Comcast Results Presentation Deck

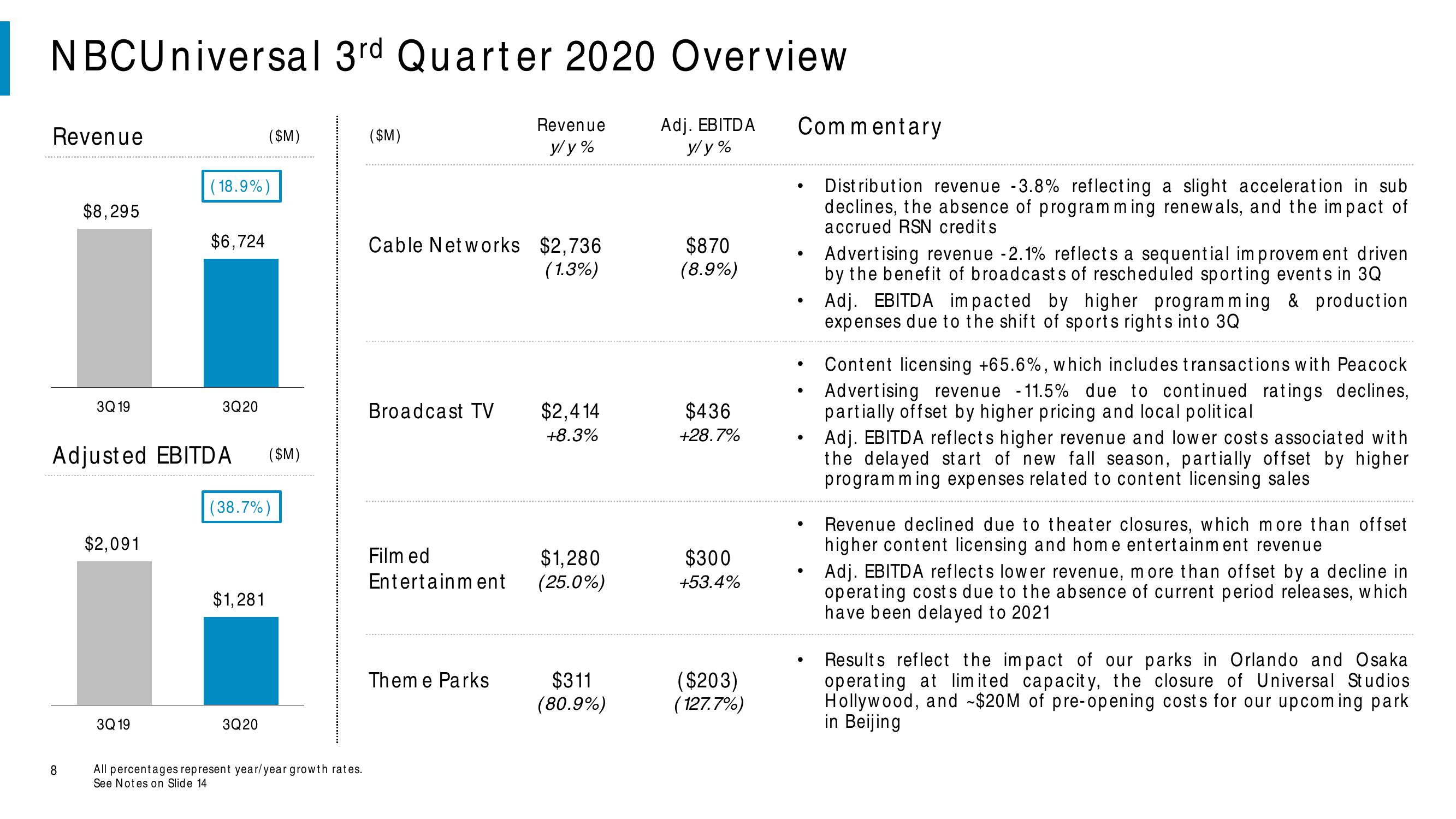

NBCUniversal 3rd Quarter 2020 Overview

Revenue

y/y%

Adj. EBITDA

y/y%

Revenue

$8,295

8

3Q 19

$2,091

3Q 19

(18.9%)

$6,724

Adjusted EBITDA ($M)

3Q20

($M)

(38.7%)

$1,281

3Q20

All percentages represent year/year growth rates.

See Notes on Slide 14

($M)

Cable Networks $2,736

(1.3%)

Broadcast TV

Film ed

Entertainment

Theme Parks

$2,414

+8.3%

$1,280

(25.0%)

$311

(80.9%)

$870

(8.9%)

$436

+28.7%

$300

+53.4%

($203)

(127.7%)

Commentary

●

●

●

●

●

●

●

Distribution revenue -3.8% reflecting a slight acceleration in sub

declines, the absence of programming renewals, and the impact of

accrued RSN credits

Advertising revenue -2.1% reflects a sequential improvement driven

by the benefit of broadcasts of rescheduled sporting events in 3Q

Adj. EBITDA impacted by higher programming & production

expenses due to the shift of sports rights into 3Q

Content licensing +65.6%, which includes transactions with Peacock

Advertising revenue -11.5% due to continued ratings declines,

partially offset by higher pricing and local political

Adj. EBITDA reflects higher revenue and lower costs associated with

the delayed start of new fall season, partially offset by higher

programming expenses related to content licensing sales

Revenue declined due to theater closures, which more than offset

higher content licensing and home entertainment revenue

Adj. EBITDA reflects lower revenue, more than offset by a decline in

operating costs due to the absence of current period releases, which

have been delayed to 2021

Results reflect the impact of our parks in Orlando and Osaka

operating at limited capacity, the closure of Universal Studios

Hollywood, and ~$20M of pre-oper costs for our upcoming park

in BeijingView entire presentation