Lanvin Results Presentation Deck

SERGIO ROSSI 2022 RESULTS

AND 2023 GUIDANCE

KEY HIGHLIGHTS

●

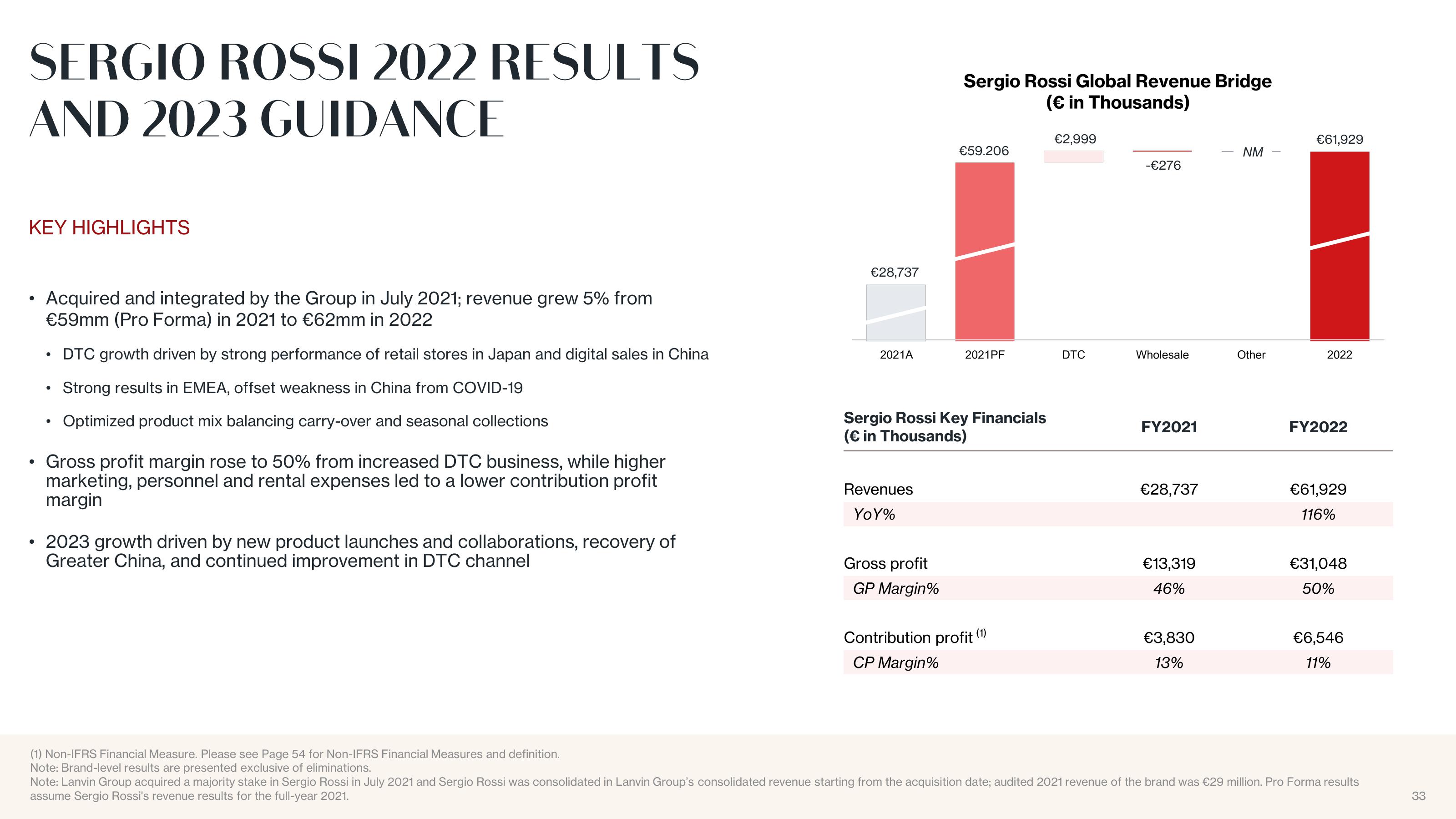

Acquired and integrated by the Group in July 2021; revenue grew 5% from

€59mm (Pro Forma) in 2021 to €62mm in 2022

DTC growth driven by strong performance of retail stores in Japan and digital sales in China

Strong results in EMEA, offset weakness in China from COVID-19

Optimized product mix balancing carry-over and seasonal collections

●

●

Gross profit margin rose to 50% from increased DTC business, while higher

marketing, personnel and rental expenses led to a lower contribution profit

margin

2023 growth driven by new product launches and collaborations, recovery of

Greater China, and continued improvement in DTC channel

€28,737

2021A

Revenues

YoY%

Gross profit

Sergio Rossi Global Revenue Bridge

(€ in Thousands)

Sergio Rossi Key Financials

(€ in Thousands)

GP Margin%

€59.206

2021PF

Contribution profit (1)

CP Margin%

€2,999

DTC

-€276

Wholesale

FY2021

€28,737

€13,319

46%

€3,830

13%

NM

Other

€61,929

2022

FY2022

€61,929

116%

€31,048

50%

€6,546

11%

(1) Non-IFRS Financial Measure. Please see Page 54 for Non-IFRS Financial Measures and definition.

Note: Brand-level results are presented exclusive of eliminations.

Note: Lanvin Group acquired a majority stake in Sergio Rossi in July 2021 and Sergio Rossi was consolidated in Lanvin Group's consolidated revenue starting from the acquisition date; audited 2021 revenue of the brand was €29 million. Pro Forma results

assume Sergio Rossi's revenue results for the full-year 2021.

33View entire presentation