Vale Investor Day Presentation Deck

The equity story for Vale

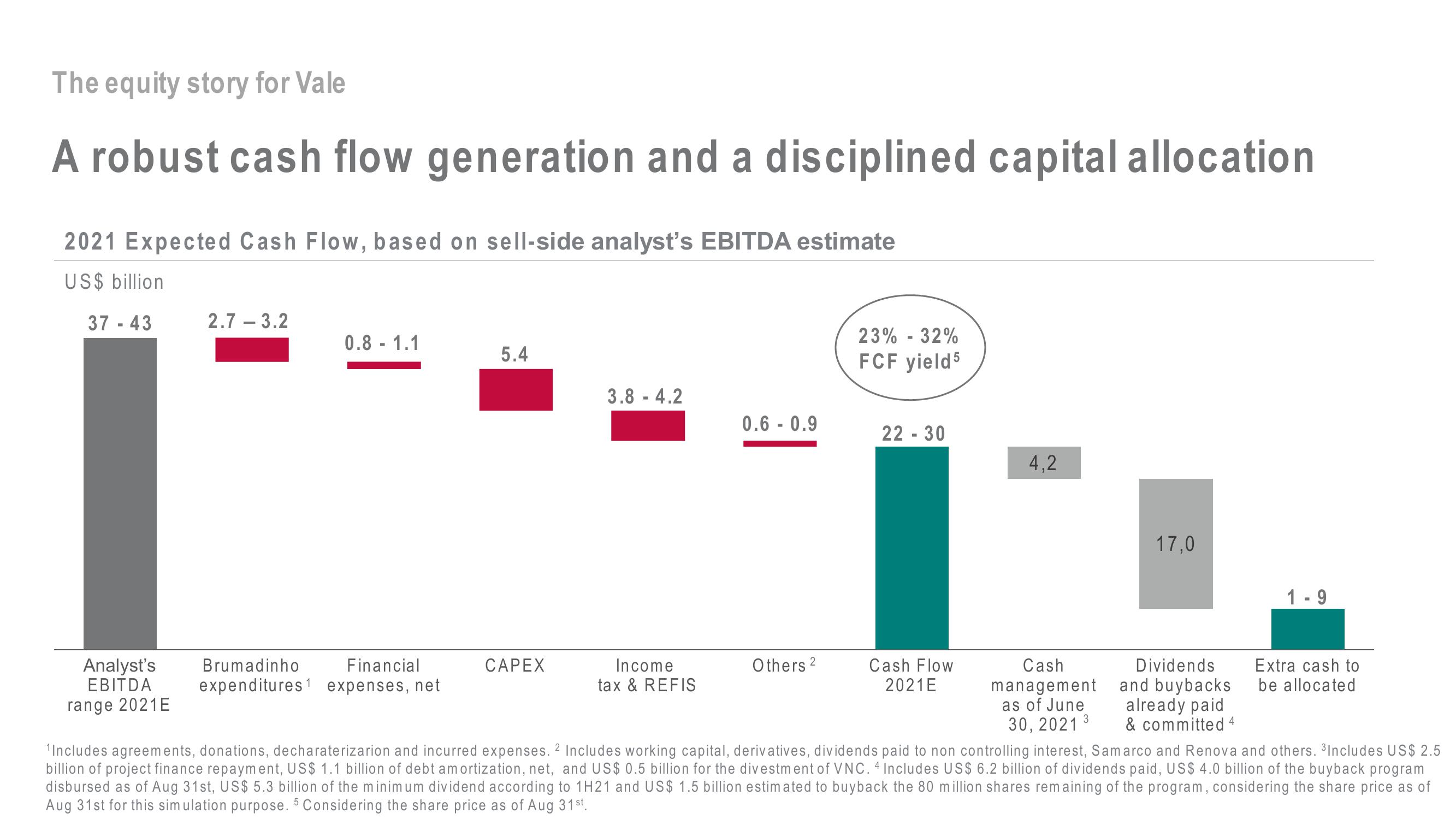

A robust cash flow generation and a disciplined capital allocation

2021 Expected Cash Flow, based on sell-side analyst's EBITDA estimate

US$ billion

37 - 43

2.7-3.2

Analyst's

EBITDA

range 2021E

0.8-1.1

5.4

Brumadinho

Financial

expenditures1 expenses, net

3.8-4.2

CAPEX

0.6 - 0.9

Income

tax & REFIS

23% -32%

FCF yield 5

Others 2

Dividends

and buybacks

already paid

& committed 4

¹Includes agreements, donations, decharaterizarion and incurred expenses. 2 Includes working capital, derivatives, dividends paid to non controlling interest, Samarco and Renova and others. Includes US$ 2.5

billion of project finance repayment, US$ 1.1 billion of debt amortization, net, and US$ 0.5 billion for the divestment of VNC. 4 Includes US$ 6.2 billion of dividends paid, US$ 4.0 billion of the buyback program

disbursed as of Aug 31st, US$ 5.3 billion of the minimum dividend according to 1H21 and US$ 1.5 billion estimated to buyback the 80 million shares remaining of the program, considering the share price as of

Aug 31st for this simulation purpose. 5 Considering the share price as of Aug 31st.

22 - 30

4,2

Cash Flow

2021E

17.0

Cash

management

as of June

30, 2021 3

1-9

Extra cash to

be allocatedView entire presentation