Goldman Sachs Investment Banking Pitch Book

Goldman

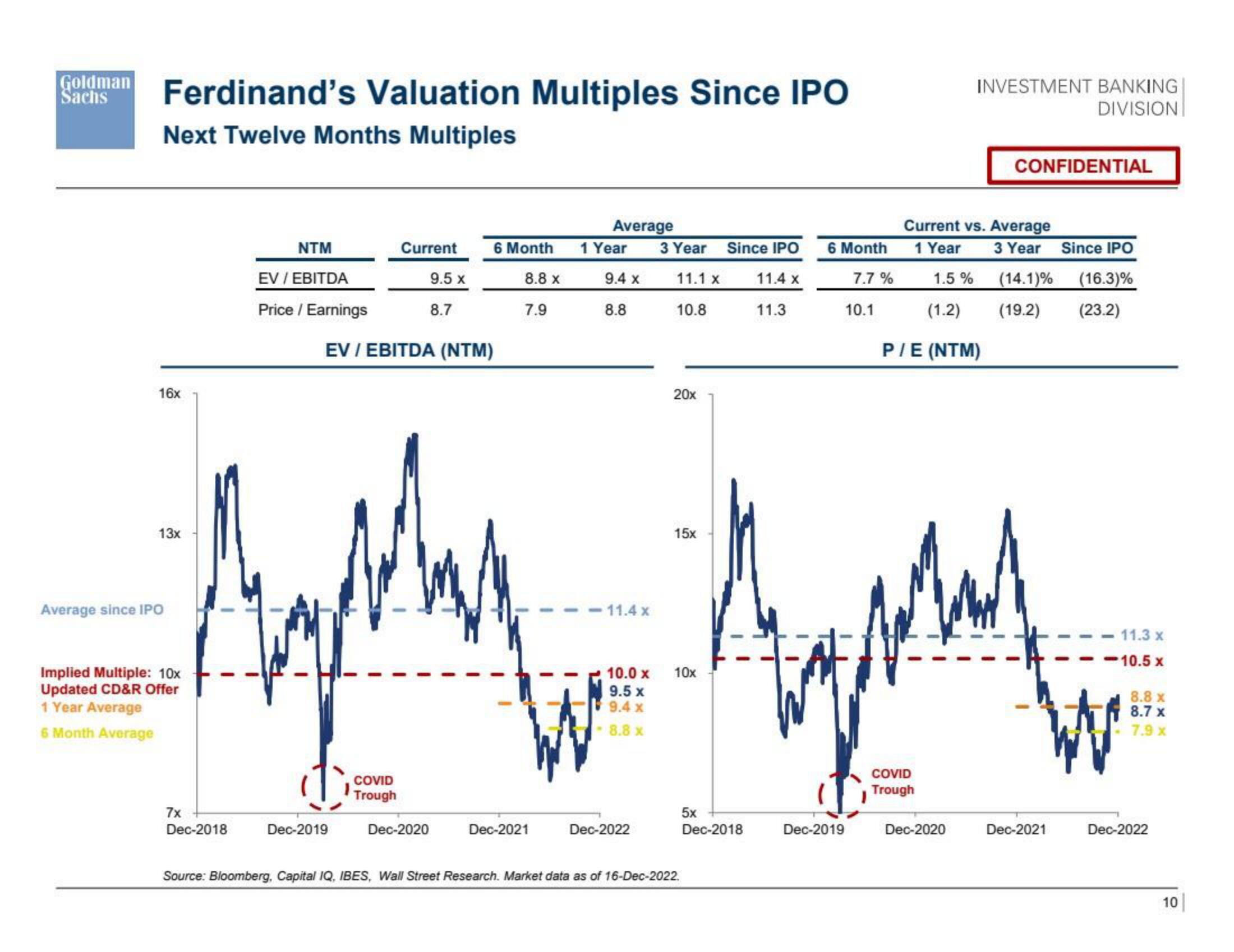

Sachs Ferdinand's Valuation Multiples Since IPO

Next Twelve Months Multiples

16x

13x

Average since IPO

NTM

EV / EBITDA

Price / Earnings

EV / EBITDA (NTM)

Ruptur Amply

10.0 x

9.5 x

9.4 x

8.8 x

COVID

Trough

COVID

Trough

Implied Multiple: 10x

Updated CD&R Offer

1 Year Average

6 Month Average

7x

Dec-2018

Dec-2019

Current

Dec-2020

9.5 x

8.7

6 Month

8.8 x

7.9

Average

Dec-2021

1 Year

9.4 x

8.8

11.4 x

Dec-2022

3 Year

11.1 x

10.8

20x

15x

10x

Source: Bloomberg, Capital IQ, IBES, Wall Street Research. Market data as of 16-Dec-2022.

Since IPO

11.4 x

11.3

5x

Dec-2018

6 Month

7.7%

10.1

Dec-2019

INVESTMENT BANKING

DIVISION

Current vs. Average

1 Year

1.5%

CONFIDENTIAL

P/E (NTM)

Dec-2020

(1.2) (19.2)

3 Year Since IPO

(14.1)% (16.3)%

(23.2)

Dec-2021

11.3 x

-10.5 x

8.8 x

8.7 x

7.9 x

Dec-2022

10View entire presentation