Sonos Results Presentation Deck

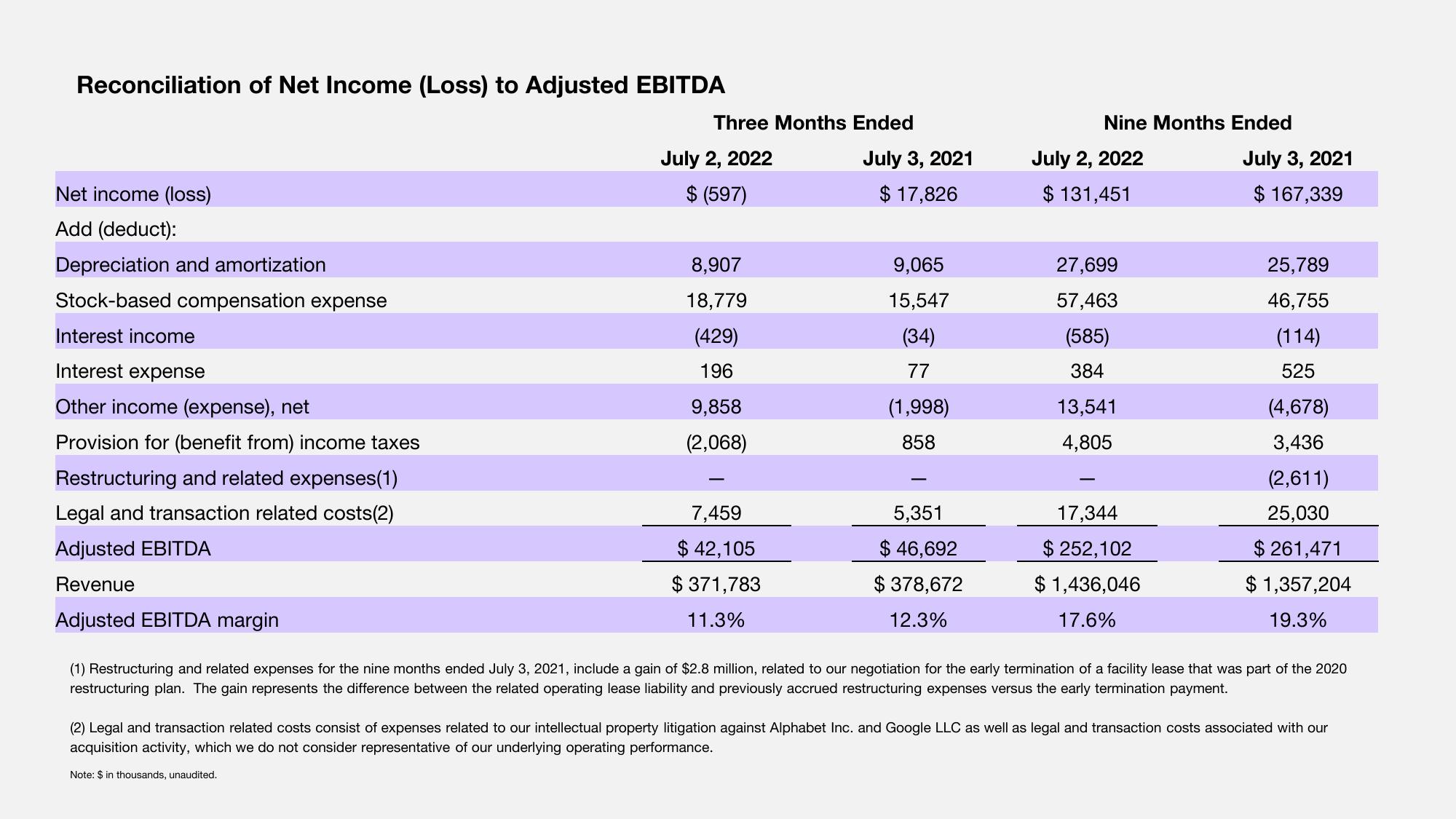

Reconciliation of Net Income (Loss) to Adjusted EBITDA

Net income (loss)

Add (deduct):

Depreciation and amortization

Stock-based compensation expense

Interest income

Interest expense

Other income (expense), net

Provision for (benefit from) income taxes

Restructuring and related expenses(1)

Legal and transaction related costs(2)

Adjusted EBITDA

Revenue

Adjusted EBITDA margin

Three Months Ended

July 2, 2022

$ (597)

8,907

18,779

(429)

196

9,858

(2,068)

7,459

$ 42,105

$ 371,783

11.3%

July 3, 2021

$ 17,826

9,065

15,547

(34)

77

(1,998)

858

5,351

$ 46,692

$ 378,672

12.3%

Nine Months Ended

July 2, 2022

$ 131,451

27,699

57,463

(585)

384

13,541

4,805

17,344

$ 252,102

$ 1,436,046

17.6%

July 3, 2021

$ 167,339

25,789

46,755

(114)

525

(4,678)

3,436

(2,611)

25,030

$261,471

$ 1,357,204

19.3%

(1) Restructuring and related expenses for the nine months ended July 3, 2021, include a gain of $2.8 million, related to our negotiation for the early termination of a facility lease that was part of the 2020

restructuring plan. The gain represents the difference between the related operating lease liability and previously accrued restructuring expenses versus the early termination payment.

(2) Legal and transaction related costs consist of expenses related to our intellectual property litigation against Alphabet Inc. and Google LLC as well as legal and transaction costs associated with our

acquisition activity, which we do not consider representative of our underlying operating performance.

Note: $ in thousands, unaudited.View entire presentation