LionTree Investment Banking Pitch Book

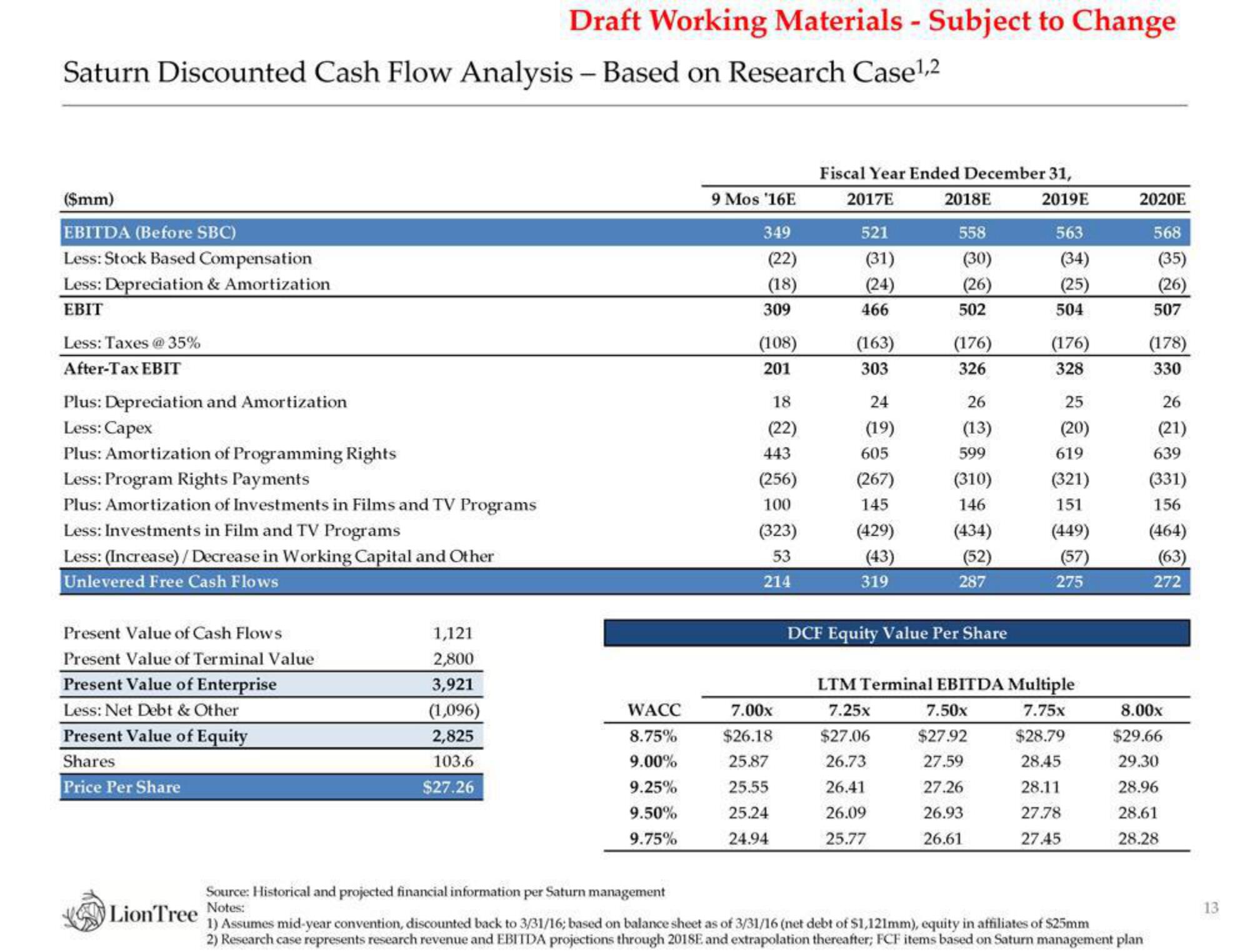

Saturn Discounted Cash Flow Analysis - Based on Research Case¹,2

($mm)

EBITDA (Before SBC)

Less: Stock Based Compensation

Less: Depreciation & Amortization

EBIT

Less: Taxes @ 35%

After-Tax EBIT

Plus: Depreciation and Amortization

Less: Capex

Plus: Amortization of Programming Rights

Less: Program Rights Payments

Plus: Amortization of Investments in Films and TV Programs

Less: Investments in Film and TV Programs

Less: (Increase) /Decrease in Working Capital and Other

Unlevered Free Cash Flows

Present Value of Cash Flows

Present Value of Terminal Value

Present Value of Enterprise

Less: Net Debt & Other

Present Value of Equity

Shares

Price Per Share

Draft Working Materials - Subject to Change

1,121

2,800

3,921

(1,096)

2,825

103.6

$27.26

LionTree Notes:

WACC

8.75%

9.00%

9.25%

9.50%

9.75%

Source: Historical and projected financial information per Saturn management

9 Mos '16E

349

(22)

(18)

309

(108)

201

18

(22)

443

(256)

100

(323)

53

214

7.00x

$26.18

25.87

25.55

25.24

24.94

Fiscal Year Ended December 31,

2017E

2019E

521

(31)

(24)

466

(163)

303

24

(19)

605

(267)

145

(429)

(43)

319

2018E

558

(30)

(26)

7.25x

$27.06

26.73

26.41

26.09

25.77

502

(176)

326

26

(13)

599

(310)

146

(434)

(52)

287

DCF Equity Value Per Share

563

7.50x

$27.92

27.59

27.26

26.93

26.61

(34)

(25)

504

(176)

328

25

(20)

619

(321)

151

(449)

(57)

LTM Terminal EBITDA Multiple

7.75x

$28.79

28.45

28.11

27.78

27.45

275

2020E

568

(35)

(26)

1) Assumes mid-year convention, discounted back to 3/31/16; based on balance sheet as of 3/31/16 (net debt of $1,121mm), equity in affiliates of $25mm

2) Research case represents research revenue and EBITDA projections through 2018E and extrapolation thereafter; FCF items based on Saturn management plan

507

(178)

330

26

(21)

639

(331)

156

(464)

(63)

272

8.00x

$29.66

29.30

28.96

28.61

28.28

13View entire presentation