Melrose Results Presentation Deck

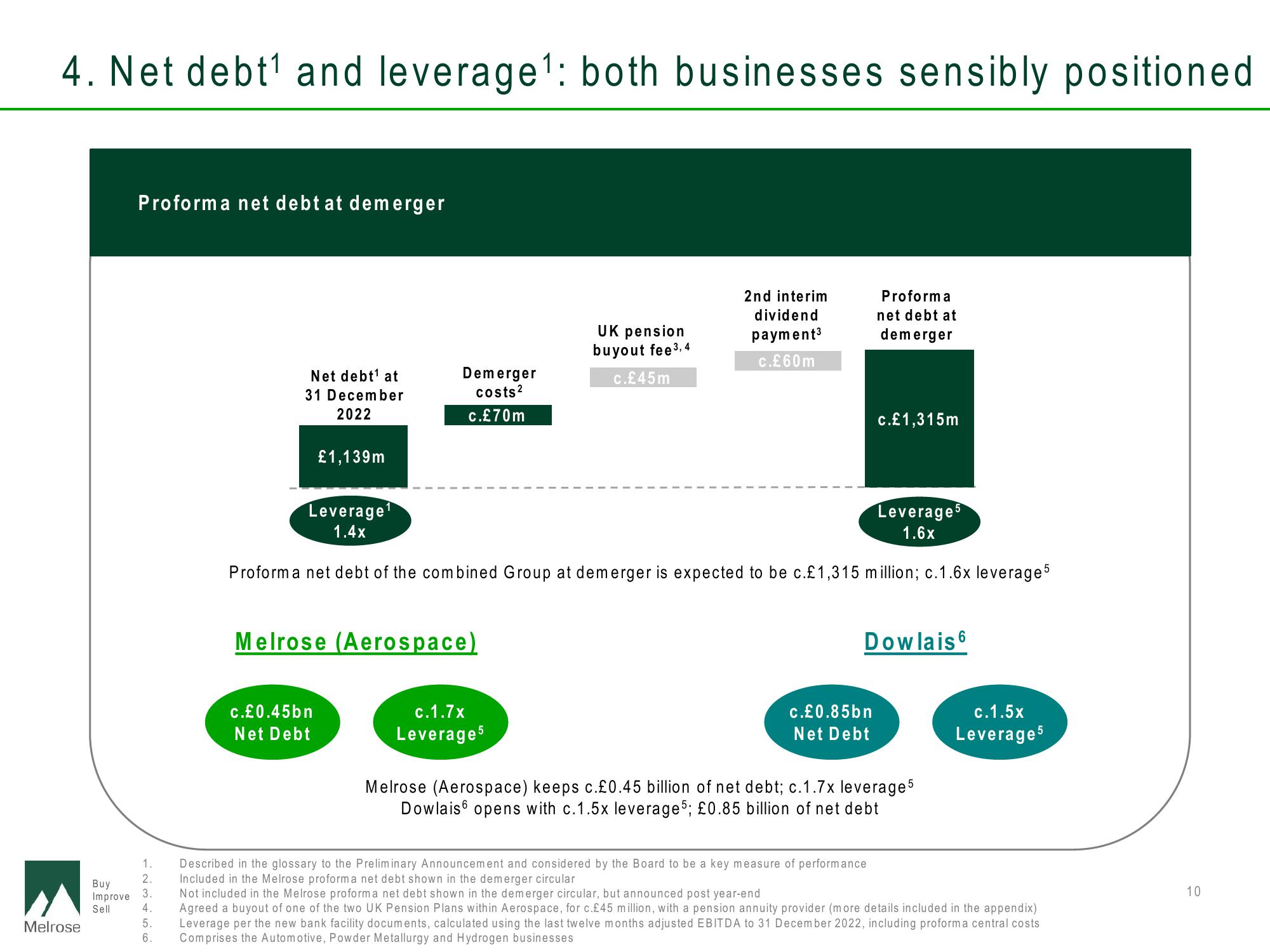

4. Net debt¹ and leverage¹: both businesses sensibly positioned

Melrose

Proforma net debt at demerger

1.

2.

Buy

Improve 3.

Sell

4.

5.

6.

Net debt¹ at

31 December

2022

£1,139m

Leverage¹

1.4x

Demerger

costs²

c.£70m

c.£0.45bn

Net Debt

Melrose (Aerospace)

UK pension

buyout fee 3,4

c.£45m

c.1.7x

Leverage 5

2nd interim

dividend

payment³

c.£60m

Proforma net debt of the combined Group at demerger is expected to be c.£1,315 million; c.1.6x leverage 5

Proforma

net debt at

demerger

c.£1,315m

c.£0.85bn

Net Debt

Leverage5

1.6x

Dowlais 6

Melrose (Aerospace) keeps c.£0.45 billion of net debt; c.1.7x leverage 5

Dowlais opens with c.1.5x leverage5; £0.85 billion of net debt

c.1.5x

Leverage 5

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Included in the Melrose proforma net debt shown in the demerger circular

Not included in the Melrose proforma net debt shown in the demerger circular, but announced post year-end

Agreed a buyout of one of the two UK Pension Plans within Aerospace, for c.£45 million, with a pension annuity provider (more details included in the appendix)

Leverage per the new bank facility documents, calculated using the last twelve months adjusted EBITDA to 31 December 2022, including proforma central costs

Comprises the Automotive, Powder Metallurgy and Hydrogen businesses

10View entire presentation