TPG Results Presentation Deck

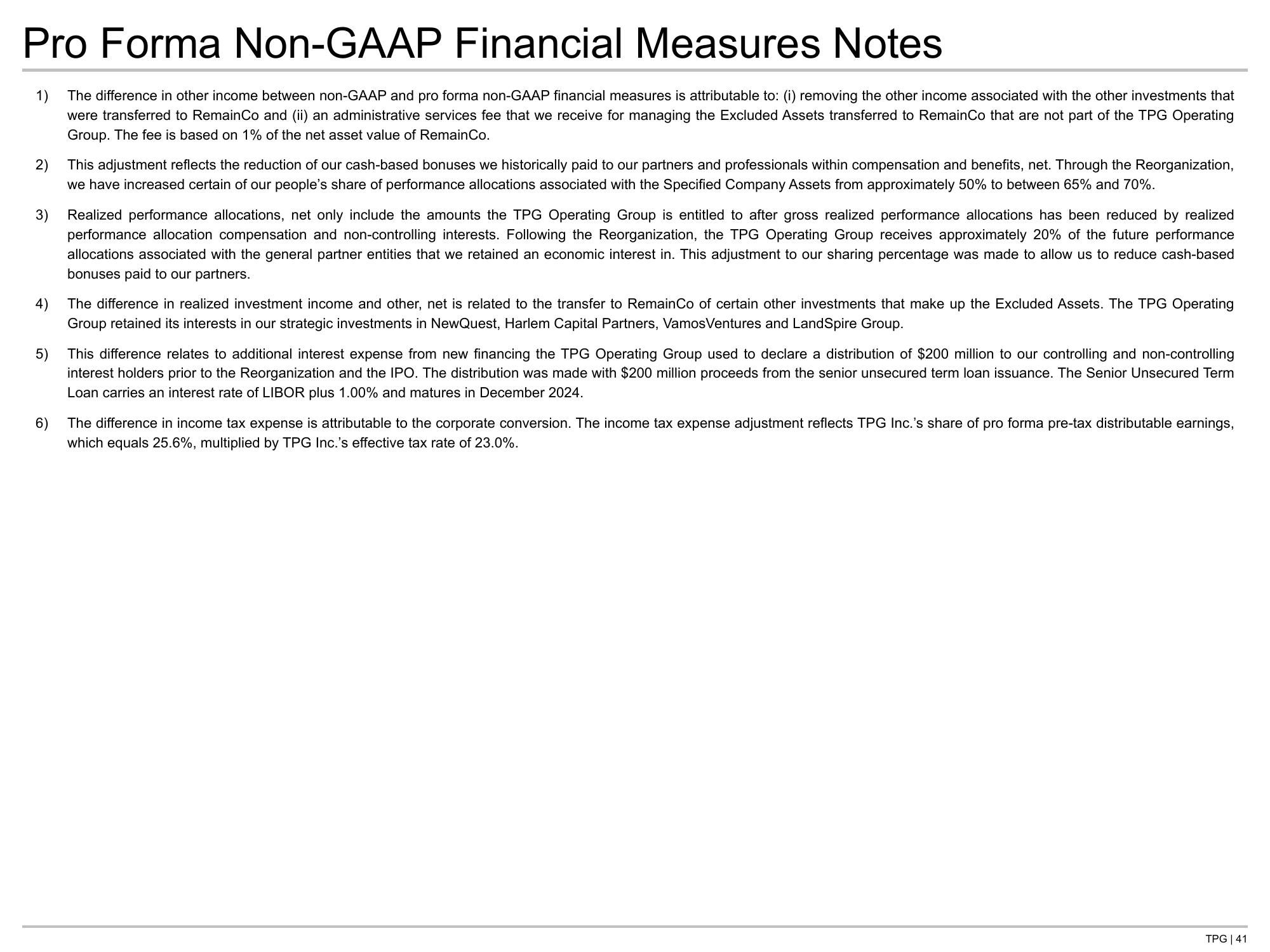

Pro Forma Non-GAAP Financial Measures Notes

1) The difference in other income between non-GAAP and pro forma non-GAAP financial measures is attributable to: (i) removing the other income associated with the other investments that

were transferred to RemainCo and (ii) an administrative services fee that we receive for managing the Excluded Assets transferred to RemainCo that are not part of the TPG Operating

Group. The fee is based on 1% of the net asset value of RemainCo.

2) This adjustment reflects the reduction of our cash-based bonuses we historically paid to our partners and professionals within compensation and benefits, net. Through the Reorganization,

we have increased certain of our people's share of performance allocations associated with the Specified Company Assets from approximately 50% to between 65% and 70%.

3)

4)

The difference in realized investment income and other, net is related to the transfer to RemainCo of certain other investments that make up the Excluded Assets. The TPG Operating

Group retained its interests in our strategic investments in NewQuest, Harlem Capital Partners, VamosVentures and LandSpire Group.

5)

Realized performance allocations, net only include the amounts the TPG Operating Group is entitled to after gross realized performance allocations has been reduced by realized

performance allocation compensation and non-controlling interests. Following the Reorganization, the TPG Operating Group receives approximately 20% of the future performance

allocations associated with the general partner entities that we retained an economic interest in. This adjustment to our sharing percentage was made to allow us to reduce cash-based

bonuses paid to our partners.

6)

This difference relates to additional interest expense from new financing the TPG Operating Group used to declare a distribution of $200 million to our controlling and non-controlling

interest holders prior to the Reorganization and the IPO. The distribution was made with $200 million proceeds from the senior unsecured term loan issuance. The Senior Unsecured Term

Loan carries an interest rate of LIBOR plus 1.00% and matures in December 2024.

The difference in income tax expense is attributable to the corporate conversion. The income tax expense adjustment reflects TPG Inc.'s share of pro forma pre-tax distributable earnings,

which equals 25.6%, multiplied by TPG Inc.'s effective tax rate of 23.0%.

TPG | 41View entire presentation