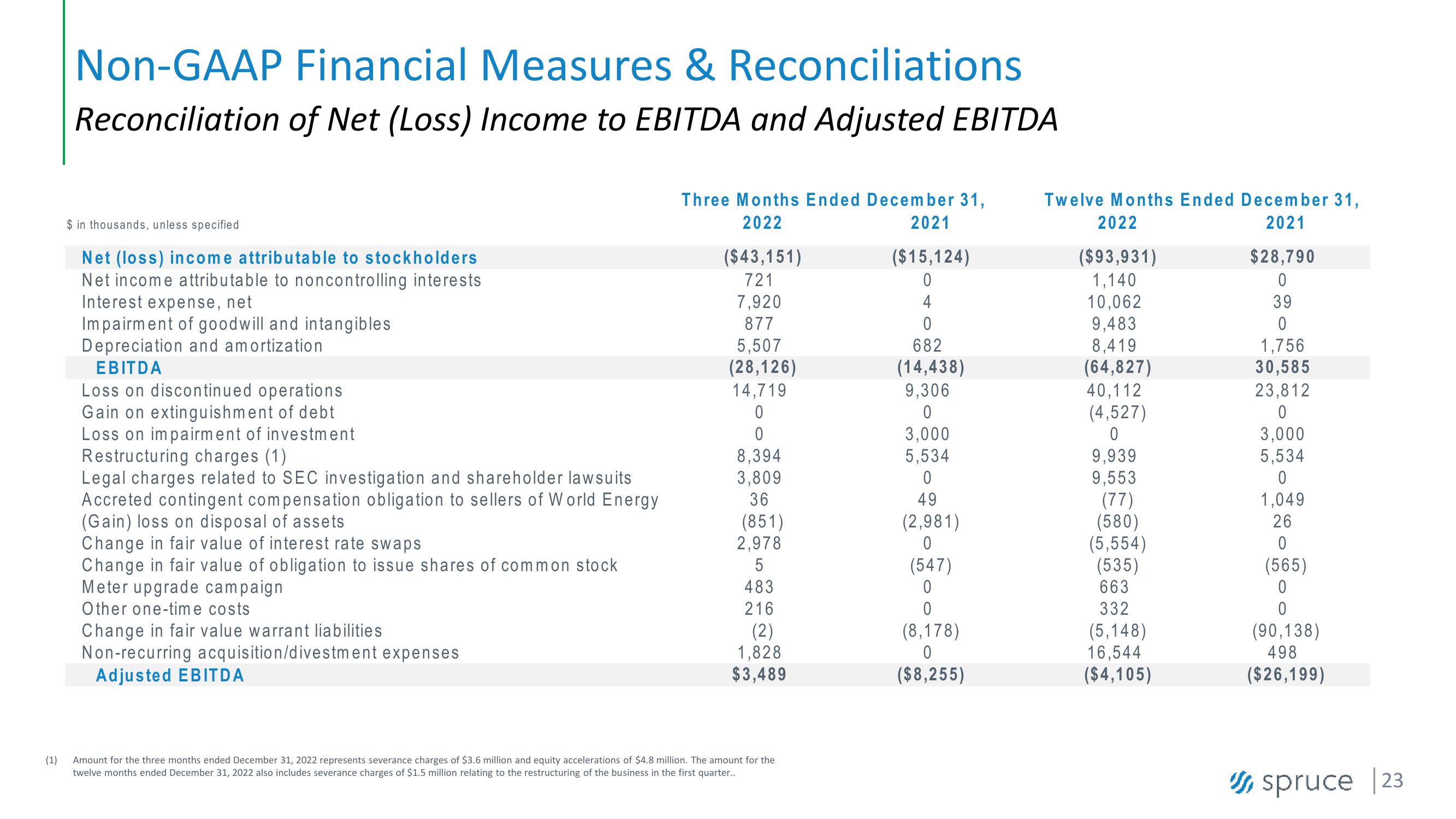

Non-GAAP Financial Measures & Reconciliations

Reconciliation of Net (Loss) Income to EBITDA and Adjusted EBITDA

$ in thousands, unless specified

Net (loss) income attributable to stockholders

Net income attributable to noncontrolling interests

Interest expense, net

Impairment of goodwill and intangibles

Depreciation and amortization

EBITDA

Loss on discontinued operations

Gain on extinguishment of debt

Loss on impairment of investment

Restructuring charges (1)

Legal charges related to SEC investigation and shareholder lawsuits

Accreted contingent compensation obligation to sellers of World Energy

(Gain) loss on disposal of assets

Change in fair value of interest rate swaps

2021

Three Months Ended December 31,

2022

Twelve Months Ended December 31,

2022

2021

($43,151)

($15,124)

($93,931)

$28,790

721

0

1,140

0

7,920

4

10,062

39

877

9,483

0

5,507

682

8,419

1,756

(28,126)

(14,438)

(64,827)

30,585

14,719

9,306

40,112

23,812

0

0

(4,527)

0

0

3,000

0

3,000

8,394

5,534

9,939

5,534

3,809

0

9,553

36

49

(77)

0

1,049

(851)

(2,981)

(580)

26

2,978

0

(5,554)

0

Change in fair value of obligation to issue shares of common stock

5

(547)

(535)

(565)

Meter upgrade campaign

483

0

663

0

Other one-time costs

216

0

332

Change in fair value warrant liabilities

(2)

(8,178)

(5,148)

Non-recurring acquisition/divestment expenses

1,828

0

Adjusted EBITDA

$3,489

($8,255)

16,544

($4,105)

0

(90,138)

498

($26,199)

(1) Amount for the three months ended December 31, 2022 represents severance charges of $3.6 million and equity accelerations of $4.8 million. The amount for the

twelve months ended December 31, 2022 also includes severance charges of $1.5 million relating to the restructuring of the business in the first quarter..

spruce | 23View entire presentation