Cartrack IPO

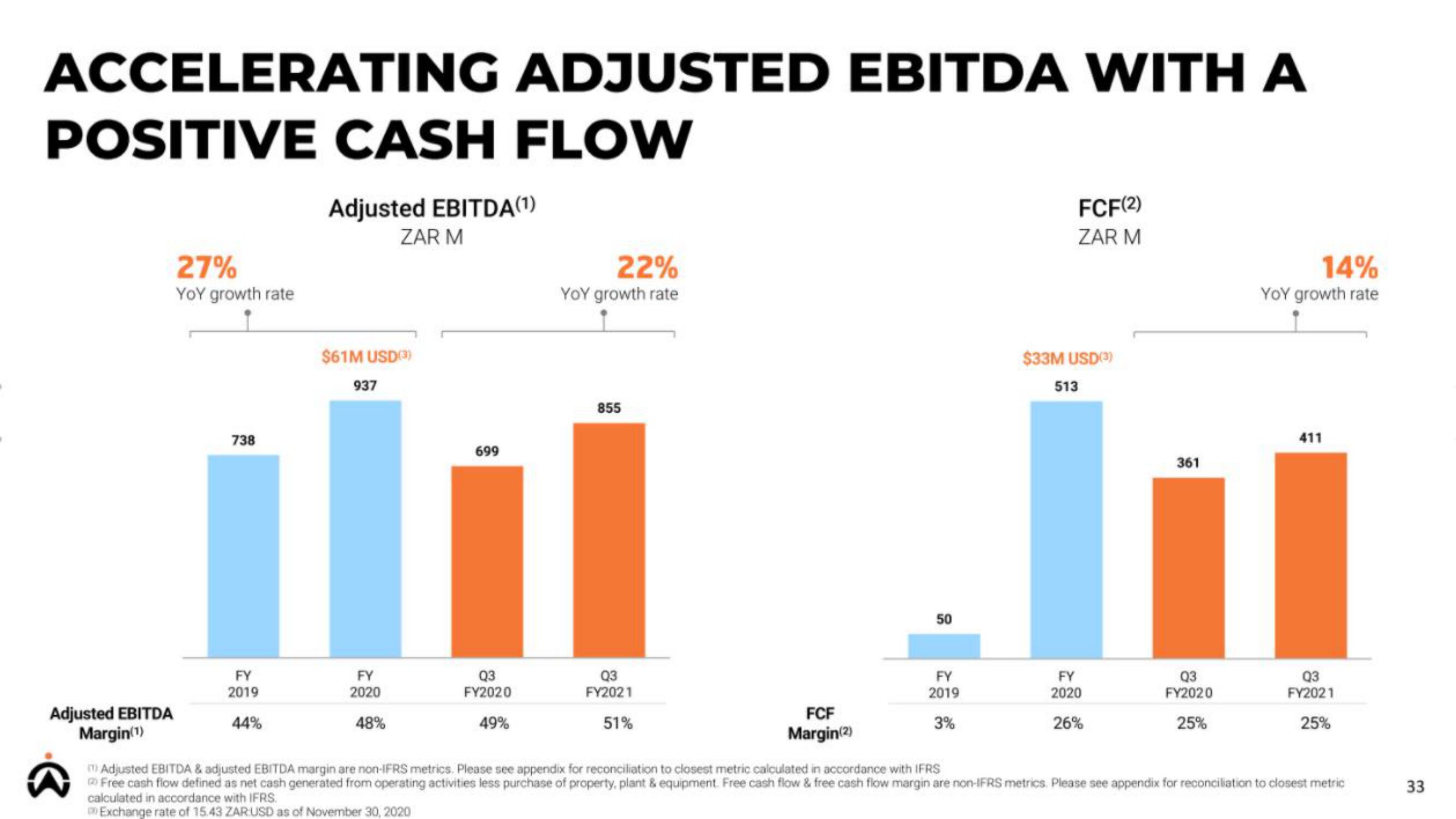

ACCELERATING ADJUSTED EBITDA WITH A

POSITIVE CASH FLOW

Adjusted EBITDA(1)

ZAR M

Adjusted EBITDA

Margin(¹)

27%

YOY growth rate

738

FY

2019

44%

$61M USD(3)

937

FY

2020

48%

699

Q3

FY2020

49%

22%

YOY growth rate

855

Q3

FY2021

51%

FCF

Margin(2)

50

FY

2019

3%

FCF(2)

ZAR M

$33M USD(0)

513

FY

2020

26%

361

Q3

FY2020

25%

14%

YOY growth rate

411

Q3

FY2021

25%

m) Adjusted EBITDA & adjusted EBITDA margin are non-IFRS metrics. Please see appendix for reconciliation to closest metric calculated in accordance with IFRS

20 Free cash flow defined as net cash generated from operating activities less purchase of property, plant & equipment. Free cash flow & free cash flow margin are non-IFRS metrics. Please see appendix for reconciliation to closest metric

calculated in accordance with IFRS.

Exchange rate of 15.43 ZAR:USD as of November 30, 2020

33View entire presentation