Apollo Global Management Investor Presentation Deck

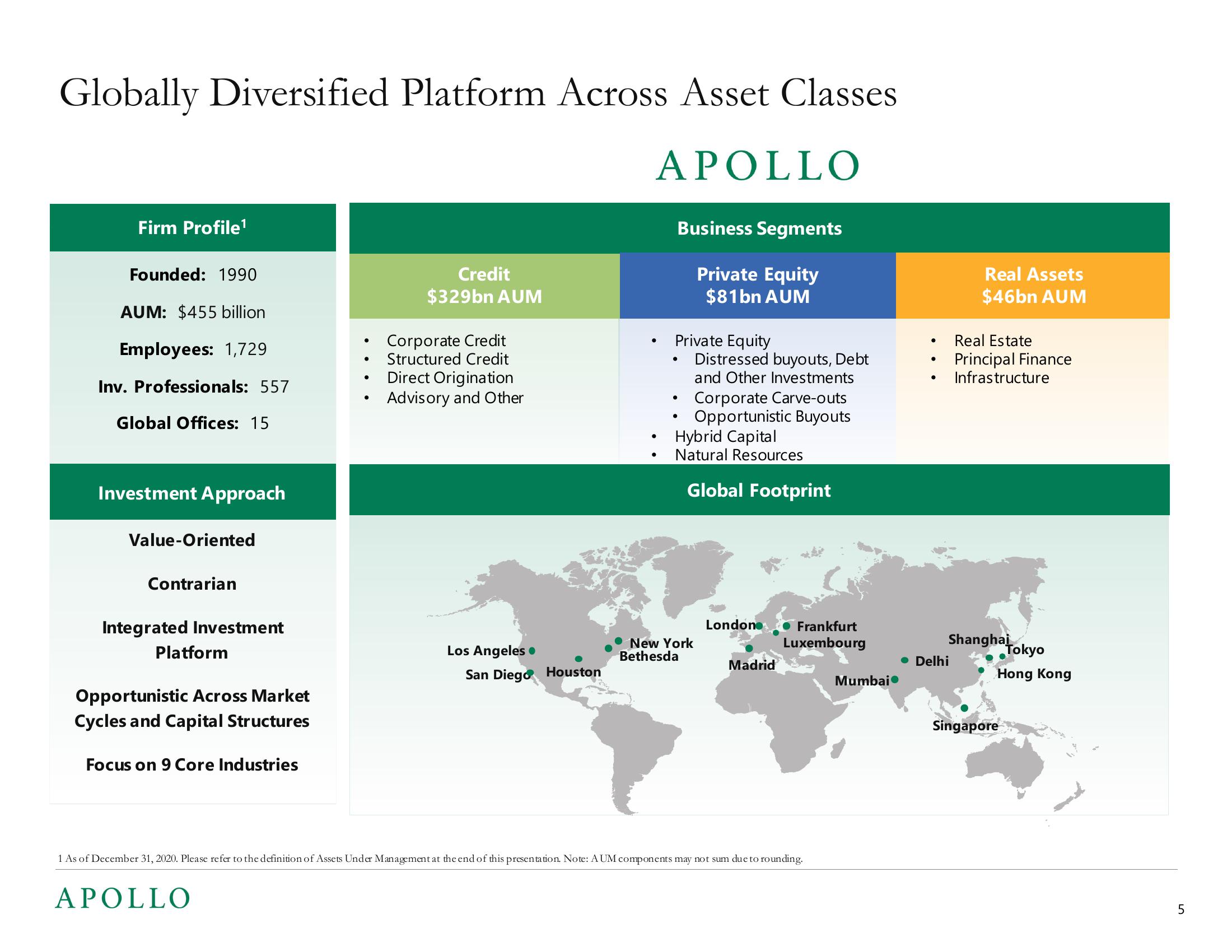

Globally Diversified Platform Across Asset Classes

APOLLO

Firm Profile¹

Founded: 1990

AUM: $455 billion

Employees: 1,729

Inv. Professionals: 557

Global Offices: 15

Investment Approach

Value-Oriented

Contrarian

Integrated Investment

Platform

Opportunistic Across Market

Cycles and Capital Structures

Focus on 9 Core Industries

●

APOLLO

●

●

Credit

$329bn AUM

Corporate Credit

Structured Credit

Direct Origination

Advisory and Other

Los Angeles.

San Diego Houston

Business Segments

Private Equity

$81bn AUM

Private Equity

●

●

●

Distressed buyouts, Debt

and Other Investments

Corporate Carve-outs

Opportunistic Buyouts

Hybrid Capital

Natural Resources

Global Footprint

New York

Bethesda

Londone

Madrid

Frankfurt

Luxembourg

1 As of December 31, 2020. Please refer to the definition of Assets Under Management at the end of this presentation. Note: AUM components may not sum due to rounding.

Mumbai

.

●

●

Real Assets

$46bn AUM

• Delhi

Real Estate

Principal Finance

Infrastructure

Shanghai

Tokyo

Hong Kong

Singapore

LO

5View entire presentation