Rocket Companies Investor Presentation Deck

Endnotes

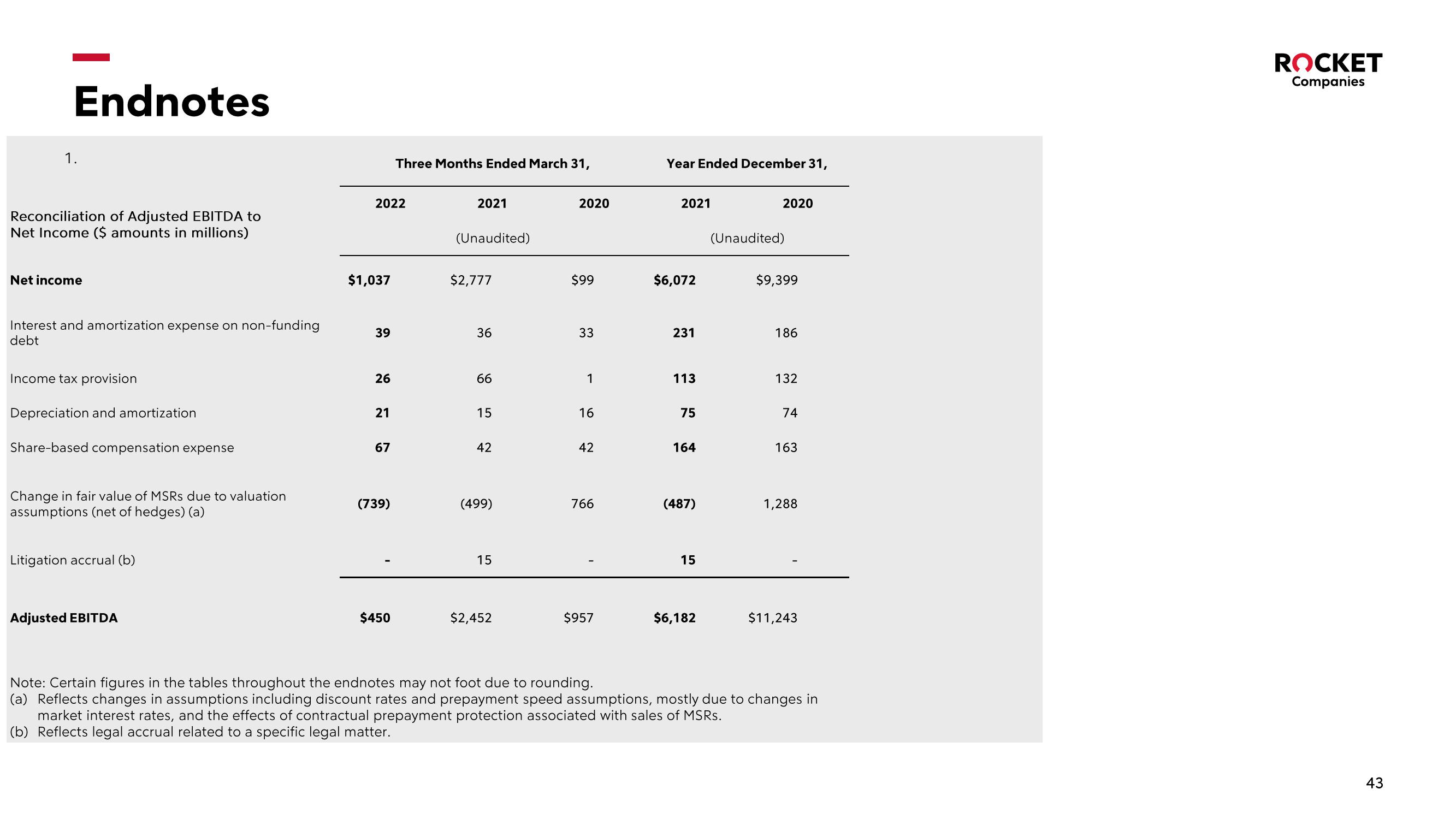

1.

Reconciliation of Adjusted EBITDA to

Net Income ($ amounts in millions)

Net income

Interest and amortization expense on non-funding

debt

Income tax provision

Depreciation and amortization

Share-based compensation expense

Change in fair value of MSRs due to valuation

assumptions (net of hedges) (a)

Litigation accrual (b)

Adjusted EBITDA

2022

$1,037

39

26

21

67

(739)

Three Months Ended March 31,

$450

2021

(Unaudited)

$2,777

36

66

15

42

(499)

15

$2,452

2020

$99

33

1

16

42

766

$957

Year Ended December 31,

2021

$6,072

231

113

75

164

(487)

15

$6,182

2020

(Unaudited)

$9,399

186

132

74

163

1,288

$11,243

Note: Certain figures in the tables throughout the endnotes may not foot due to rounding.

(a) Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in

market interest rates, and the effects of contractual prepayment protection associated with sales of MSRs.

(b) Reflects legal accrual related to a specific legal matter.

ROCKET

Companies

43View entire presentation