WeWork Results Presentation Deck

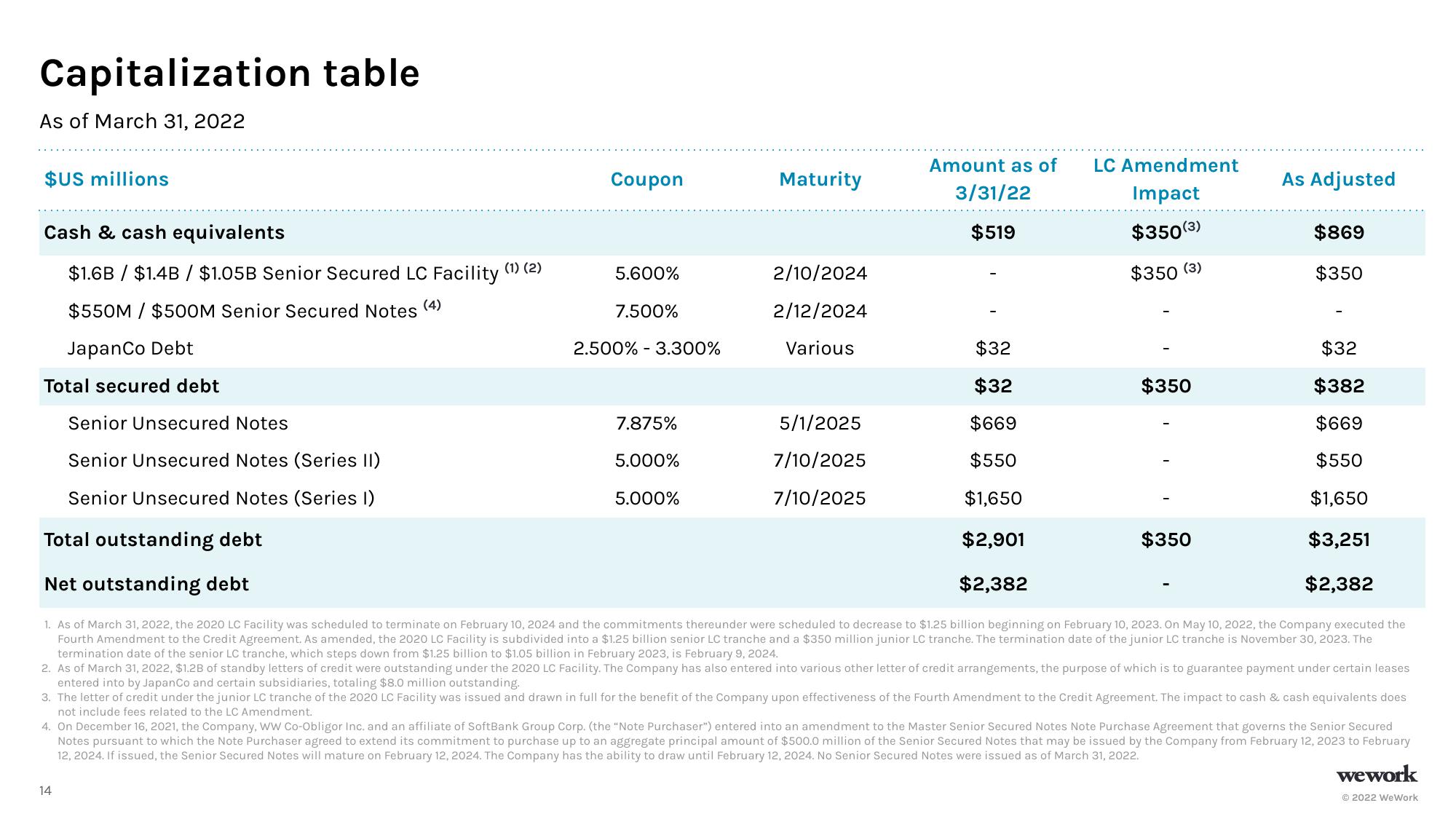

Capitalization table

As of March 31, 2022

$US millions

Cash & cash equivalents

$1.6B / $1.4B / $1.05B Senior Secured LC Facility

$550M $500M Senior Secured Notes (4)

JapanCo Debt

Total secured debt

Senior Unsecured Notes

Senior Unsecured Notes (Series II)

Senior Unsecured Notes (Series 1)

(1) (2)

Coupon

14

5.600%

7.500%

2.500% - 3.300%

7.875%

5.000%

5.000%

Maturity

2/10/2024

2/12/2024

Various

5/1/2025

7/10/2025

7/10/2025

Amount as of LC Amendment

3/31/22

Impact

$519

$350 (3)

$350 (3)

$32

$32

$669

$550

$1,650

$2,901

$2,382

$350

$350

As Adjusted

$869

$350

$32

$382

$669

$550

$1,650

$3,251

$2,382

Total outstanding debt

Net outstanding debt

1. As of March 31, 2022, the 2020 LC Facility was scheduled to terminate on February 10, 2024 and the commitments thereunder were scheduled to decrease to $1.25 billion beginning on February 10, 2023. On May 10, 2022, the Company executed the

Fourth Amendment to the Credit Agreement. As amended, the 2020 LC Facility is subdivided into a $1.25 billion senior LC tranche and a $350 million junior LC tranche. The termination date of the junior LC tranche is November 30, 2023. The

termination date of the senior LC tranche, which steps down from $1.25 billion to $1.05 billion in February 2023, is February 9, 2024.

2. As of March 31, 2022, $1.2B of standby letters of credit were outstanding under the 2020 LC Facility. The Company has also entered into various other letter of credit arrangements, the purpose of which is to guarantee payment under certain leases

entered into by JapanCo and certain subsidiaries, totaling $8.0 million outstanding.

3. The letter of credit under the junior LC tranche of the 2020 LC Facility was issued and drawn in full for the benefit of the Company upon effectiveness of the Fourth Amendment to the Credit Agreement. The impact to cash & cash equivalents does

not include fees related to the LC Amendment.

4. On December 16, 2021, the Company, WW Co-Obligor Inc. and an affiliate of SoftBank Group Corp. (the "Note Purchaser") entered into an amendment to the Master Senior Secured Notes Note Purchase Agreement that governs the Senior Secured

Notes pursuant to which the Note Purchaser agreed to extend its commitment to purchase up to an aggregate principal amount of $500.0 million of the Senior Secured Notes that may be issued by the Company from February 12, 2023 to February

12, 2024. If issued, the Senior Secured Notes will mature on February 12, 2024. The Company has the ability to draw until February 12, 2024. No Senior Secured Notes were issued as of March 31, 2022.

wework

Ⓒ2022 WeWorkView entire presentation