Doma SPAC Presentation Deck

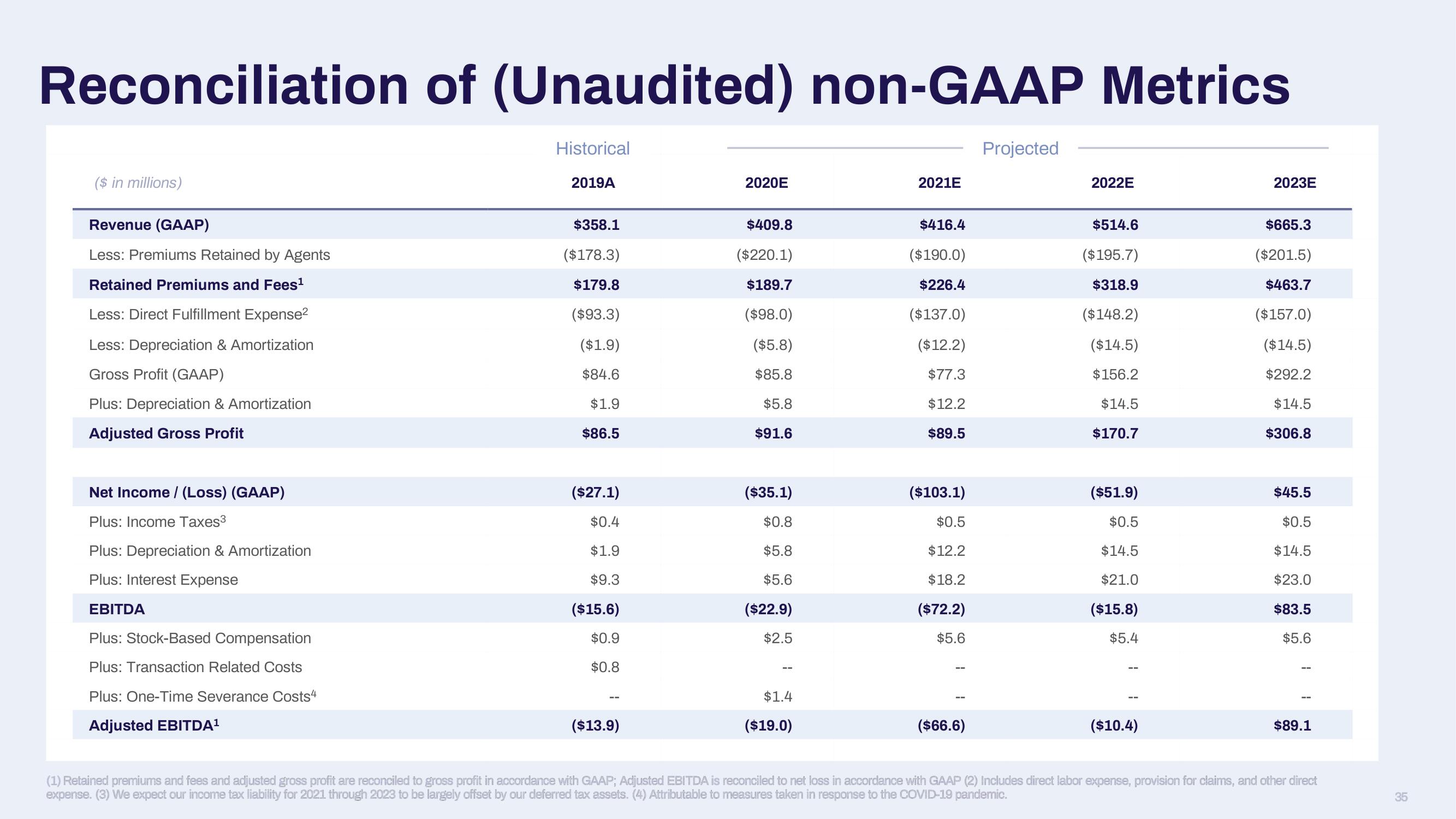

Reconciliation of (Unaudited) non-GAAP Metrics

($ in millions)

Revenue (GAAP)

Less: Premiums Retained by Agents

Retained Premiums and Fees¹

Less: Direct Fulfillment Expense²

Less: Depreciation & Amortization

Gross Profit (GAAP)

Plus: Depreciation & Amortization

Adjusted Gross Profit

Net Income / (Loss) (GAAP)

Plus: Income Taxes³

Plus: Depreciation & Amortization

Plus: Interest Expense

EBITDA

Plus: Stock-Based Compensation

Plus: Transaction Related Costs

Plus: One-Time Severance Costs4

Adjusted EBITDA¹

Historical

2019A

$358.1

($178.3)

$179.8

($93.3)

($1.9)

$84.6

$1.9

$86.5

($27.1)

$0.4

$1.9

$9.3

($15.6)

$0.9

$0.8

($13.9)

2020E

$409.8

($220.1)

$189.7

($98.0)

($5.8)

$85.8

$5.8

$91.6

($35.1)

$0.8

$5.8

$5.6

($22.9)

$2.5

==

$1.4

($19.0)

2021E

$416.4

($190.0)

$226.4

($137.0)

($12.2)

$77.3

$12.2

$89.5

($103.1)

$0.5

$12.2

$18.2

($72.2)

$5.6

($66.6)

Projected

2022E

$514.6

($195.7)

$318.9

($148.2)

($14.5)

$156.2

$14.5

$170.7

($51.9)

$0.5

$14.5

$21.0

($15.8)

$5.4

($10.4)

2023E

$665.3

($201.5)

$463.7

($157.0)

($14.5)

$292.2

$14.5

$306.8

$45.5

$0.5

$14.5

$23.0

$83.5

$5.6

--

$89.1

(1) Retained premiums and fees and adjusted gross profit are reconciled to gross profit in accordance with GAAP; Adjusted EBITDA is reconciled to net loss in accordance with GAAP (2) Includes direct labor expense, provision for claims, and other direct

expense. (3) We expect our income tax liability for 2021 through 2023 to be largely offset by our deferred tax assets. (4) Attributable to measures taken in response to the COVID-19 pandemic.

35View entire presentation