Gatos Silver Investor Presentation Deck

Silver Equivalent Production (2) (Moz)

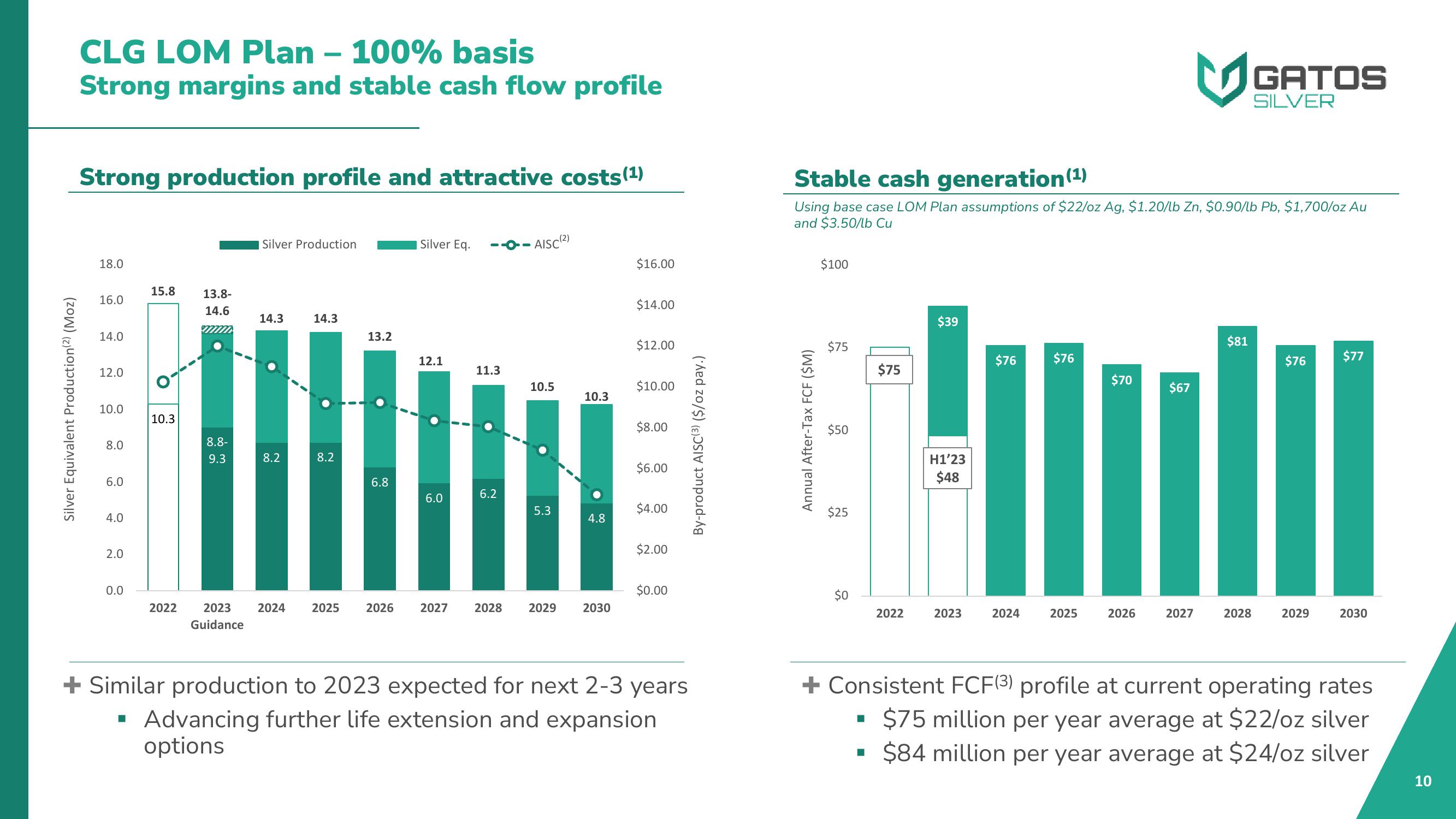

CLG LOM Plan - 100% basis

Strong margins and stable cash flow profile

Strong production profile and attractive costs (¹)

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

0.0

15.8 13.8-

14.6

■

O.

10.3

2022

8.8-

9.3

Silver Production

14.3

8.2

2023 2024

Guidance

14.3

8.2

2025

13.2

6.8

Silver Eq.

12.1

6.0

11.3

6.2

- AISC (²)

10.5

5.3

10.3

4.8

2026 2027 2028 2029 2030

$16.00

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

+ Similar production to 2023 expected for next 2-3 years

Advancing further life extension and expansion

options

By-product AISC(³) ($/oz pay.)

Stable cash generation (¹)

Using base case LOM Plan assumptions of $22/oz Ag, $1.20/lb Zn, $0.90/lb Pb, $1,700/oz Au

and $3.50/lb Cu

Annual After-Tax FCF ($M)

$100

$75

$50

$25

$0

$75

■

2022

$39

H1’23

$48

2023

$76

2024

$76

2025

$70

2026

$67

2027

$81

GATOS

SILVER

2028

$76

2029

$77

2030

+ Consistent FCF (3) profile at current operating rates

$75 million per year average at $22/oz silver

$84 million per year average at $24/oz silver

10View entire presentation